Geopolitical Compass #31

When virtue signalling forces market dislocations, outsized profits are there for the taking.

This Week:

Virtue signalling gone wrong

Germany’s youth ‘health crisis’

Liberland attacked

Market dislocations provide outsized profit

The secret manual for newly elected politicians

Canada

The applause and standing ovation for a Nazi in the Canadian parliament last week has made headlines worldwide, so you don’t need me to brief you on it.

The disingenuous deflection and “we didn’t know” after the fact is just pathetic. Without even looking into the history of any one individual; anyone fighting against the Soviet Union in Ukraine during WWII has to be a Nazi.

It’s great to see the idiotic Ukraine virtue signalling finally being called out. That Trudeau has the temerity to try and invoke anti-Russian sentiment into his non-apology shows the utter contempt he holds for his own people and their intelligence.

With Trudeau’s poll numbers already in the gutter, let’s hope the rumors circulating of a no-confidence motion being introduced and his advisors recommending he resign turn out to be true.

Of course he’ll never admit to being the little weasel that he is and will be given a cushy private industry position - but at least the wider public won’t have to suffer him anymore and perhaps…. just perhaps Canada can move on from his suicidal policies.

Germany

The woke green mind virus is hitting Germany’s young hard.

More than 40 percent of young Germans say that climate change has negative effects on their mental and physical health, according to a survey by health insurance company vivida bkk. Of the 14 to 34 year olds surveyed, 41 percent said they feel the effects of climate change on their bodies. The majority of those affected, 83 percent, say they suffer physically from increasing extreme weather conditions, with many also mentioning circulatory problems and allergies.

This is what happens when you brainwash impressionable teenagers with hysterical, made up climate nonsense. The same way we saw people lose their minds over the Covid scam.

Providing a bogeyman unites people in fear of a common cause, driving them into what they believe is the safety of a protector - in this case government.

These causes are increasingly invented by inept governments seeking to distract people from the decaying state of society brought on by their actions, primarily manipulation of the money supply leading to massive prices rises across all sectors of the economy.

Stay aware of these false flags, prepare yourself for more to come and when they do - take a step back and question what you’re being told. Don’t blindly accept.

Liberland

On the morning of Thursday, September 21, a private company acting on behalf of the Croatian Forests (Hrvatske Šume d.o.o.) accompanied by police made an unannounced extraterritorial incursion into Liberland and demolished and removed Liberland property. Liberlanders living on the land were threatened with arrest if they interfered. An unspecified number of Liberlanders were arrested under the vague charges of “failure to comply with a lawful order.”

This is the problem I see with the free cities projects trying to establish themselves around the world. They will all remain dependent on the benevolence of existing governments and the agreements signed. Agreements that come under threat when new politicians, not a party to the original deal, take over the reigns of government.

Might this change in the future? I hope so, the theory of privately run cities providing essential services and more freedoms with lower taxes - fee for service governance - make perfect sense.

But we know throughout history, today as much as any time, threatened governments don’t need to make sense.

Limited bureaucracy, fee for service governance, lower taxes and individual property rights amongst other goals are all noble and worth working toward. I also have my doubts they will be able to achieve these goals within the next couple decades. After that, once the West had thoroughly collapsed? Quite possibly. But collapse always takes longer than people expect. Look at Argentina.

While I look on these projects with great interest, for the moment I maintain my strategy of Flag Theory, trying to ensure I have clearly demarcated lines and jurisdictions between the different areas of my life; citizenship, residency, business, corporate structures, assets, playgrounds. Not leaving all aspects of your life open to the whims of one, or even two or three governments is key to living a free man.

The best way I’ve found to function within the rules of overreaching government is to ensure no government really cares about you, particularly the places where you spend most of your time.

If you can achieve that, you’ll be much freer to go about life unaccosted.

Market Dislocations

The dislocation in shipping markets worldwide continues, particularly in the crude and product tanker segments. With the inefficiencies introduced into global shipping routes, coupled with limited supply response from shipping companies unwilling to order new vessels, many industry insiders as well as investors strongly believe it remains a good time to be positioned in the industry.

