Antimony: A Critical Metal for Tech and Industry, Facing a Supply Crunch

Antimony is critical to making so many things we take for granted, but it is facing a dire supply-side situation. Can it be overcome, or will this metal's price skyrocket?

As we see playing out in multiple other commodity markets, most prominently in oil and copper - the supply side can often play a more crucial factor in returns for investors than demand which most focus on. Antimony is another essential metal the world relies on without realising it.

Many countries rank antimony as equal to or of higher importance than rare earths. Yet the supply side of antimony looks incredibly vulnerable, both for the world as a whole, but in particular for Western nations. The antimony price has been rising substantially over the last two years, and due to the demand/supply realities, it seems likely we’ll see a continuation in this upward trend over the long term.

The challenge as always is finding the best investment expression for a positive view on an idea. But first, a little background into one of the world’s rarest metals, with annual consumption of only 170,000 tonnes - less than even tin, the other critical-yet-short-supply metal.

Demand for Antimony

Antimony is used to produce a plethora of products we use in everyday life including;

Technology; Semiconductors, circuit boards, rechargeable batteries (lithium-ion and liquid metal), smartphones, shipbuilding and electronics.

Military; Communication Systems, night vision goggles, ammunition tanks, infrared sensors, lasers, missile guidance systems, submarines warships, camouflage and flame retardants.

Renewable Energy; Solar panels, wind turbines, motors, generators, nuclear reactors.

By far, the most prevalent use case for antimony today is flame retardant at almost 60% of demand. It’s necessary to note this doesn't just mean use in fire retardant (extinguishers), but all types of equipment and material that require fire protection, hence its prominence in military application.

We are seeing tougher fire safety regulations for construction and automotive all around the world, including really big markets like China. So I think the use of flame retardants will actually outperform GDP. And I think these two sectors — construction and automotive — are the biggest growth areas. Trioxide is used in other applications such as PET catalysts and in the pigment industry.

Antimony is classified as a critical material by all major countries on their critical metals list:

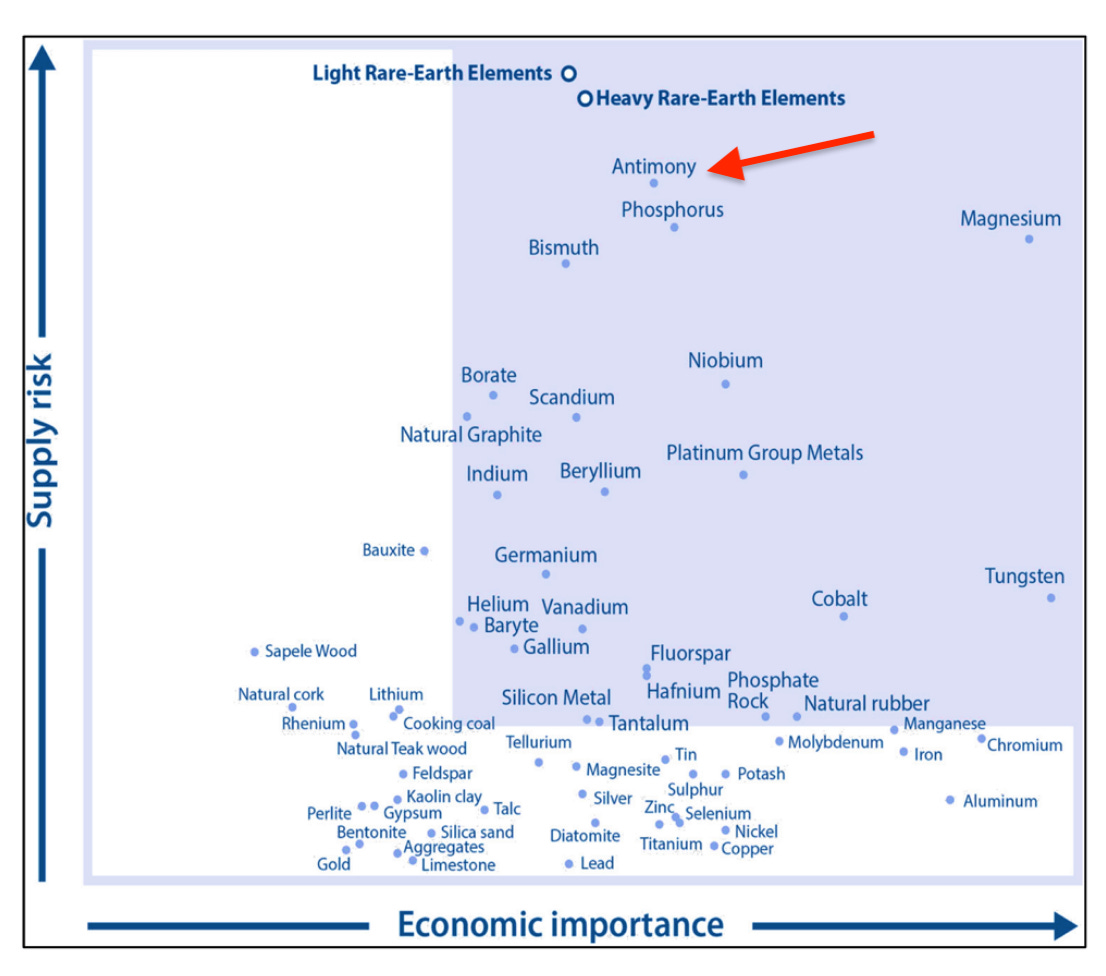

This chart provides context as to where antimony stands relative to other metals in importance:

Outside of rare earth metals famous in the investment world, antimony has the highest criticality of supply and economic importance.

While the majority of volume in antimony is used in fire retardant applications, its important to understand how important its use in military applications is:

The use of antimony in military applications is quite extensive: Antimony has an extremely wide variety of military uses and has had for over a century, as so eloquently stated by Rousch (1937), “...Antimony is the last of the non-ferrous group of strategic metals, but it by no means the least important, for it has more uses of direct military character than any other member of the group...” This is truer today than it was in 1937 given its use in high tech electronics that are found in night vision googles, communications equipment, infrared sensors, explosives formulations, ammunition primers, military clothing (both for its fire retardant and infrared absorption characteristics) and numerous other uses (USGS, 2018). It is used in hardening lead in bullets and shrapnel, in armor piercing projectiles, as a reaction activator with beryllium in nuclear weapons and reactors and in the production or tritium (used in hydrogen bombs). In addition, it has a critically important use in manufacturing high quality glass (as a clarifier to remove impurities) used in military binoculars, precision optics and laser sighting and survey equipment. It is a primary ingredient in many explosives formulations as well as in tracer ammunition and flares. Antimony oxides are often used in many military specifications for paints, plastics, and coatings due to its fire-retardant properties. This use was well documented in WWII when aircraft carrier decks were coated with paints and stains containing antimony trioxide to prevent fires when kamikaze pilots crashed their planes into decks attempting to ignite the wooden decks but is still as important today with our modern high technology weaponry.

Suffice to say, antimony is rather important to the military and consumption typically increases during wartime.

Annual worldwide demand for all uses of antimony currently stands at 170,000 tonnes. However due to the sensitivity of some of its uses (above), the demand picture for antimony is not always transparent:

Antimony is typically traded in private transactions versus open markets and thus the movement of concentrates and refined products is not transparent and difficult to document. Many antimony applications involve the use of proprietary formulations and tracking the use and consumption of antimony- bearing products in the downstream supply chain is poor. Import numbers reported by the U.S. Department of Commerce and the USGS commodities groups are likely underestimating both net consumption and imports. There are essentially no significant processing facilities outside of China. Although there are small operations in several countries, none of these have enough capacity to significantly impact Chinese and Russian control over the markets.

We can attest to the above comment regarding difficulty documenting antimony figures and pause here to make a special note: the amount of conflicting figures, statistics and data we have come across during our research of this investment has been surprising. Please take all figures mentioned as a best effort to present the big picture.

The antimony market is predicted to reach US$ 2.9 billion by 2032, with sales growing at an average CAGR of 4% from 2022 to 2032. Valued at US$1.7 billion in 2021, the market will likely have reached US$2 billion by the end of last year. A small market for sure - so no chance of major mining houses paying attention - but critical nonetheless, especially when you look at the supply side.

