This Week:

Should AI be cancelled for energy usage too?

Launch of Bitcoin ETF’s will increase demand in an already tight supply market.

China car exports rising.

War crimes experts are no longer sure what constitutes a crime.

Breaking News: Norway gets cold in winter.

Artificial Intelligence

Turns out it takes a lot of energy to run AI software.

However, due to the "large variation between image generation models," that number can also be smaller. Overall, across all models the researchers tested, generating 1,000 images took an average of 2.907 kWh, roughly the equivalent of charging a phone's battery to 24 percent per image.

Does that mean AI needs to be cancelled to appease the Climate Cult, or does it get a pass because ‘it’s cool’? Selective cancelling to suit it seems.

Bitcoin

With the launch this week of Bitcoin ETF’s in the United States, it’s interesting to note banks/brokers formerly hostile to Bitcoin are mellowing their stance.

A brokerage account I hold at one of the big Singapore banks previously allowed the purchase of the Swiss 21 Shares Bitcoin ETF. At some point last year, they stopped trading in all Bitcoin related ETF’s (remember, the US is late to the game), but today I successfully allocated into the Bitwise (BITB) ETF and around half of the eleven US ETF’s were also available for trade.

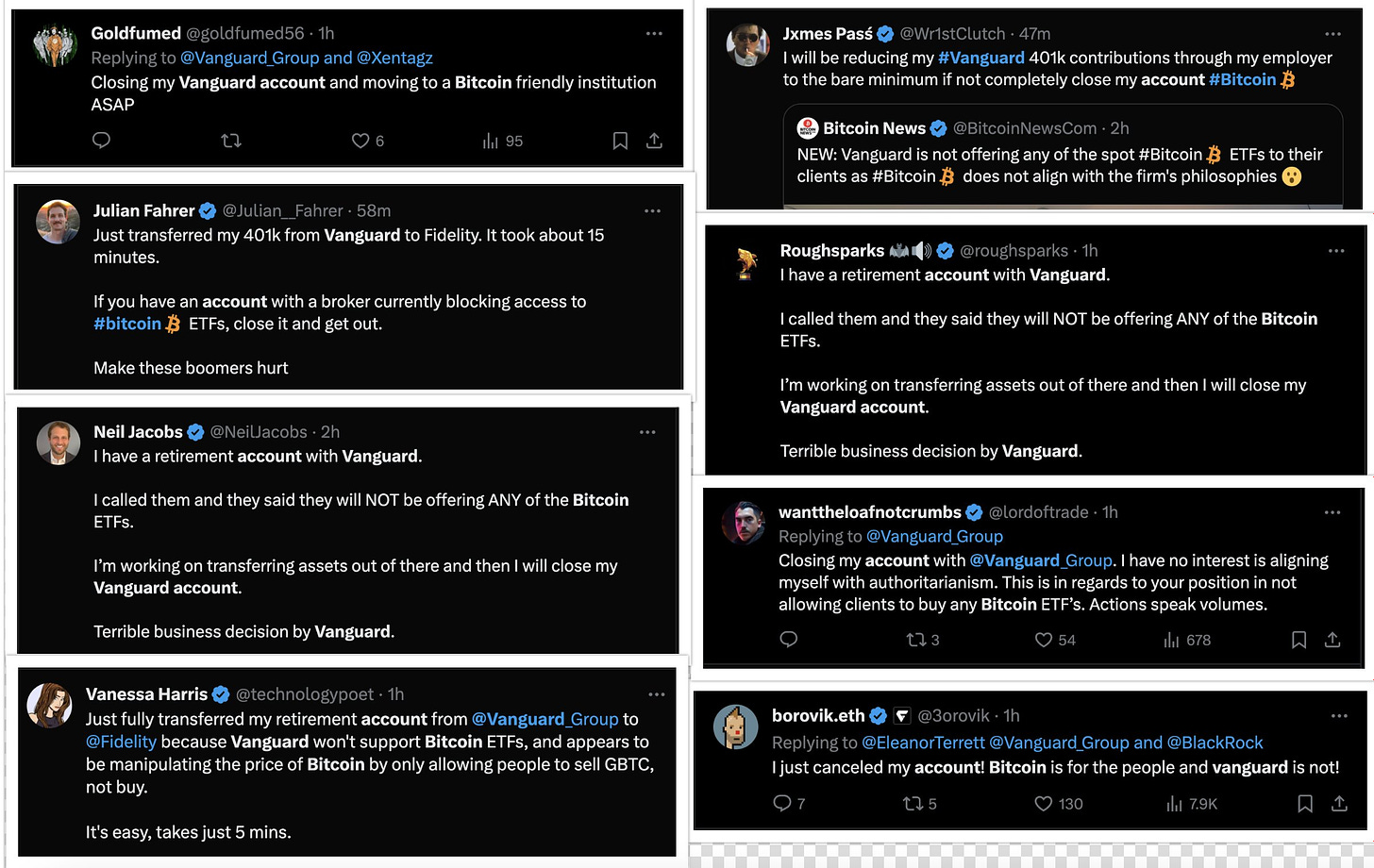

Conversely Vanguard in the US is holding the line, not allowing purchase of the new ETF’s.

"While we continuously evaluate our brokerage offer and evaluate new product entries to the market, spot Bitcoin ETFs will not be available for purchase on the Vanguard platform. We also have no plans to offer Vanguard Bitcoin ETFs or other crypto-related products. Our perspective is that these products do not align with our offer focused on asset classes such as equities, bonds, and cash, which Vanguard views as the building blocks of a well-balanced, long-term investment portfolio."