A good rundown of the prospects of the product tanker market can be heard from this Q&A session of industry leaders at the recent Marine Money conference.

But it’s not just the Greeks, Norwegians and Monegasque that are profiting from high TCE rates. The same is true for Russia’s fleet. Sovcomflot, the majority government owned shipping company that transports crude, product and LNG as well as upstream services quietly announces (on it’s Russian site only, not on the English version) H1 2023 EBITDA of USD 867 million, almost equaling the entire 2022 level of USD 1,039 million. Not bad for a company with a market cap of USD 940 million. If Q1 figures maintain over the year (let alone rise), SCF is on a P/E of 0.82, while also drastically reducing debt.

It also doesn’t sound like the Russians are expecting markets to normalise anytime soon:

Revenues from the tanker business segments (transportation of crude oil and petroleum products) are supported by favorable market conditions against the background of increased demand for tanker tonnage, taking into account the changing geography of international trade of oil and petroleum products. Despite the presence of a seasonal decline in freight rates in the summer, the company believes that market fundamentals, including limited growth of the global tanker fleet due to a small number of orders for the construction of new vessels, suggest a high probability of sustainability in the medium term of freight rates for level above historical averages.

So what are the takeaways from government interference with sanctions against Russian energy and shipping?

Government interference for it’s own political agenda or virtue signalling doesn’t have the desired effect - the market always finds away to meet demand with supply.

The interference works to increase prices for end consumers.

The dislocations provided by government allow smart businesses and investors to profit from the insanity of bureaucrats.

Sadly most of us can’t take advantage of these cheap valuations of energy related companies in Russia. But that doesn’t mean they don’t exist elsewhere.

Where can we find other dislocations in the energy market if we can’t buy Russia?

How about Poland?

Assuming you’re not of the belief that Russia is out to conquer all of Europe and Poland will be invaded any week now, some may see value in Central Europe’s largest energy company.

Orlen SA after a 3-way merger in 2022 is still misunderstood by the market as well as clouded by the war next door in Ukraine. It’s also looked on unfavourably since it’s a majority Polish government State Owned Enterprice (SOE). Somewhat justifiably markets love tarring SOE’s with suspicion, but many times this pessimism is taken to excess.

Orlen - incidentally also the largest company in Central Europe - is being championed by the Polish government, similar to many other SOE energy firms we see worldwide including ENI, TotalEnergies, Petrobras and Ecopetrol. The company has growing production assets in Norway, domestic Polish and Central Europe gas resources and infrastructure, extensive refining operations, a network of over 3,200 service stations across five countries, as well as diversifying into other energy sources including paying some mandatory homage to the wind and solar gods (🤦🏼♂️) and also looking to develop nuclear SMR’s. Currently at a P/E < 2, the market is pricing Orlen lower than the much maligned Petrobras.

You could also look at Jastrzebska Spotka Weglowa SA (JSW). The leading producer of high quality metallurgical coal in the EUSSR and a major producer of coke. Another dislocation in investment markets, after all coal is evil and dying right?

Met coal is used in the steel making process and while there is a gradual move to Electric Arc Furnaces in the industry, this will be a decades long shift and even if Europe moves further along this path - met coal is easily transportable to the huge appetite of Indian and Chinese steel producers. Also remember EAF steel requires recycled steel, there will always be demand for new steel, even decades from now. Yet the same market dislocations exist in this market - met coal miners are being priced like they’ll be out of business in five years.

JSW’s current market cap is PLN 5.2 billion, with PLN 3.7 billion cash and if current met coal prices hold - a P/E around 0.9.

Why such a low valuation? Well for a start it’s coal, the antithesis of ESG investors, even if the business is almost 80% met coal. “mUh aLL cOaL iS BaD.”

From a political perspective, JSW is also an SOE and inside the EUSSR, not a prime place to be. But Poland has always been very vocal in it’s opposition to the idiotic policies coming from Brussels and as mentioned - met coal is a product easily exported to wherever it’s needed.

