Geopolitical Compass #21

Diversity is done. Bye bye to cash. Central Bank arsonists. No coal = pay more for less energy. German self immolation.

TLDR; They’re coming for your cash, coal reduction leads to increased electricity prices and less supply, the coming demise of diversity, central banks admit the obvious, nuclear energy realities, and Germany is hell-bent on destroying…itself.

Cashless Society

Australia largest bank is removing cash from numerous branches, but cash will still be available from ATM’s at these locations… with strict daily limits… for now.

Australian’s along with many others are sleep walking into cashless societies with ultimate control from CBDC’s unavoidable. When government is working on taking away your ability to even use their crappy fiat money (and it’s inbuilt debasement through inflation) without additional controls, you can imagine what they have in store for your future.

If you don’t think they’ll be dictating how, where and when you use your money in the future, you need your head read. Prepare yourself now.

Coal

Last week I explained how China, India and Indonesia are building more coal power plants and will continue to increase coal generation capacity for years to come while paying some lip service to ESG to get Western bodies off their back.

This week, in the West where coal is a four letter word, power plants are being shut down left and right and the ESG morons rule supreme - we see the inevitable consequences.

A report by the Australian Energy Regulator (AER) said wholesale electricity prices rose over the second quarter of the year because of higher demand in southern states, lower solar generation, and reduced cheap coal capacity in NSW and Queensland.

"We're planning for the removal of coal-fired power out of the network by 2030. We have to get 12 gigawatts of new energy into the mix.

"We also know that we're really trying to undertake the industrial revolution in 15 years."

What could possibly go wrong? 🤦🏼♂️

They’re already starting to lay the ground work to obfuscate the failure of Western grid infrastructure as a purposeful ‘choice’ to help the climate, instead of gross stupidity and negligence of government policy…

Diversity

What a shame.

This was always going to happen. Why? Because the West has had it so good for so long, it has manufactured all types of ‘first world’ problems and distractions - actively encouraged by government with a ‘fight amongst yourselves peasants, just leave us alone’ attitude.

It’s the same reason jaywalking is such a social faux pas in places like Austria. When you have a very good life, people get upset over trivial matters that are not an issue when real hardship is present.

As the Western world continues it’s decent into decay over the coming decade, many people are in for a shock when they find no one cares anymore about their pet cause of pronouns, fluidity, the colour of their feelings or any one of hundreds of other manufactured distractions.

Germany

The current German government is hell bent on continuing it’s destruction of the nation, burning as many bridges before the increasingly unpopular Greens lose their position at the top.

In it’s latest strategy on China, Germany again feels the need to criticise it’s largest trading partner on internal issues. Bullet, meet foot:

While the German government deems fit to criticise China on domestic issues, in the mean time it’s industrial base is making a mad scramble for the exits, beating a path to…. you guessed it, China.

Germany’s biggest companies are ditching the fatherland.

Chemical giant BASF has been a pillar of German business for more than 150 years, underpinning the country’s industrial rise with a steady stream of innovation that helped make “Made in Germany” the envy of the world.

But its latest moonshot — a $10 billion investment in a state-of-the-art complex the company claims will be the gold standard for sustainable production — isn’t going up in Germany. Instead, it’s being erected 9,000 kilometers away in China.

Even as it chases the future in Asia, BASF, founded on the banks of the Rhine in 1865 as the Badische Anilin- & Sodafabrik, is scaling back in Germany. In February, the company announced the shutdown of a fertilizer plant in its hometown of Ludwigshafen and other facilities, which led to about 2,600 job cuts.

“We are increasingly worried about our home market,” BASF Chief Executive Martin Brudermüller told shareholders in April, noting that the company lost €130 million in Germany last year. “Profitability is no longer anywhere near where it should be.”

A related problem is that Germany’s most important industrial segments — from chemicals to autos to machinery — are rooted in 19th-century technologies. While the country has thrived for decades by optimizing those wares, many of them are either becoming obsolete (the internal combustion engine) or simply too expensive to produce in Germany.

With a government hell bent on deindustrialisation coupled with a loss of access to cheap Russian energy, German industry can see the writing on the wall, and it’s not pretty.

As the strongest nation in Europe self immolates, what chance does the rest of Western Europe have?

Inflation

The BIS released it’s 2023 annual report, stating the obvious - central banks went too far with money printing and are the cause of inflation (which they always are by definition):

With the benefit of hindsight, the extraordinary monetary and fiscal stimulus deployed during the pandemic, while justified at the time as an insurance policy, appears too large, too broad and too long-lasting. It contributed to the inflation surge (Graph 20) and to the current financial vulnerabilities.

