Geopolitical Compass #3

Australia wants to take the war to China. French 'democracy' in action. UK standard of living crisis. Georgia's reason for being (according to the US).

Notable events in geopolitics and capital markets this week. Expand your perspective, gain context, and discover actionable insights.

Australia

Former Prime Minister Paul Keating has voiced his opinion of the recently announced AUKUS deal for Australia to buy/build US nuclear powered submarines to ensure its protection against China.

Keating points out China has never overtly or indirectly threatened Australia, has no interest in attacking Australia, and even if it did - all great wars are fought on land, so would need to transport via sea all weapons and troops, and to think three (active at any one time out of eight) submarines will protect Australia from invasion is just ridiculous. He outlines the true heart of the matter:

The Americans will never condone or accept a State as large as them, and that’s what China presents. China’s mere presence. They (US) would have preferred China remain in poverty forever. The fact that China is now an industrial economy larger than the United States…. They say ‘hang on, this is not in the playbook. What an affront.’

Australia is simply becoming an even greater vassal state of the US and will take actions to its own detriment as instructed.

He also raises the pertinent point that unlike Australia's current smaller Collins Class submarines which are designed for Australian waters and are defensive, these new submarines are much larger, less suitable for domestic Australian waters and designed to sit off the coast of China.

It’s a shame politicians can only speak freely once out of office.

Real Reason for the Deal?

Caitlin Johnstone argues the move by Australia is actually more likely an act to defend itself against the United States.

Contrary to Joe Hockey’s claims, Australia is not paying hundreds of billions of dollars to knit itself even further into the U.S. war machine because “the cost of failure is far greater than the cost of investment.”

In truth those hundreds of billions of dollars are more like pizzo payments to the Mafia; we’re letting the boss wet his beak so he doesn’t trash our business and break our kneecaps.

Nobody ever talks about this, even though anyone who studies U.S. foreign policy knows it’s true. Australian propagandists make up stories about what China might do to us if we don’t play along with Washington’s brinkmanship against Beijing, but they never talk about what the U.S. would do to us if we don’t.

This is because they don’t want us thinking too hard about the fact that we are being coerced by the world’s most powerful government into preparing to fight a war of unfathomable horror under the tacit threat of inflicting even worse horrors upon us if we don’t.

Australia is caught between a rock and a Pentagon, and both are the fault of the United States. The U.S. is responsible for engineering all these hostilities between China and the Western power alliance in its desperate attempts to secure unipolar hegemony, and the U.S. is responsible for creating the fear other countries feel knowing what fate might befall them if they disobey its dictates.

Banking Crisis

An excellent take on the current banking crisis. All is by design and leading us toward more control of our freedom.

Just when it seems the financial moral hazard created by the Federal Reserve cannot get any more treacherous, the fu**ers find a way. There is no way they can mathematically fight inflation while at the same time saving irresponsible banks by compensating their bond losses while guaranteeing all uninsured deposits.

Imagine a house on fire. Firefighters in the front hose it down with water. Then they run around to the back of the house and hose it down with gasoline. Then they run back to the front of the house, and they repeat this until there is only an ash heap. This is what the Fed has just announced they will be doing.

Central banks are in opposition to free markets. They are entities for enslavement through credit (usury) at all levels. They create fictional money (fiat) tied to nothing by the source of the power/tyranny of the state’s standing armies, or energy monopolies. They intentionally inflate the currency to manage their own liabilities.

There are no free markets. There are centrally controlled markets for both exploitation and looting, and intentional demolition to usher in their new system for enslavement—Central Bank Digital Currencies (CBDCs).

Conversely, Sberbank - Russia’s largest bank - frozen out of the Western financial system is performing well this week.

So Where Are We Going?

Another great take on the crisis and where we’re likely heading here.

