Geopolitical Compass #4

Sweden and Switzerland abandon hundreds of years of neutrality. Mongolia can soon expect an influx of NGOs. Step up in attacks on Bitcoin are incoming.

Notable events in geopolitics and capital markets this week. Expand your perspective, gain context, and discover actionable insights.

EUSSR

Lagarde Embarrassed By Russians

Convicted criminal and head of the European Central Bank Christine Lagarde may decide to let you keep some control over small amounts of your money once the digital Euro is introduced….. maybe.

We are considering whether for very small amounts, you know, anything that is around three, four hundred Euros. We could have a mechanism where there is zero control. But that could be dangerous.

Source - Vovan & Lexus

Got that? It could be dangerous to give you limited control over your money. Lagarde remains one of the best free advertisements for Bitcoin.

Macron Embarrassed by Himself

During an interview on French TV about increasing the retirement age for French workers due to tough times (not untrue and a move needed by majority of pension systems worldwide), mid-way through Macron realises he’s wearing an 80,000 Euro watch…

Fed Balance Sheet

Money printer go brrrrrrr. Long-term there is only one direction this can go until total confidence is lost and hyperinflation sets in. Expect the current banking crisis to require much more guarantees and printing before it settles.

If in doubt, zoom out. Notice in the chart below the 2008 Global Financial Crisis now looks like a little blip. With each passing crisis, ever higher dollars need to be created (expansion of the Fed’s balance sheet) to keep the system functioning. This is your cash savings and buying power diminishing.

Indonesia

Indonesia and China have resumed maritime cooperation.

Mongolia

Confirmation at this weeks meetings between Xi and Putin that progress on the Power of Siberia 2 natural gas pipeline from China to Russia continues. The pipeline will transit through Mongolia.

Foreign interference including ‘Pro-democracy’ and ‘freedom movements’ in Mongolia will be harder for the West to stage considering Mongolia’s geographic and historical ties with both countries, but details like that never stop the US from trying. Watch this space.

Russia

A flurry of news during Xi Jinping’s visit to Moscow including;

China-Russia trade volumes in 2022 are expected to have surpassed the $200 billion planned several years ago.

2/3 of trade between Russian and China is carried out in rubles and yuan.

Russia and China will work together to uphold the fundamental norms of international relations according to Xi Jinping.

Russia is writing off $20 billion of African nations’ debts. This comes after a similar $20 billion write off of Soviet era debt by Putin in 2019.

Sweden

After two hundred years of neutrality, Sweden’s parliament has voted to join the NATO military block against Russia. Sweden which was not seen as a threat to Russia will now have NATO offensive missiles placed on its territory, increasing tensions in the region and forcing Russia’s hand into making counter moves for its defence.

At every turn the West continues to escalate tensions rather than working to reduce them.

Switzerland

Not to be outdone by the Swedes, the Swiss continue dismantling their 207 years of neutrality.

On the diplomatic level, the Foreign Policy Committee of the National Council (CPE-N) discussed Switzerland's commitments at the multilateral level, in particular within the framework of the OSCE, as well as the Chinese President's current visit to Russia and its geopolitical implications. She also addressed the issues of the re-export of war material and the financing of Ukraine's reconstruction. Concerning this last subject, the CPE-N approved, by 13 votes against 11 and 1 abstention, a proposal for a committee motion (23.3437) instructing the Federal Council to present to Parliament a support plan for Ukraine endowed with at least 5 billion francs. The majority of the committee is of the opinion that Ukraine needs significant financial support, in particular for humanitarian aid, the protection of the civilian population, mine clearance, the promotion of peace and the reconstruction of civilian infrastructure.

Without neutrality, capital is and will continue to flow to other safe havens including Singapore and Dubai. Hopefully the Swiss economy will be able to survive on tourism and watches.

United Kingdom

Digital Pound

The UK government has released its white paper on the coming digital pound and how it will enslave enrich you.