But even for a coal miner, JSW is dirt cheap when compared to other met coal names worldwide trading at P/E’s around 4-4.5. Even compared to Indonesian thermal coal miners trading at 3.2 P/E, this company is cheap.

The main reason JSW is currently so unloved by the market is that despite hemorrhaging cash, overly cautious management decided not to distribute a dividend for 2021 or 2022, instead opting to keep it for a coal market downturn. A few years back JSW set up Fundusz Inwestycyjny Zamknięty (FIZ), a closed-end investment fund to stockpile cash and investments for a rainy day.

The Group has been investing in a portfolio of financial assets through the Closed-end Investment Fund (“FIZ”) in which the Parent Company holds 100% outstanding investment certificates. The Fund subscribes to a conservative investment policy. In periods of upswing on the coal markets, the Parent Company intends to transfer a portion of its cash surpluses to FIZ to have them invested. The Company will be able to use the funds accumulated in FIZ in periods of market downturn and/or in periods of negative cash flows generated by the Group.

In 2022, the Group invested a total amount of PLN 4.2 billion in the portfolio of FIZ assets. As at 31 December 2022, the net value of the Fund’s assets amounts to PLN 4,893.6 million (PLN 507.7 million as at 31 December 2021).

A downturn that looks increasingly like it’s not coming due to a steadfast refusal of met coal miners to expand production in any meaningful way, banks refusing to finance the industry and governments declining new permits to explore/expand. Couple this with increasing demand from Asia for met coal and you have the perfect storm.

Currently only 10% of JSW’s product is exported outside the EUSSR due to the block still being the fourth largest importer of met coal (after China, India and South Korea). Poland and Czech Republic are the only domestic producers of met coal inside the union. Security of supply for commodities is paramount which the EUSSR is finding out currently as it desperately tries to secure energy from anywhere it can (except Russia of course).

With these market dynamics, profits maintaining and cash inside JSW and FIZ swelling, I doubt even this management team can hold back the very vocal demands from shareholders for a dividend or other capital measures next year. If and when that happens, just to move closer to the still-cheap valuation of other coal miners, JSW is looking at a 3x in price, and a yield (at current stock price) I’d conservatively estimate at 20-30%. That’s assuming met coal prices just maintain average levels for the year to date and don’t continue climbing higher.

SOE’s definitely have their share of problems when it comes to government interference and pessimistic investment markets, but there is money to be made when they go from horrendously undervalued, to just very cheap.

Politicians

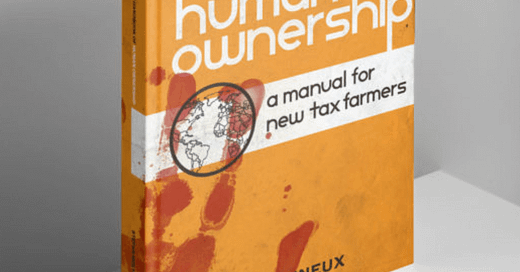

The secret manual for newly appointed elected politicians.

Hey – seriously - congratulations on your new political post!

If you are reading this, it means that you have ascended to the highest levels of government, so it’s really, really important that you don’t do or say anything stupid, and screw things up for the rest of us.

The first thing to remember is that you are a figurehead, about as relevant to the direction of the state as a hood ornament is to the direction of a car – but you are a very important distraction, the “smiling face” of the fist of power. So hold your nose, kiss the babies, and just think how good you would look on a stamp. A stamp, for mail… No, not email, mail. Never mind, we’ll explain later.

Now, before we go into your media responsibilities, you must understand the true history of political power, so you don’t accidentally act on the naïve idealism you are required to project to the general public.

The reality of political power is very simple: bad farmers own crops and livestock – good farmers own human beings.

This is not nearly as simple as it sounds, hence the need for this manual.

The very first thing to remember is that you are a mammal, an animal, and like all animals, you want to maximize consumption while minimizing effort. By far the most effective way to do this is to take from other people, just as a farmer takes milk and meat from cows.