$10 Million Bitcoin. Why So Bearish?

Bitcoin is one of the most valuable assets you’ll ever own. An asset to be held for generations. Don’t be shaken out.

Do you have the stomach and the mental stamina to hold onto the world’s best asset?

This week Jamie Dimon, CEO of JP Morgan Chase - the largest bank in the United States and fifth largest in the world - chimed in again with his perspective on Bitcoin:

The CEO of one of the worlds largest banks doesn’t like Bitcoin. Shocker!

Those entrenched at the top of a legacy system will never voluntarily relinquish their control and profits. This applies to regulators in government as much as it does rent-seeking gatekeepers of the permissioned system like Jamie.

They’re afraid.

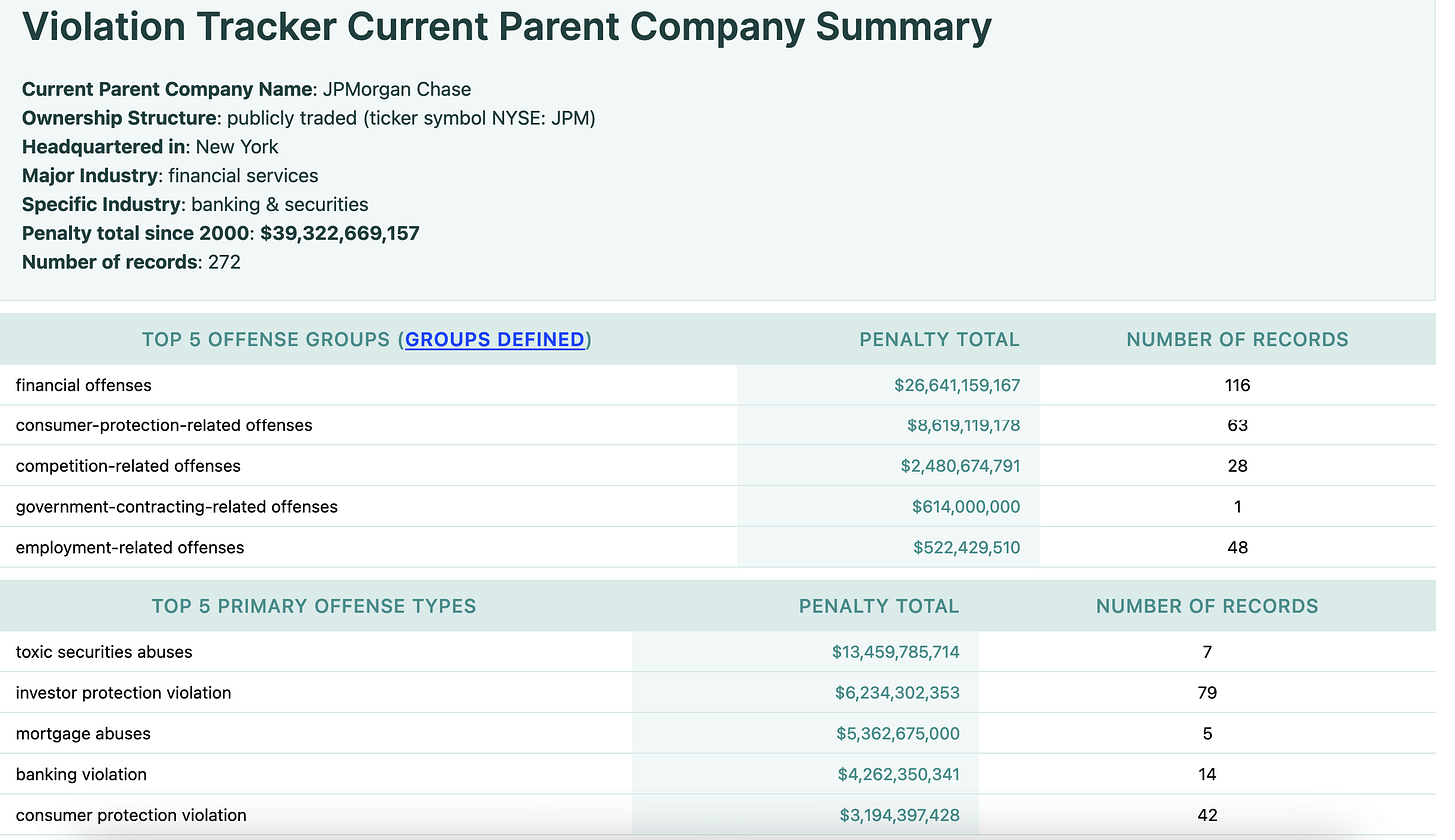

Incidentally, since he mentioned financial criminals, money laundering and tax avoidance, let’s check the track record of Jamie’s bank…

Pot, meet kettle.

It’s amazing Jamie has the audacity to speak on Bitcoin as he does. But then a man will always follow his incentives. Taking your money out of the banking system leads to lower profits.