Historically, the majority of payments have been made in cash. However, digital innovation is changing the way we pay. With the convenience of card, app, and digital wallet payment systems, the use of electronic payments has accelerated. In 2021, card payments accounted for close to 60% of UK payments and 32% of all payments were contactless. Almost a third of retail sales were made online and about 9 in 10 adults own a smartphone, which can be used to make digital payments, including in-store.

By their own admission, we already have digital money (stating the obvious I know). So why do we need their new version of a digital pound when we can already transact everything digitally?

It’s all about CONTROL. Their new ‘Digital Pound’ CBDC will afford government unprecedented control over your money. Government will have the ability to confiscate your money, impose expiry dates for spending before balances disappear, and restrict where and with who you can spend it.

Didn’t pay enough tax? Switch your money off until you agree to pay.

Attended a protest march? Fine levied and automatically deducted from your balance.

‘Climate change’ getting worse? Your overseas trip has been cancelled.

Cows are bad for the environment? You’re now rationed to only buying meat one day per month, but seeds and bugs are available all month.

Economy doing badly? Expiry date of three months imposed on your paycheck.

Ukraine in trouble? Special ‘5% Solidarity Levy’ applied to all account balances.

Obviously government isn’t stupid and understands outlining this ability to control your money will be met with loud protest and rejection. As always, creeping control will be introduced gradually to condition the masses - ‘two weeks to flatten the curve’ anybody?

I discuss this all in much greater detail here.

Armed Forces

Faced with the reality that British armed forces are utterly inadequate to launch any major military intervention:

The Army admitted that by 2025 it would only be able to field a combat division consisting of just a single maneuver brigade and an interim maneuver support brigade.

A fully capable division including a new Strike brigade will not be available for fielding until the early 2030s — more than five years late…

They have little choice but to rely on clandestine attacks and subterfuge (Nordstream pipeline attack), regime change operations (Hong Hong protests), intelligence agencies stoking tensions between other nations (India and China) and just when you think the establishment can’t go any lower, the UK has announced it will begin supplying depleted uranium rounds to Ukraine.

Depleted uranium rounds have been linked to cancer and birth defects. They were fired extensively by allied forces in Iraq.

The rounds are radioactive and scientists believe their toxic effects on human health can continue to be felt long after conflicts have ended.

Putin has warned that if the UK proceeds with its plan, Russia will be forced to react stating;

(the West) really decided to fight Russia to the last Ukrainian, not in words, but in deeds.

Bitcoin

Growing Importance

From zero, to the 18th largest asset in the world in fifteen years. This graphic is pre-banking crisis, at time of writing Bitcoin’s market cap of $548 billion now puts it in the top 10.

