Geopolitical Compass #46

The Norwegian milk shortage illustrates the wonders of central planning.

This Week:

Battery fantasy thinking.

Vanguard doesn’t like stable assets.

Got milk?

Euro slow death picks up the pace.

Red Sea disruptions potentially worse than Covid shutdowns.

Ukraine wants your men.

Batteries

When it comes to renewable energy, proponents shout that battery storage will solve the problems of the intermittency of solar and wind without ever going into detail. Here’s the Premier of Alberta, Canada with her take on it.

Bitcoin

Vanguard CEO this week doubling down on the firms dislike for ‘stable assets.’ 🤦🏼♂️

Meanwhile the markets pent up demand for Bitcoin is showing with buyers previously unable to buy directly (for various reasons), now piling into the ETFs.

In the first six trading days, the ETFs have taken in $1.2 billion more than the GBTC ETF lost over the same period.

AUM in Bitcoin ETF has already blasted past silver and it’s a matter of when not if they’ll overtake gold.

Central Planning

After last weeks issue where we showed the buses aren’t working, Norway continues this week with a milk shortage (as well as eggs and potatoes).

But during this shortage when Norway is importing milk powder from the EUSSR, a Norwegian dairy farmer who produces over their quota will be fined by the government.

Moe now has to pay 82,000 in tax because she produced more milk than her quota - despite the country's milk shortage.

Couldn't the overproduction tax have been dropped now that there is a milk shortage?

That is what the Norwegian Directorate of Agriculture requires. But we are careful not to tamper with the quotas because it is a good system. The farmers have benefited from a quota system over time.

This is what happens under central planning instead of allowing the free market to operate.

Euro

Speaking of central planning, let’s check in on how the Euro is doing in international payments.

January 2019

USD 45.02%

EUR 34.47%

November 2023

USD 59.78%

EUR 12.88%

It’s hard to tell by the chart, but EVERY SINGLE CURRENCY has increased it’s share of SWIFT payments as a percentage, at the expense of the Euro.

Note this is SWIFT only which obviously doesn’t account for all international payments, but since it’s one of the proud methods of control by the West to subjugate the world, it’s fairly telling when the Euro is collapsing even in that curated garden.

Who would have thought negative interest rates, collapsing your societies and gleefully going along with sanctioning other people’s money would result in a lack of confidence like this?

What currency are you holding?

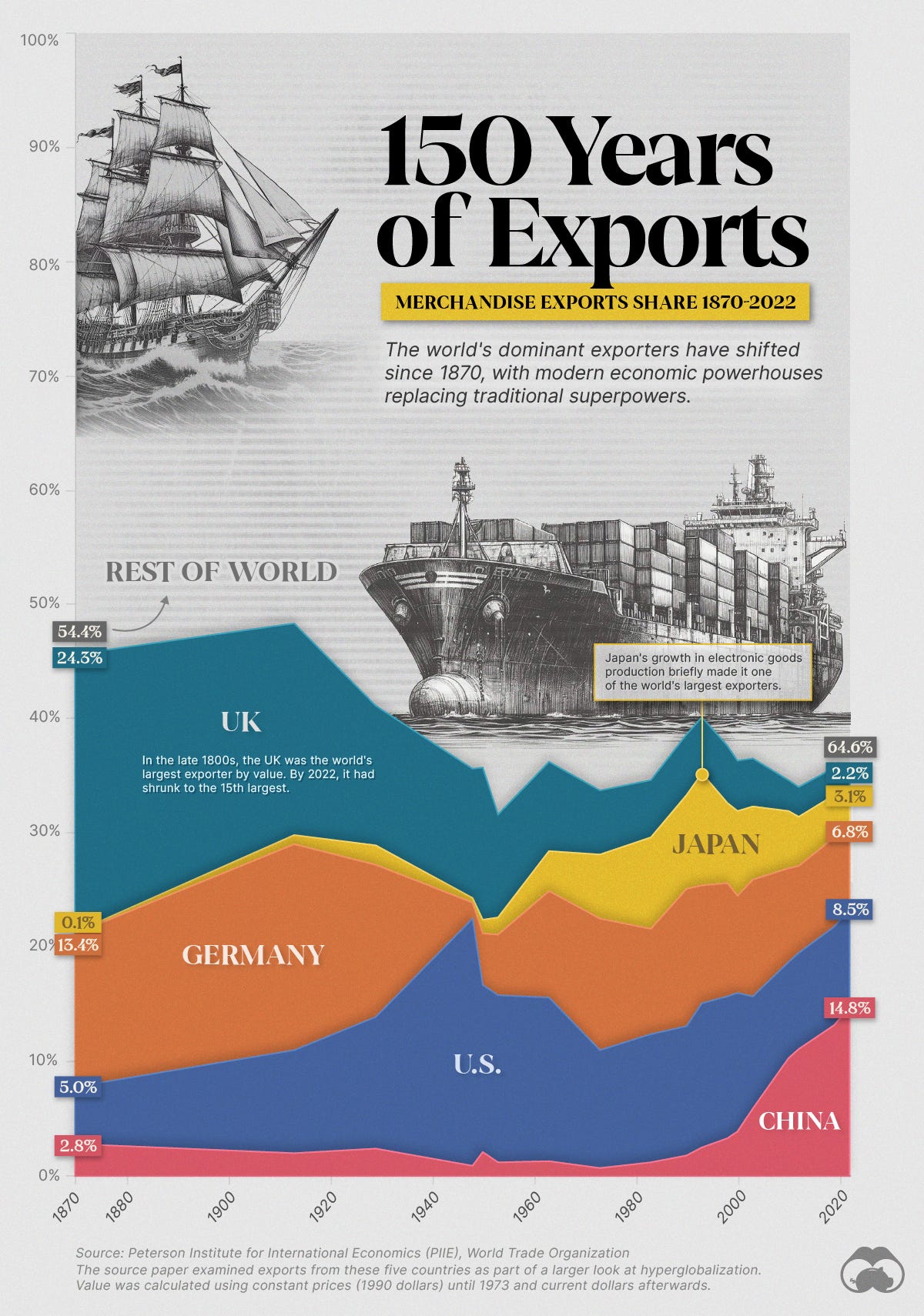

Global Exports

Shipping

Nothing to see here:

Sea-Intelligence analyzed current vessel delays compared to delays over the last several years in a report for clients. The data shows that the longer transit around the Cape of Good Hope as ships divert from the Red Sea is already having a more significant impact on vessels available to pick up containers at ports than during the pandemic. This supply chain measure is known in the industry as “vessel capacity.”

Ukraine

The Clown President of Ukraine has taken your money and your weapons, now that so many of his men have died, he wants yours too.

If you enjoyed this weeks issue, please subscribe and share with a friend.