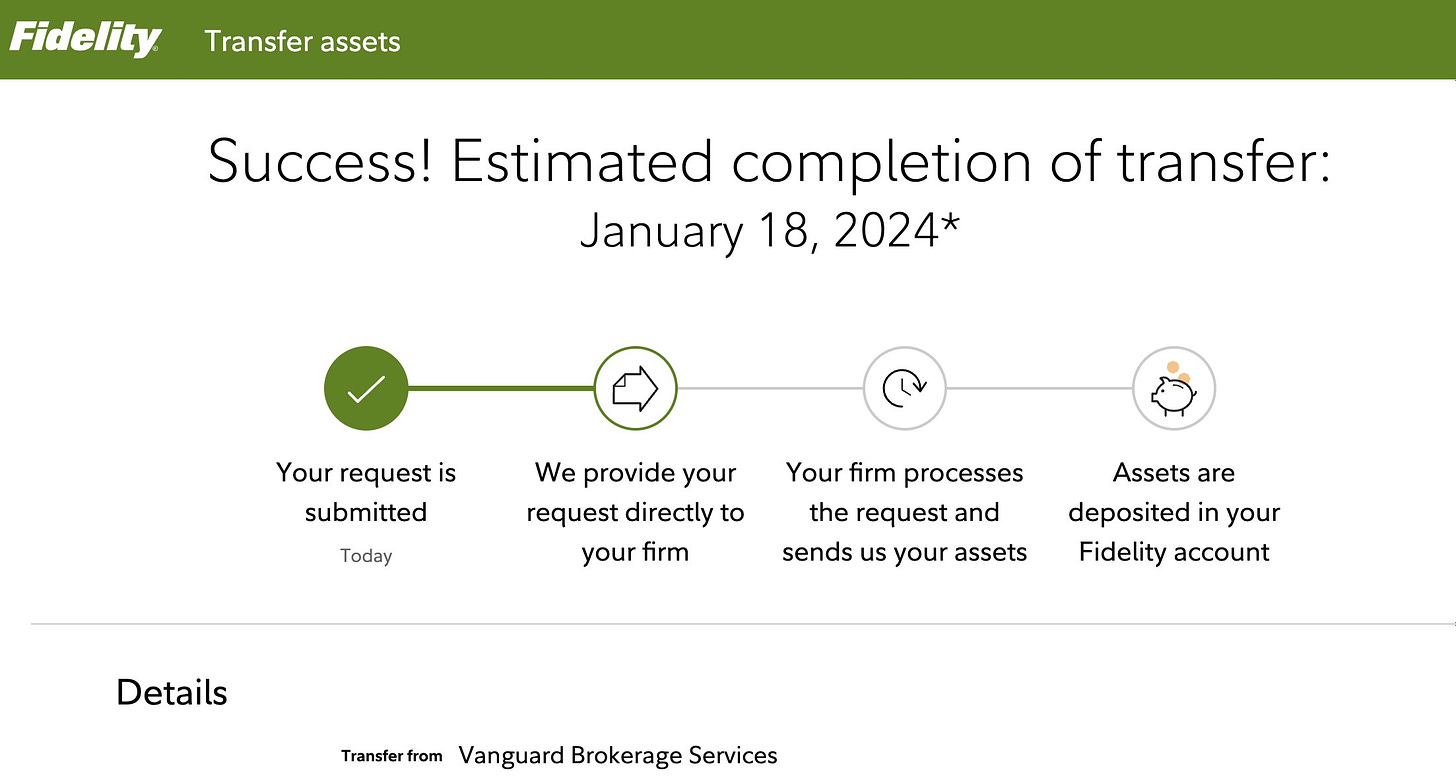

Some clients are already migrating to asset managers that aren’t short-sighted.

Buying a Bitcoin ETF is not the same as buying Bitcoin, but not giving your clients access to a readily made, mass market financial instrument they desire is not a good look for a fund manager.

In the first two days of trading, the new Bitcoin ETF’s saw a collective $625m in primary inflows:

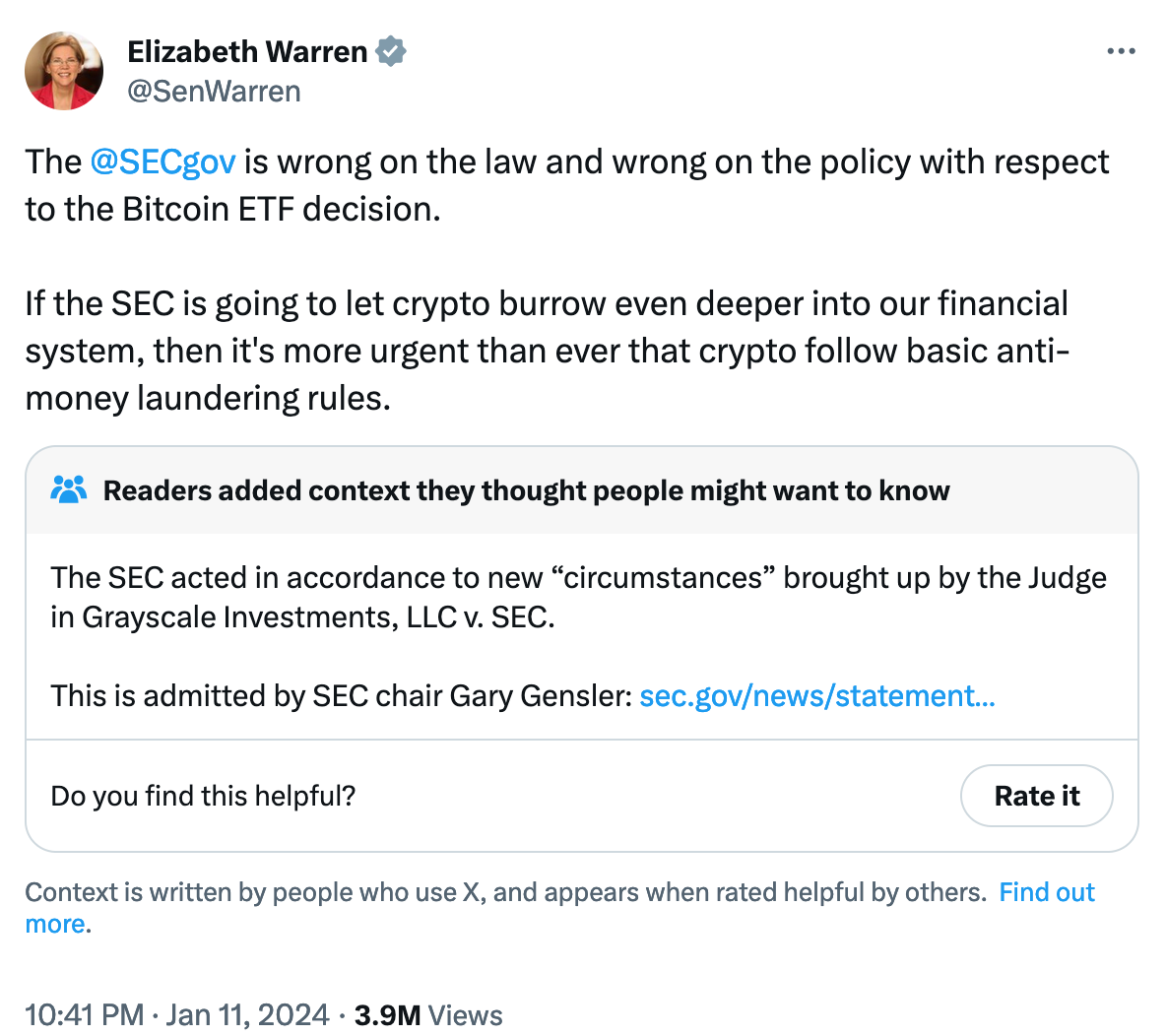

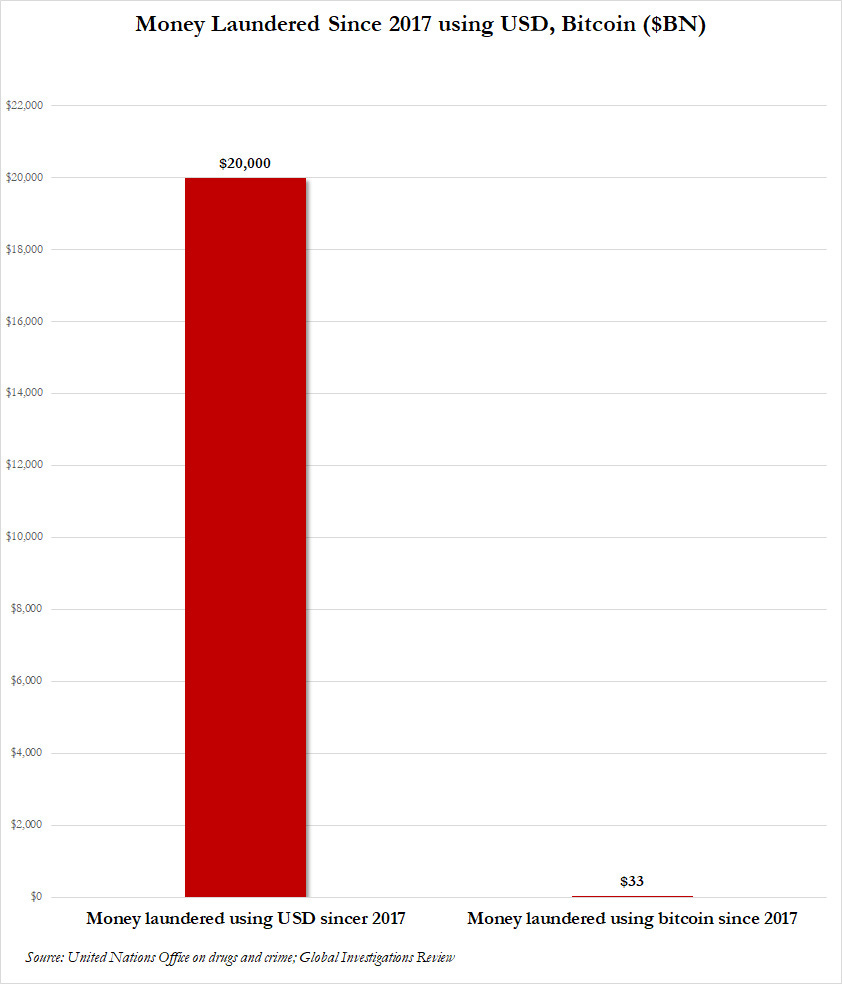

Not to be outdone by Vanguard, Elizabeth Warren spouted more of her money laundering drivel. It’s become clear she’s now on the payroll of the big banks she claims to rail against.

Except facts continue to get in the way of her narrative every time:

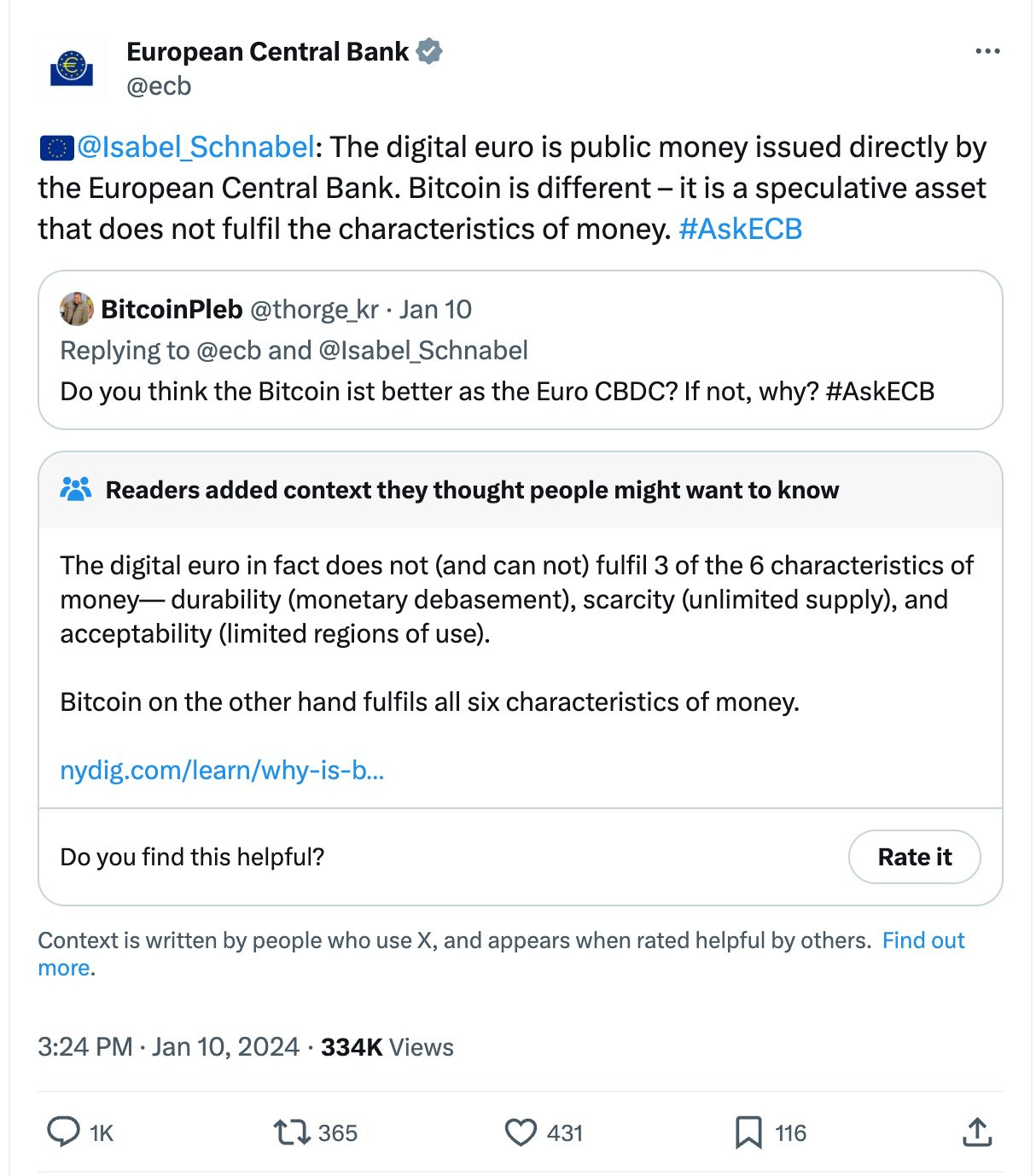

European Delusion

Going to throw this in here so we can see when they switch to ‘highly likely’ instead. I’d say as the Euro continues to devalue, 3-5 years maximum.

Happily, in the same Q&A session, Community Notes swooped in for the win against more EUSSR state narrative:

China

A trend that is expected to continue, yet the three listed car carriers/RORO shipping players are valued at a median 2024 PE of 4.3, EV/EBITDA 2.9, 0.74 P/NAV and sitting on double digit yields.

The market is scared of the large order book with deliveries arriving in late 2024. What happens if Chinese car exports continue growing at a rapid pace? China does not yet have a sufficient fleet of it’s own car carriers, in the mean time the independent Höegh Autoliners, Gram Car Carriers and Wallenius Wilhelm are locking in rates at double or more expiring contracts.

Israel vs Russia

Keir Starmer, a former war crimes expert (apparently) is now unsure what constitutes one. Seems to be a lot of this going around Western politics.

Norway

Oslo replaced the entire public bus fleet with electric buses. How could electric vehicle makers possibly have known Norway get’s cold during the winter?