Between his words and the agreement received from the screaming banshee Elizabeth Warren, they couldn’t have made a better advertisement for Bitcoin if they tried.

Don’t Be Shaken Out

Next year is shaping up to be quite an epic year for Bitcoin already. We have an upcoming ETF announcement, the fourth halving, and the likely breaking of something in financial markets which will necessitate the continuing inflation spiral which will ramp up again next year.

With all these events, it’s inevitable the price of Bitcoin will continue to be volatile.

At the advent of a financial market crisis, Bitcoin will drop like all other liquid assets as people scramble to convert to cash. No, this isn’t an invitation to trade or time your entry, you’ll fail.

Trading Bitcoin is like trading Apple, Amazon, Google, or Facebook a decade ago. The more you obsess over timing the market, the more mistakes you make. They were all technology networks that were dominant & destined to grow. The best strategy is to buy bitcoin and wait. - Michel Saylor

I explain here why you shouldn’t try to time buying Bitcoin 👇🏼

Bitcoin Accumulation Strategy

Bitcoin offers us a truly sovereign way to store the earnings we work hard for, to protect our monetary savings from theft by inflation, or outright confiscation. I don’t know about you, but I’d rather save the money I work hard for in a form that can’t just be

After the initial shock of a financial markets calamity, Bitcoin will then rocket back up as the liquidity crisis subsides, governments step in with money printing bazookas and again send the price of scarce assets like Bitcoin soaring.

Through these highs and lows, you’ll be faced with multiple temptations to sell your Bitcoin.

You’ll feel like panic selling when the price drops substantially. You’ll be tempted to sell when you’ve doubled or tripled your money and Bitcoin “can’t possibly go any higher” when it hits $250,000.

It’s at times like that it helps to look at the bigger picture. Bitcoin is the money and asset of the future. But to get to that point, it has a long way to go (read rise).

The Bigger Picture

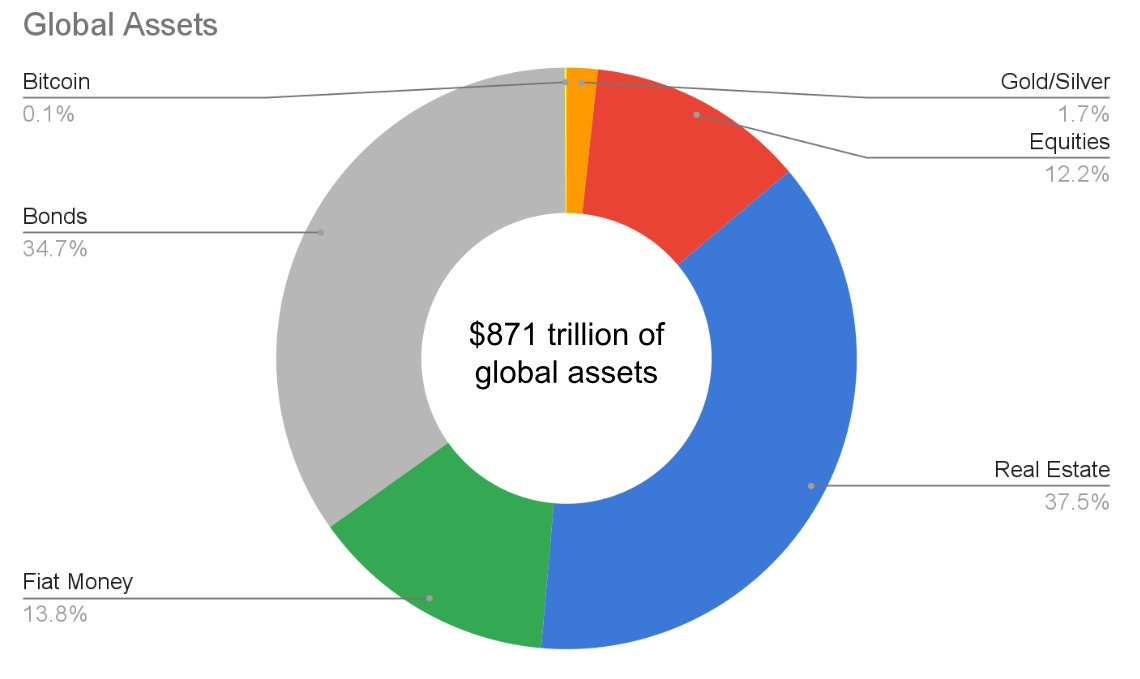

Even after the meteoric price rise to where it sits today, Bitcoin total market value is still insignificant in the global asset pie:

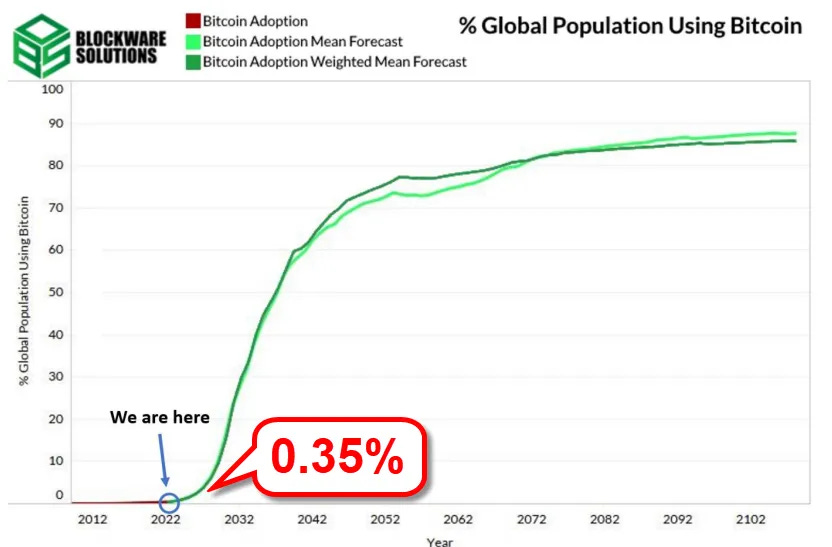

Bitcoin’s adoption as a global asset is happening gradually. It’s adopted in cycles, with each one bigger than the last.

Group One: A small group of tech bros.

Group Two: Libertarians and anarcho capitalists who can see past “gold it the only option”.

Group Three: A minority of people in developing countries who can think outside the narrative being dictated to them and are desperate to escape hyperinflation . The recent election of Millei in Argentina illustrates that even after years of punishment under government inflation, over 40% of people still voted to continue the same treatment.

Group Four: Prescient fund managers who realize the end game in the current fiat system. Some like Bill Miller much sooner than others.

Group Five: Smart investors, ahead of the majority. 👉🏼 this is the stage we’re at now 👈🏼

Group Six: Mass investment markets (ETFs) - the stage we’ll be entering in 2024.

Group Seven: Wider adoption as money when awareness spreads to those who will just want to use it to function in everyday life, to save money to protect from inflation, not just as an asset play (similar to group 3 above, except inflation will be rampant for billions).

Whenever teenage girls and corporate CEOs covet the same new technology, something extraordinary is happening. - Michael Saylor

The groupings above are by no means exhaustive, Group Seven could be further split many more times, but hopefully you get the idea.

The graph below illustrates how early we still are in the Bitcoin adoption cycle with only 0.35% of the worlds population actively participating.

Where do you think the price of Bitcoin will head as the percentage of the world’s population using it grows?

How much share of the global asset pie Bitcoin eventually settles at will not be known for decades. Your guess is as good, though likely not as bullish as mine 🚀🚀🚀

As Bitcoin grows in adoption, the trend and price will not simply stop at some arbitrary figure and flat line. Those that think the price will rise to $300k and settle there - thinking it’s then time to cash in - are missing the reality of network effects, human incentives and behaviour.

If 400 million people adopt Bitcoin by 2030 which sends the price to $2 million per coin, why would billions of other people worldwide not follow this example by allocating into Bitcoin also?

For Bitcoin to stop as such a low point, it’s effectively saying that presented with a far superior money, the other 7.6 billion of the 8 billion people in the world will opt to ignore this better monetary technology and stick with rubbish, government backed currency and its inherent control and inflation.

Yes, I’m saying $2 million per Bitcoin is a low number.

When presented with the smart phone technology, very few people chose to stick with the rotary handset.

Bitcoin is either a zero, or it’s ultimate value is in the double digit millions per coin (in today’s dollars).

It has already proven it’s not a zero with millions around the world opting to use it as a store of value. So that leaves one other option, an option that has no end in sight for the next generation or so.

If billions more people pile into Bitcoin, the price goes higher - regardless of how crazy the number starts to look.

Before my time is up in this world, I expect Bitcoin to be in the double digit millions per coin.

It’s Not Easy Being Early

I get it, these numbers sound crazy and it’s not easy being early and holding through volatility, up or down. I’ve held Bitcoin since early 2017 and it’s been a hell of a ride.

Not as early as some. This is Greg:

Don’t be like Greg. The numbers will change, but the principle remains the same.

The wealthiest people through history didn’t get that way by selling their business or assets early. Jeff Bezos didn’t sell Amazon when it was up a mere 10x, 20x or 50x. The Walton and Hermes families are still the largest holders of each respective business. Property in Hong Kong has been owned by the same families for generations.

The truly wealthy don’t sell appreciating assets. They own them for decades, and in the case of families, multiple generations. They use these assets to accumulate more assets. To generate more income. Continually growing their wealth while holding onto their assets.

Regardless of the amount of Bitcoin you hold, it is likely one of the most valuable assets you’ll ever own. An asset to be held for generations. Don’t be shaken out.

Prepare yourself mentally for what is coming, and hodl.

Subscribe to support my work and receive more content like this.