Geopolitical Compass #39

Why would China not dominate this manufacturing industry like it has many others?

This Week:

Argentina to become a libertarian utopia?

Fidelity’s new Bitcoin report

China’s rise in the automotive industry

Elections in the West are broken

Guyana to shrink?

Ukraine new ‘Dad’s Army’

Argentina

Libertarian Milei wins the Presidency in Argentina with 55% of the vote. Not a resounding win, which means he’ll need to work with the parliament to achieve many of his goals, but it will be a very interesting to watch his next steps.

Here’s hoping he can achieve what he set out to. Abolishing the central bank alone would be good for the people.

But realize that by abolishing the Argentine central bank and dollarizing the economy, he simply substitutes in the US Fed and it’s policies instead. Bitcoiners need to take a breather, he’s not going to do a Bukele.

Meet the new boss, same as somewhat better than the old boss.

Abolishing the central bank and reigning in government spending will be positive steps. Inflation will be tempered, but it will still exist. Argentina will also cede a great deal of control over it’s own affairs to the US. Perhaps the lesser of two evils considering the destruction brought about by continual socialist rule in Argentina.

There’s never a perfect solution, compromise will always be needed for any long term progress. He’s coming in with the right ethos - to stop the globalists and socialists. If he is able to carry out at least some of his agenda, Argentina will turn a corner to more prosperous times, or at least, less terrible times. That will provide opportunity for many.

But don’t be under any illusion, with Milei, Argentina will fall well and truly under the increasingly frenetic, but still strong arm of the United States.

Bitcoin

Fidelity - one of the world’s largest fund managers - extremely bullish on Bitcoin as always. Dispelling persistent criticisms in a new report including the current favourite criticism of electricity usage.

Further, if powering Bitcoin, a global digital monetary network, is considered wasteful, then what does that make the traditional financial system? Consider the energy use and carbon footprint of brick-and-mortar banks and credit unions, corporate office buildings, paper credit card statements, plastic credit cards, paper promotional offers, mining metals for fiat coins, harvesting lumber and other materials to print physical government-issued currency, the human time and energy required to keep the traditional financial system running, and more. Energy is a fundamental requirement for much of modern society, so it is more of a question of where energy comes from and for what purpose it is used

Car Production

After the rise of China over the last twenty years in production of virtually everything, is there any doubt it will be different with cars?

Until recently, the majority of China’s car manufacturing capacity has been targeted at domestic consumers. However the pivot to an export industry has begun in earnest over the last couple years.

Foreign sales of Chinese-branded cars could reach 9 million vehicles by 2030, double Japan’s exports in 2022 (China is on track to export around 5 million vehicles this year).

Chinese-made vehicles cost roughly 40% as much as German-made ones and are popular in emerging markets like Brazil.

Western companies including Tesla and GM produce in China to export worldwide. Tesla currently accounts of ten percent of China car exports and models from now Chinese owned brands including Volvo and MG are gaining a lot of favour with Western consumers.

At present China exports very few cars to the United States due to domestic US tariffs and geopolitical tensions. So all this growth is without the world’s largest consumer economy as a customer.

You could invest in Chinese car manufacturers like BYD to play this trend and likely do well. I’ve chosen instead to invest in the shortage of ships to move the millions of cars per year - and rising rapidly - to the rest of the world.

“What we are seeing now, clearly there is a fairly large backlog of new vessels, but I think it’s important to emphasise that these are coming gradually over several years,” Hoegh Autoliners chief executive Andreas Enger said on the company’s third-quarter earnings call.

Enger said Hoegh Autoliners had investigated the issue and found roughly a third of Chinese seaborne auto exports — which have surged as of late thanks to the growth of electric vehicle production — were being carried in containers.

The nontraditional shipping comes as Hoegh Autoliners reports effectively total utilisation across its ships and Oslo-listed rival Gram Car Carriers reports it is sold out for 2023 and only has 4% of revenue days available in 2024.

Even with a large vessel order book, it appears these carriers will be facing a boom in business over the coming years from Chinese car exports. That’s before you factor in rising exports of other rolling goods from China like excavation, mining and construction equipment which also benefits RORO carriers.