Supply of Antimony

The name 'antimony' comes from the Greek words anti and monos - meaning a metal not found alone. Antimony is commonly found with gold. But even then, it is rare. Around 70% of antimony is mined as a by-or-co-product.

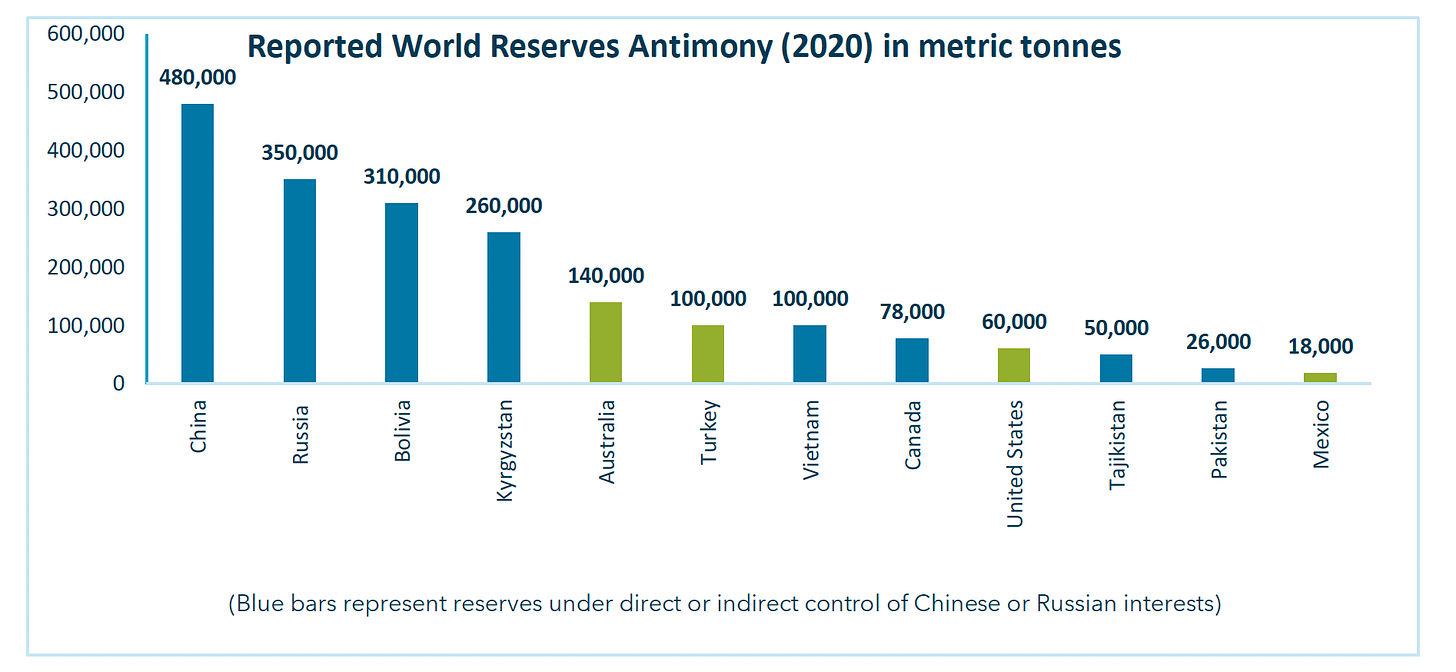

As the chart below shows - supply is very concentrated, with China, Russia and Tajikistan cumulatively accounting for 88% of all mine production in 2022. China switched to importing concentrate from other countries a few years ago.

Looking at the chart, you’ll note there is only one Western nation with a tiny 3.6% of supply. China and Russia are the largest miners of antimony by far.

China, Russia, their satellites, and their political and economic allies dominate the world’s antimony upstream supply chain, accounting for more than 97% of global mine production (USGS, 2021). The USGS (2021) reports U.S. net import reliance in 2020 was estimated at 81%, with most of the supplies primarily sourced directly or indirectly from China, Russia or Tajikistan (who’s mines are under Chinese control).

