This Week:

Coal setup for a decade of outsized returns

Did we say billions? Better make that trillions

Inflation has always and will always be a government phenomenon

Winter is coming

Coal

“Is coal the new tobacco?” It seems that way.

The choice investors face; light your money on fire with renewable fairy tales, or compound your capital with reality. Kontrarian Capital with a good take on the setup for coal over the coming years, despite the already sizeable gains in the sector.

EUSSR

Millions of Germans just silently screamed.

The pace of money printing, cushy backdoor deals, rising taxes and virtue signalling will increase until the ultimate inevitable collapse. Rome 2.0.

Governments and Inflation

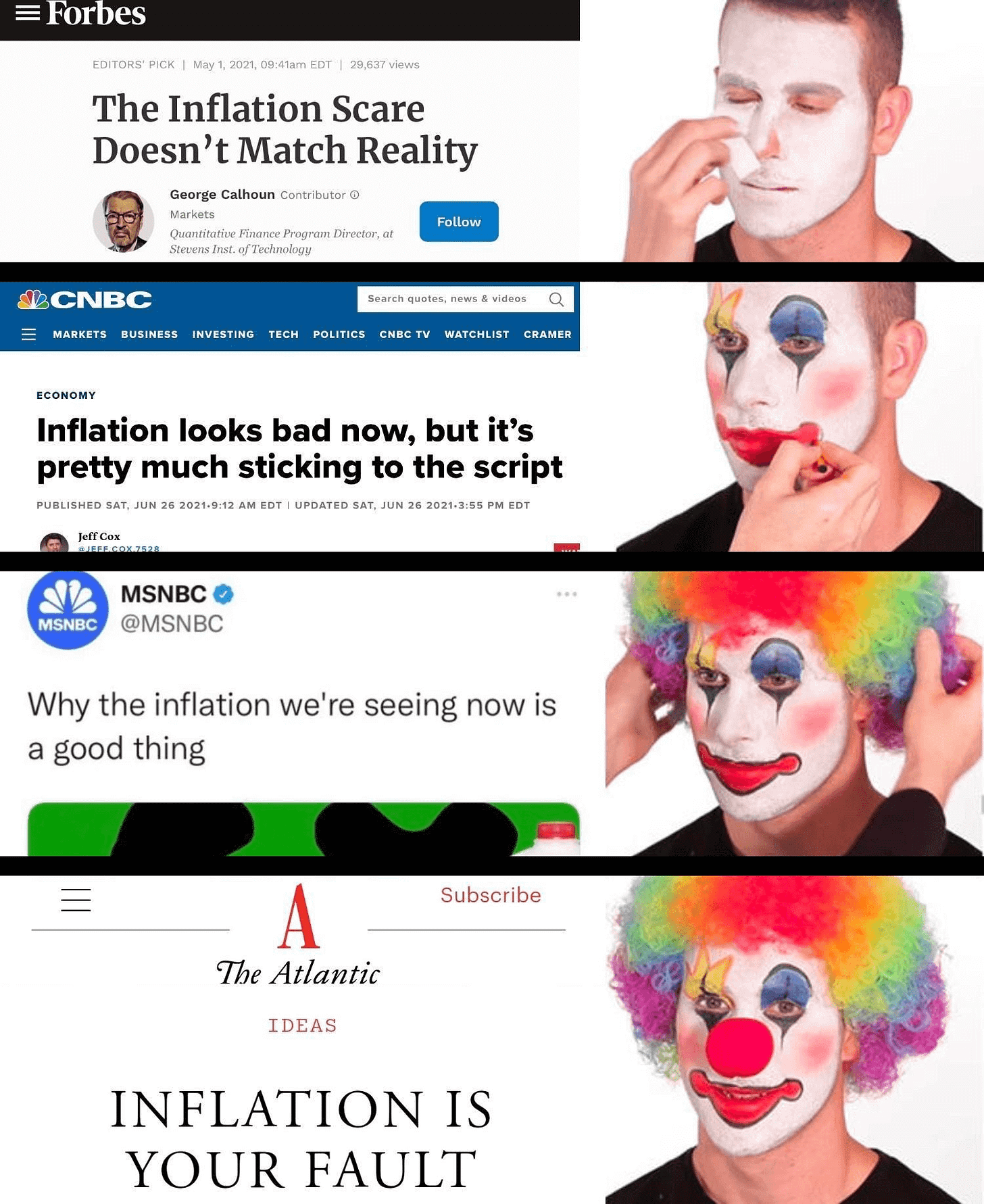

Milton Friedman told us forty years ago what the governments are telling you today. Some things never change, and the governments inability to accept responsibility for its own actions is high up on the list.