Financial Sovereignty

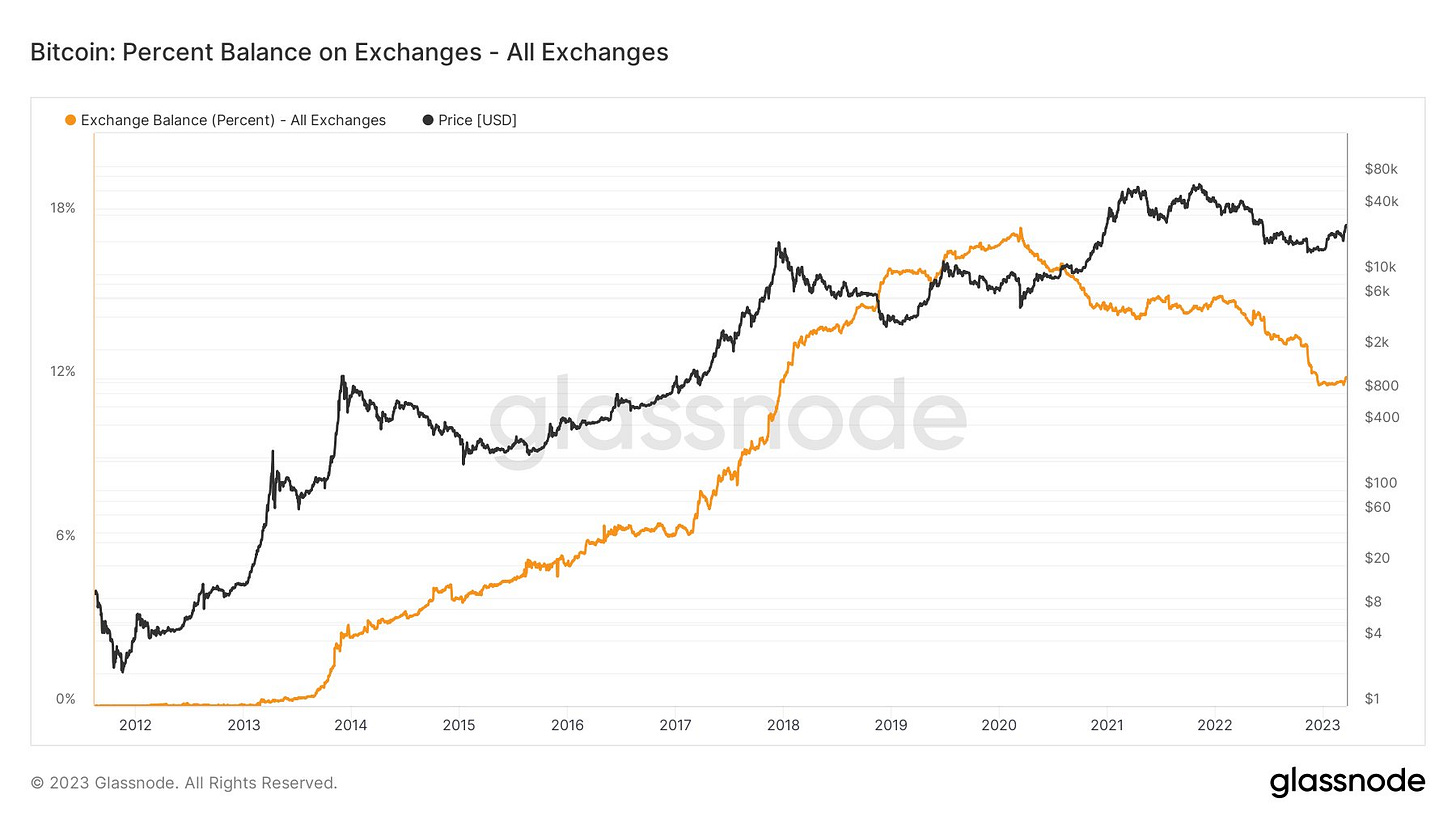

Currently there is the lowest amount of Bitcoin left on exchanges since 2018 - the type of ‘bank run’ we want to see. More people are understanding ‘not your keys, not your Bitcoin’ and the importance of taking custody of your asset.

There is a general mood in the market that there is impending legal action or closing of the on/off ramps coming soon. The current banking crisis will accelerate the trend, demonstarted by Kraken this week as it shut down ACH deposits and withdrawals.