While I’m sure that is abhorrent to all you Ayn Rand wannabes (like Ken Griffin and Bill Ackman), the continuation of BTFP solves a very serious problem for the USG. The US Treasury has a lot of bonds to sell, and less and less people want to own them. I believe that the BTFP will be expanded such that any eligible security, which are mostly treasuries and mortgages, held on a US banks’ balance sheet is eligible to be exchanged for fresh newly printed dollars at the 1-year interest rate. This gives the banks comfort that as their deposit base grows, they can always buy government debt in a risk-free fashion. The banks will never again have to worry about what happens if interest rates rise, their bonds lose value, and their depositors want back their money.

The most frightening outcome for the Fed is if people move their capital out of the system. After guaranteeing deposits, the Fed doesn’t care if you move your money from SVB into a money market fund earning a higher rate. At least your capital is still purchasing government debt. But what if, instead, you bought an asset that is not controlled by the banking system?

Assets like gold, real estate, and (obviously) Bitcoin are not liabilities on someone else’s balance sheet. If the banking system goes bust, those assets still have value. But, those assets must be purchased in physical form.

If reading this makes you sick to your stomach, it may be time to consider opting out a portion of your savings into another system that isn’t manipulated: Bitcoin, you can read my take here.

France

‘Democracy’ at work in France. Macron passes an unpopular law without a vote, but Marine Le Pen is the ultra right wing fascist. Makes sense.

Protests inside the parliament as the Prime Minister attempted to deliver her speech.

Time to party like it’s 1789?

Georgia

US-backed protests continue in Georgia. Not content with killing the proposed Foreign Agents bill, NGO’s now seems intent on a colour revolution to install a more cow-towing government eager to implement US policy of agitation toward Russia on a second front.

Georgia’s Prime Minister, Irakli Garibashvili, does not want an expanded war with Russia—especially one that drags Georgia into the conflict.

As such, Samantha Power and her minions at USAID believe the prime minister of Georgia must now be removed and replaced with an anti-Russian (i.e., pro-war) leader cut from the same pro-American cloth as Georgia’s US-backed President, Salome Zurabishvili.

Georgia’s American purpose is to generate regional instability. Who pays the price?

Not America.

Georgia.

Georgia is but a smaller version of Ukraine, another cog in the American “belt of instability.”

Just a hunch, but I’d say based on Georgia’s extremely high youth unemployment rates of men at 40% and women 38% - foreign NGO’s will be able to keep paid protestors on the streets with ease.

Indonesia

Indonesian President Joko Widodo is urging citizens of the world’s seventh largest economy to abandon Visa and Mastercard in favour of the nation’s new domestic payment system.

"Be very careful. We must remember the sanctions imposed by the US on Russia. Visa and Mastercard could be a problem," he warned.

Netherlands

Will Rutte’s government be the next globalists in the fold to lose power? Amusing to watch those so eager to wield their power over the last three years lose it completely - though I will concede that most parties were just as bad as the rot in government.

The success of the Farmer-Citizen Movement (BBB) in Wednesday’s vote, which will determine the makeup of the senate, casts doubt over the government’s ability to pass key legislation, including its plans to slash nitrogen emissions.

“The Netherlands has clearly shown we’re fed up with these policies,” BBB’s founder, Caroline van der Plas, told the public broadcaster NOS. “It’s not just about nitrogen, it’s about citizens who are not seen, not heard, not taken seriously.”

United Kingdom

Brits will have the biggest tax burden since World War II and living standards won’t return to pre-pandemic levels until 2028. The economy is expected to shrink by 0.2% this year.

The UK’s tax burden is on track to hit 37.7 per cent of GDP, the OBR added. Freezing income tax thresholds mean 3.2 million people will start paying in the next five years, 2.1 million will move up to the higher 40p rate, and 350,000 more will pay the 45p rate.

Perhaps more sanctions on Russia will improve the situation?