It didn’t ‘contribute to the inflation surge’ - it IS the inflation. Rising prices are just the result of all the additional money sloshing around looking for a home.

If only it could have been foreseen that printing trillions of dollars, euros, pounds and every other currency to chase the same or less amounts of goods would lead to massive price rises across the world economy for everything.

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.

Milton Friedman

Nuclear Energy

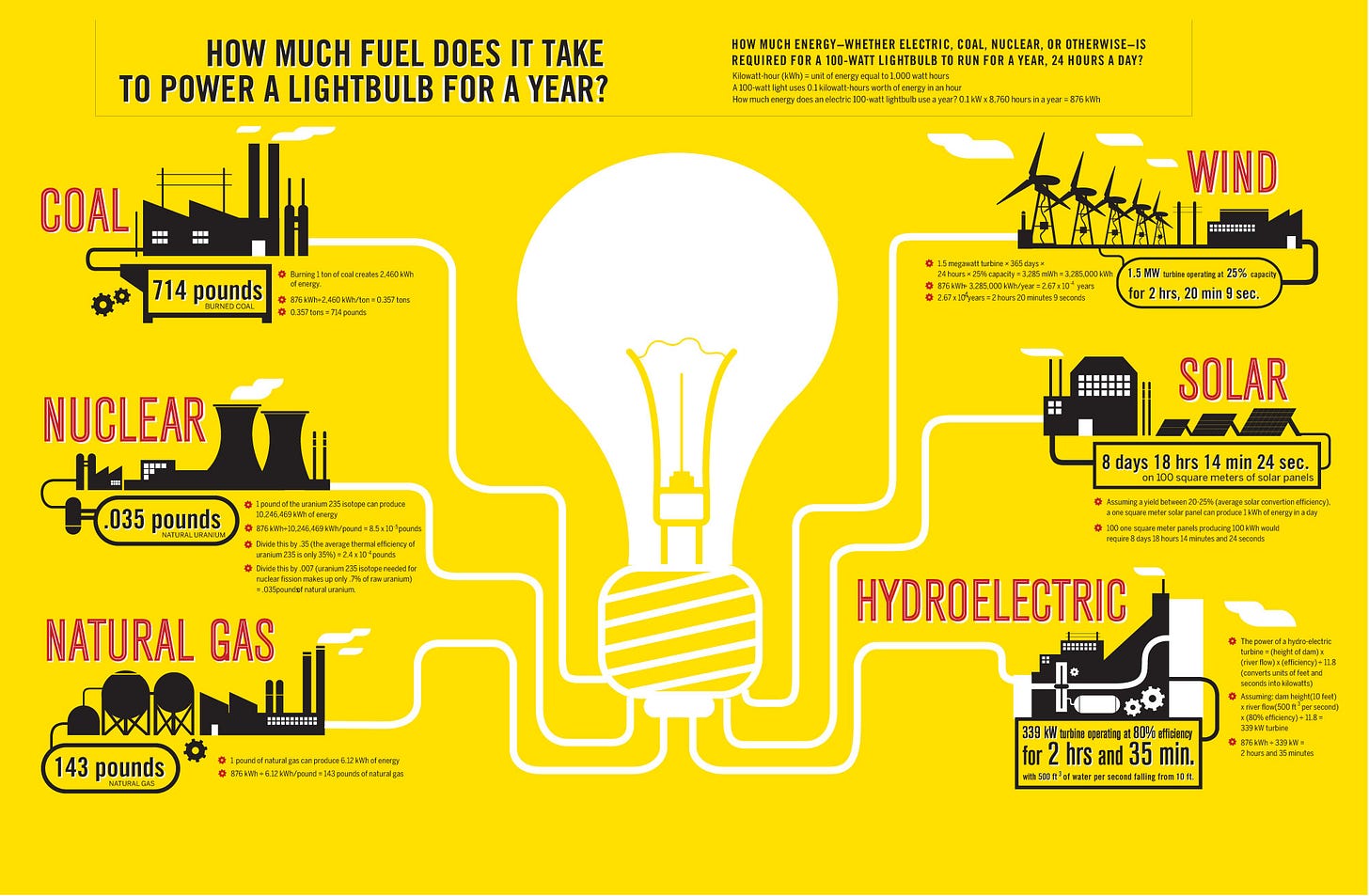

Putting things in perspective:

“But Greenpeace says nuclear energy isn’t safe” - don’t believe scaremonger narratives, believe facts:

Nuclear energy will not be a choice in the future, it will be a necessity.

If you enjoyed this weeks Geopolitical Compass, please consider sharing it to spread the word to others.