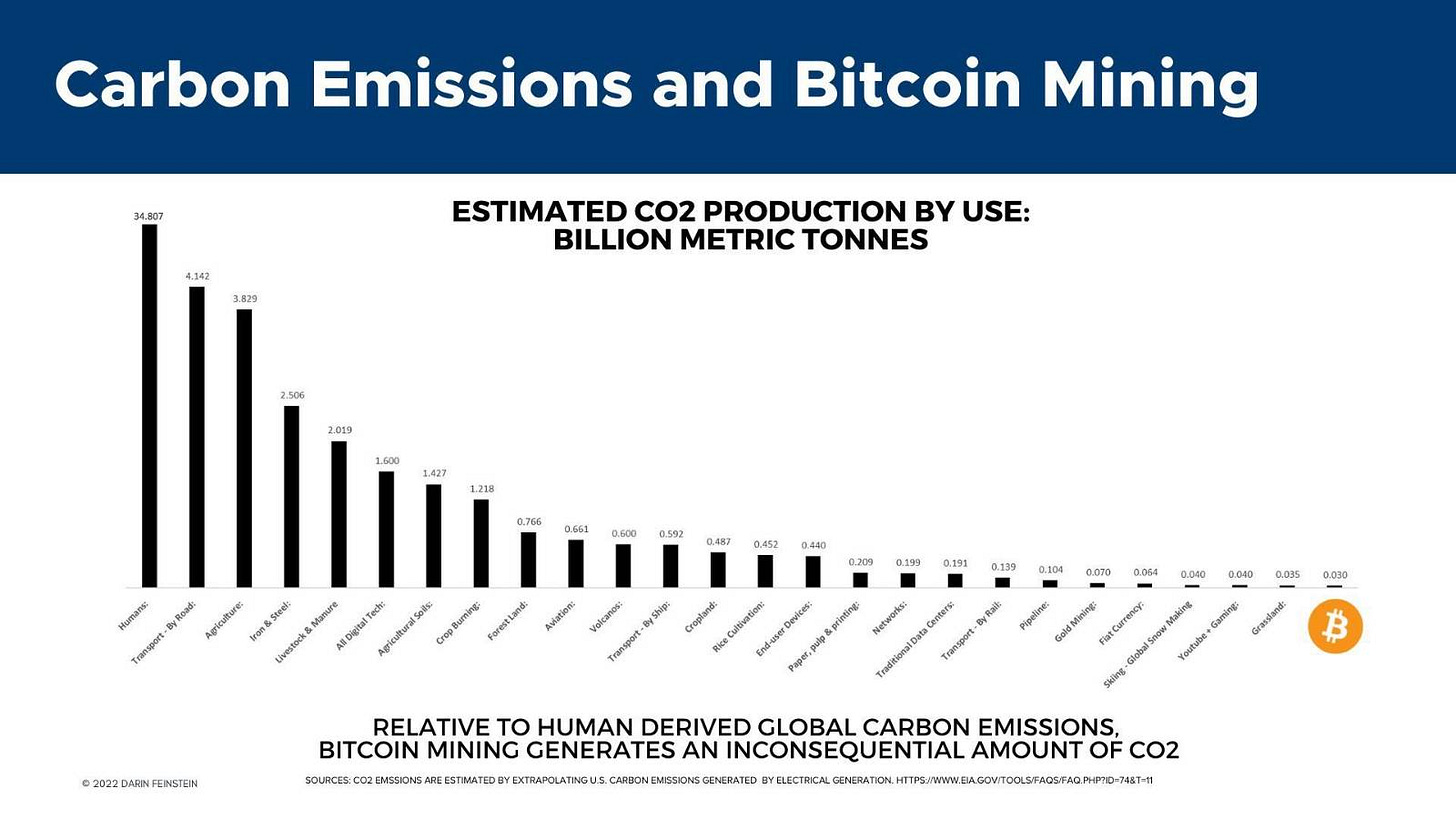

As governments continue to lose control of the current system, regulators and politicians will lash out at any scapegoat they can find. A sovereign asset, independent of their system and outside their control is the prime candidate. The argument they’ll use against Bitcoin is it’s effect on climate change, but don’t be fooled:

That’s assuming you buy into the ‘climate change’ narrative which I don’t. Understand its a very easy attack that can be levied at anything the powers that be don’t want.

That said, it’s not a question of if more attacks on Bitcoin come, but when, and that time is fast approaching. All exits from the current financial system must be blocked.

Thank you for checking out Rambling Investor. Hit the like button and use the share button to share this across social media. Leave a comment below if the mood strikes you, and don’t forget to subscribe if you haven’t done so already.