Elections

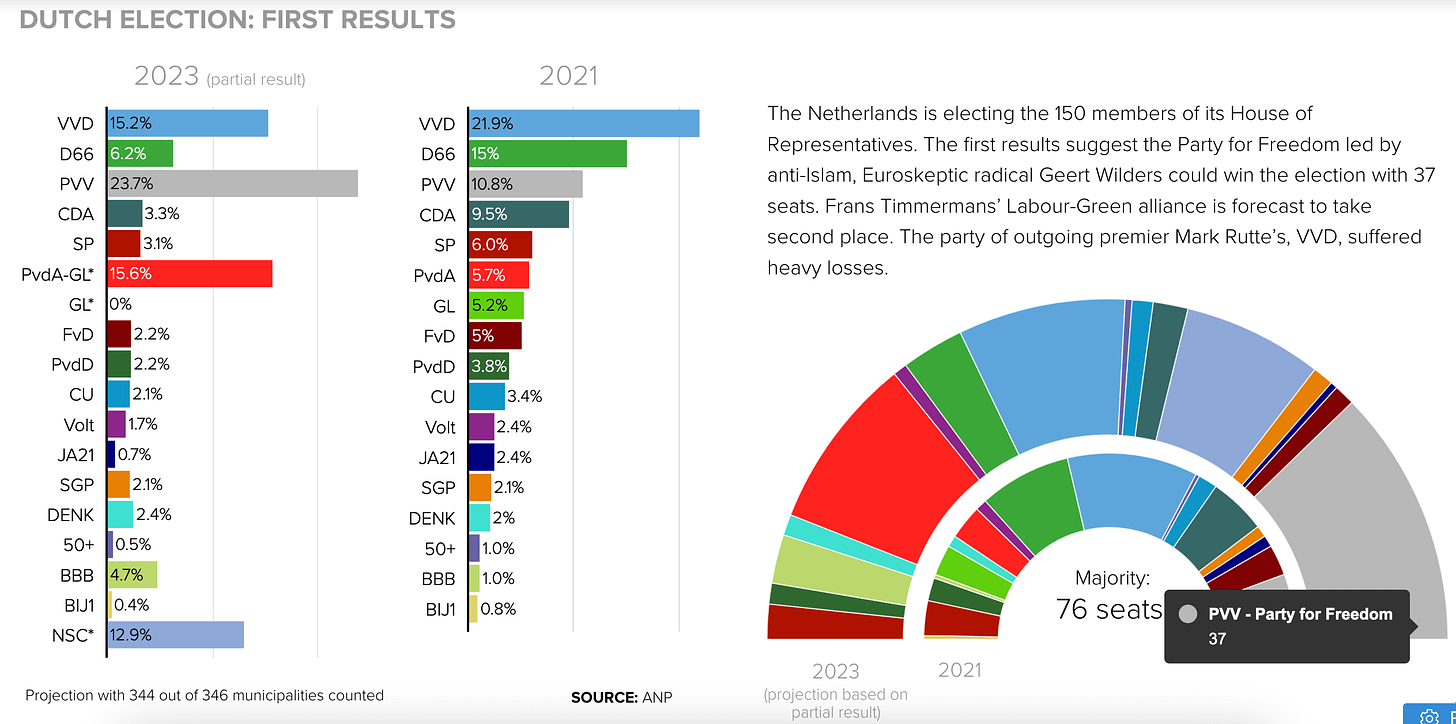

There is turmoil again this week as a globalist, EUSSR loyal government looks likely to fall to a sovereigntist party, more in favour of independent thinking in the Netherlands.

Democracy is so broken today that it just no longer works. Here are the results:

Even the PVV which has the largest vote and therefore can claim to have the ‘right to govern’ only received 37 seats, far from the needed majority of 76 needed to govern in its own right, and will have to form a coalition with opposition parties to govern. It will only be a matter of time before the government becomes hamstrung and unable to pass policy and require another election in order to try to gain more traction. If not, it will fall apart, just look at Italy for the last four decades.

Democracy is broken. While there is no easy fix, the one obvious solution which should be implemented on a global scale is to remove the right to vote from anyone who earns their living from the government. Whether that be as a government employee, contractor, or welfare recipient of any form. This mean only allowing net taxpayers to vote for who will be in charge of a country’s policy and money:

A "net taxpayer" refers to an individual, household, or entity that pays more in taxes to the government than it receives in benefits or services. The term is often used to describe those who contribute a net positive amount to government revenues.

People who rely on government for their livelihoods will only ever vote for larger government, bigger bureaucracy (jobs), more taxes, higher funding and more welfare payouts which leads to the bankrupting of nations we see across the West.

A large number of parties witnessed in the Dutch election above and in democracies worldwide are socialist parties to one degree or another. By design, these parties splinter the vote and dilute down the voice of net taxpayers (business and asset owners, and privately employed people) and eventually bog down the system to what we see in ‘democracy’ today.

Will the right to vote be removed from next tax consumers? No time soon. But with the democratic system decaying as it is, it’s conversations like this that need to start happening on a broader scale.