The concentration of sources in the above chart should already be concerning. In addition to the concentration of resources, the majority of the metal regardless of where it is mined is then shipped as feedstock to refineries and processing facilities in China.

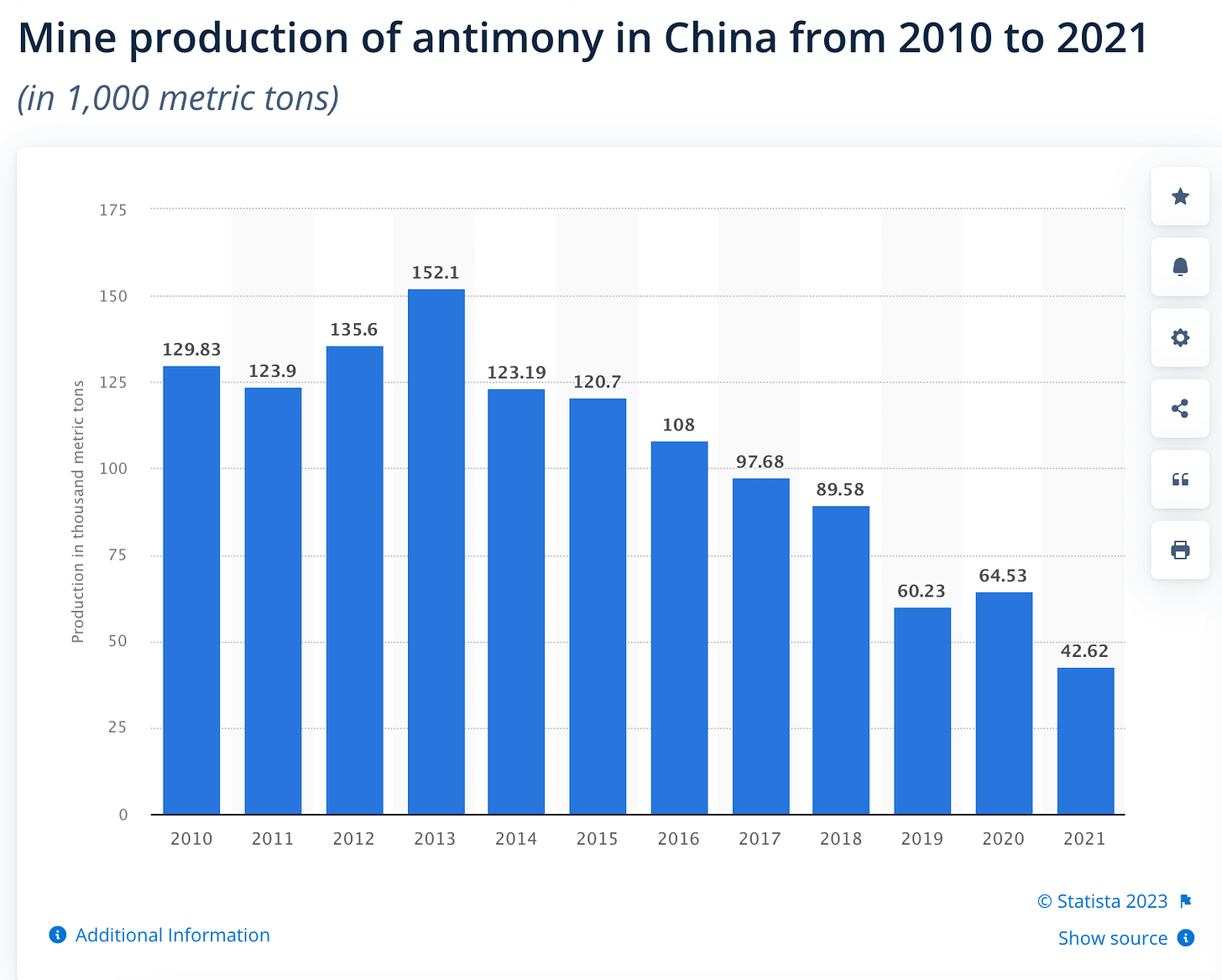

Concerning also with the limited source of supply is that China’s production volumes of this critical metal are gradually declining. Even putting aside the disruption of Covid, the trend of production in China is clear:

Note that there is some conjecture over China’s 2021 production, but the trend remains intact.