Weapons

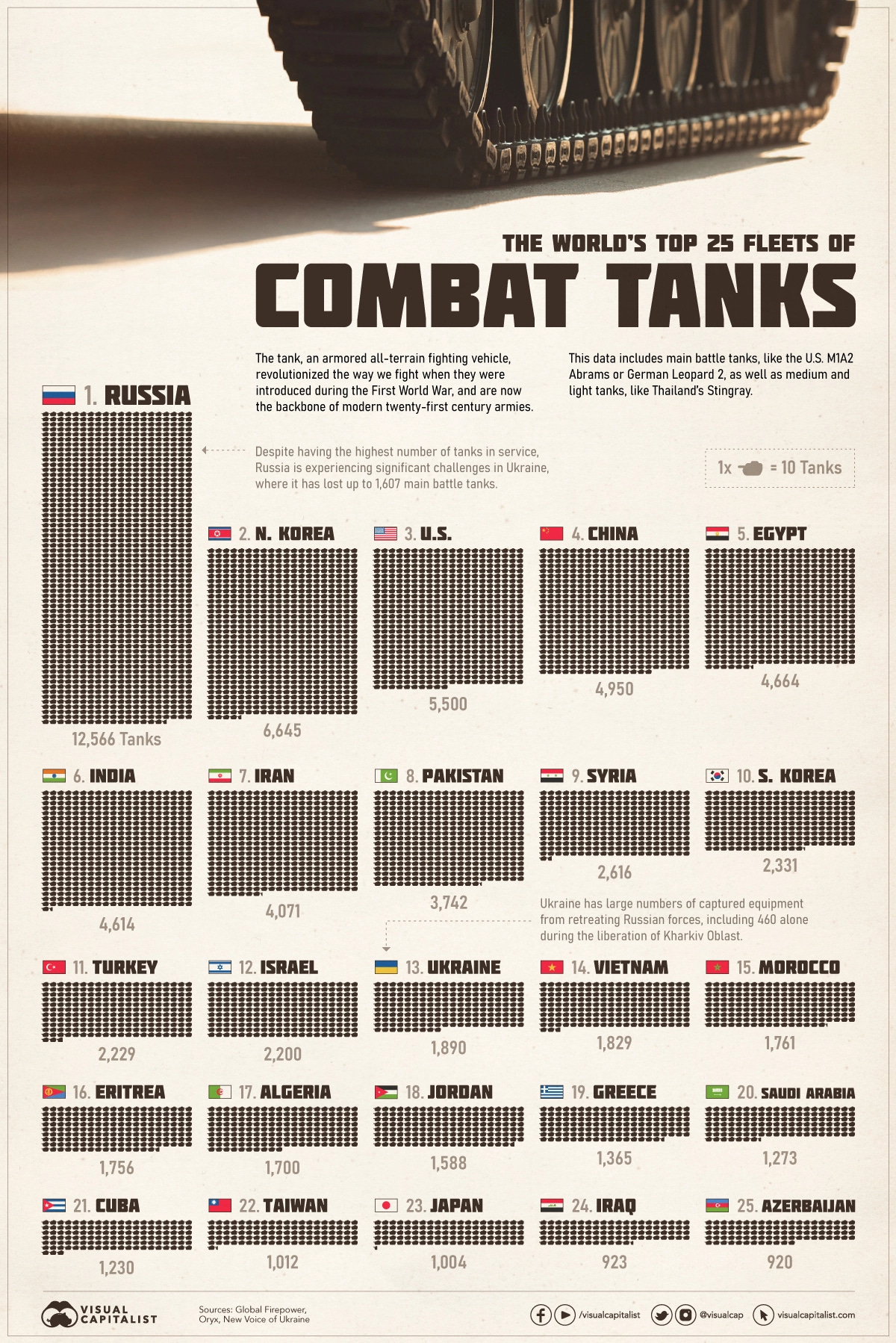

As the West pilfers its bases of tanks (and soon planes) to provide to Ukraine, let’s put in perspective who really has tank firepower. Only Greece at number 19 represents the EU contingent, even though the EU seems to be falling over themselves to give what little they have away. I would also highly question the accuracy of including 460 ‘captured tanks’ in Ukraine’s tally of 1,890 units.

Thank you for checking out Rambling Investor. Hit the like button and use the share button to share this across social media. Leave a comment below if the mood strikes you, and don’t forget to subscribe if you haven’t done so already.