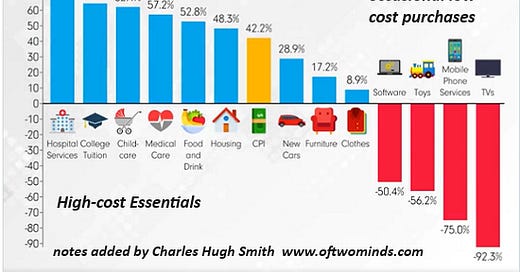

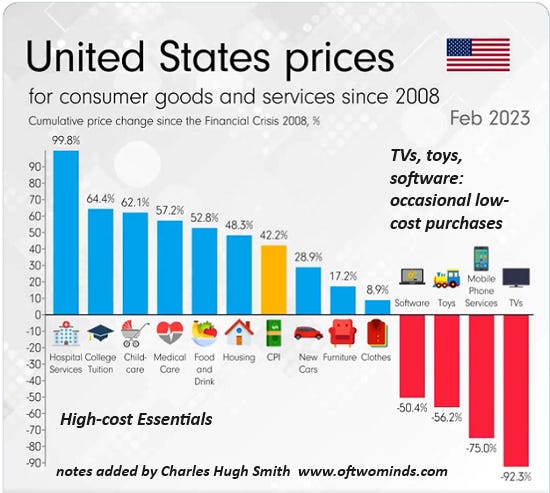

While the government blames everything under the sun for the mess it creates, it doesn’t change the reality they’ve created since the money printers went into overdrive in 2008:

This is a problem all societies face sooner or later. Government is incentivized to print money, regardless of where in the world you are. Here are prices in Brazil in 1996 - after the government “fixed” hyperinflation - compared to now:

Simple math dictates as the systemic rot in our current system increases and the debt involved rises, the coming crisis and money needing to be printed to “save” the system once again will be orders of magnitude higher than 2008 and 2020 combined.

It isn’t hard to figure out what the same chart above will look like in 2030.

Let’s try a simplified, albeit imperfect thought experiment to illustrate the effect of money printing.

Picture a room with two people in it and $1,000 in cash. The only objects in the room are two chairs. We can assume each chair sells for $500. Now dump an additional $49,000 cash into the room. The price of each chair now rises to $25,000, but nothing new was created, no value was added. But a stack of money was printed, so now the only items available to buy have their prices bid up.

When money is printed without a commensurate increase in production, that larger amount of money has to chase the same amount of goods, forcing prices up.

This same inflation hits asset prices too. It’s why your grandfather’s house cost $15,000 when he bought it and is worth $1.7 million today. Printed money doesn’t create any value, but must find a home.

Position yourself with exposure to assets that rise with inflation; gold and precious metals, Bitcoin, commodities, and relatively scarce land and property. Assets that are more limited in supply and take effort and energy to produce, that can’t just be magically printed.

These are the assets that will have inordinately more amounts of paper money being forced into them, bidding up the prices as people desperately look for ways to preserve capital.

Weather & Energy Prices

Earlier this week as I waited on the tarmac to depart from London Gatwick, my plane was delayed an additional twenty minutes to be de-iced…. twice. Meanwhile in Munich, private jets scheduled to be leaving for the global warming conference in Dubai…

Last year Europe managed to escape it’s energy deficit with a mild winter. It doesn’t look like they’ll get away with the same this year.

Expect energy rationing, calls for shorter showers by German politicians, and soaring energy prices across the continent.

Thanks for reading this weeks issue. If you enjoyed, share it with a friend.