What is also very clear is the decline in global reserves over the last two decades, particularly in China as the largest producer:

China's reserves have dropped by more than 80%, so its Reserve Replacement Ratio (RRR) is clearly insufficient. Production from state owned miners has been dropped and a large number of artisanal Chinese antimony miners can’t hope to sustain any meaningful production capacity.

Russia is doing a good job maintaining its reserves, but we know where the West currently stands with Russian supplies. Russia sends its antimony to China for processing. There is some nuance in the other countries, but the direction of total world reserves is clear - supply is dwindling.

Projects touted by exploration companies are all small in nature both in total reserves as well as potential production.

From a geopolitical standpoint which is how we tackle investing - it doesn't get much more straightforward than antimony. Not only does it currently suffer from the same capital market malice that most commodities do, but it also has 88% of mine production held by China, Russia and Tajikistan. Also important to note, much of the feed stock and processing of antimony outside China is also controlled by Chinese interests.

Tri-Star began construction of its smelter in Oman in 2016 and was in commissioning in 2019. If successful, this facility will become the first major non-Chinese smelter to be placed into operation since the 1990s, however, it is entirely dependent on imported feedstock from other locations. As the facility approached commercial production Chinese interests purchased the foreign mines that Tri-Star had arranged streaming agreements with and then shut them down – shuttering the ability of the Oman facility to obtain feedstock.

If tensions continue to escalate, potentially even breaking out into the wider conflict the West seems to be agitating toward, will China continue to supply those openly attacking them with critical metals like antimony?

Should tensions subside, the market dynamics still don’t change on the supply side without concerted effort around the world to bring meaningful further production online in the future.

These questions can't be answered with great certainty until events unfold, but for the West not to protect itself and its critical metal supply lines for such a situation is foolish. To not position as investors, we believe could be a great missed opportunity.

Antimony Players

One of the only producing antimony mines in the Western world is the Mandalay Resources (CA: MND) owned Costerfield gold mine in Victoria, Australia. The primary resource is gold, but operations also produce around 2,000 tonnes of antimony per year - 50% of Australian and arguably Western world mine production. The life of the mine at Costerfield is currently five years, but drilling and further exploration continue to increase the resource base and mine life incrementally.

Unlike other metals, being such a small market - the Chinese players in antimony are all private, with the exception of a tiny subsidiary under China Minmetals Rare Earth Co. (SH: 000831) which would only offer very diluted exposure to antimony. So even those with access to China listings are out of luck here. Like most metals, there is also a host of hopefuls digging around, raising money and creating grand plans. Some players include;

United States Antimony (UAMY); no mine production, only a refiner at present.

Mandalay Resources (CA: MOLT); a gold miner who's Australian operations produce around 2,000 tonnes of antimony annually.

Perpetua Resources (PPTA); Looking to re-open the Stibnite gold mine in Idaho, one of the largest resource, lowest cost and highest grade gold resources in the US - with expected antimony production to fulfill 35% of annual US demand.

Molten Metals (CA: MOLT); looking to re-start old mines in Slovakia.

A host of other Aussie and Canadian hopefuls including; Bayhorse Silver, Stallion Discoveries, Southern Cross Gold, Nagambie Resources and more. But to be clear, these are basically funding vehicles with a dream and their cap out looking for investors. Most will never produce and if a lucky few do, it will be quite a few years away.

Of all the theoretical projects being explored, should they come to fruition and produce at intended volumes - even the largest would not provide a meaningful impact to the supply side of the equation.

Another Antimony Source

But what if we were to tell you the figures above that are widely touted in investment slide decks are not the whole story? That there is a 'hidden' supplier that is;

Located in the Western world

Already producing volumes equivalent to around 10% of global antimony supply

Has its own refining operations not reliant on China

Supplying customers in dozens of countries

Carries zero exploration risk

Paying a dividend of 3%

Could potentially be increasing its production in the next couple years by double (though this is conjecture on our part until results and further commentary are released shortly by management)

If that would that be of interest, read on…