Bitcoin & Realestate Markets

Is Bitcoin destined to become intertwined with property markets to strengthen the appeal of holding legacy physical realestate?

Refinancing real estate can be an effective way to lock in unrealized equity from the property's market value increase and existing debt repayment, while simultaneously building bitcoin holdings. Taking advantage of bitcoin's appreciation while managing operating debt with consistent cash flow from real estate represents a strategic method for long-term growth.

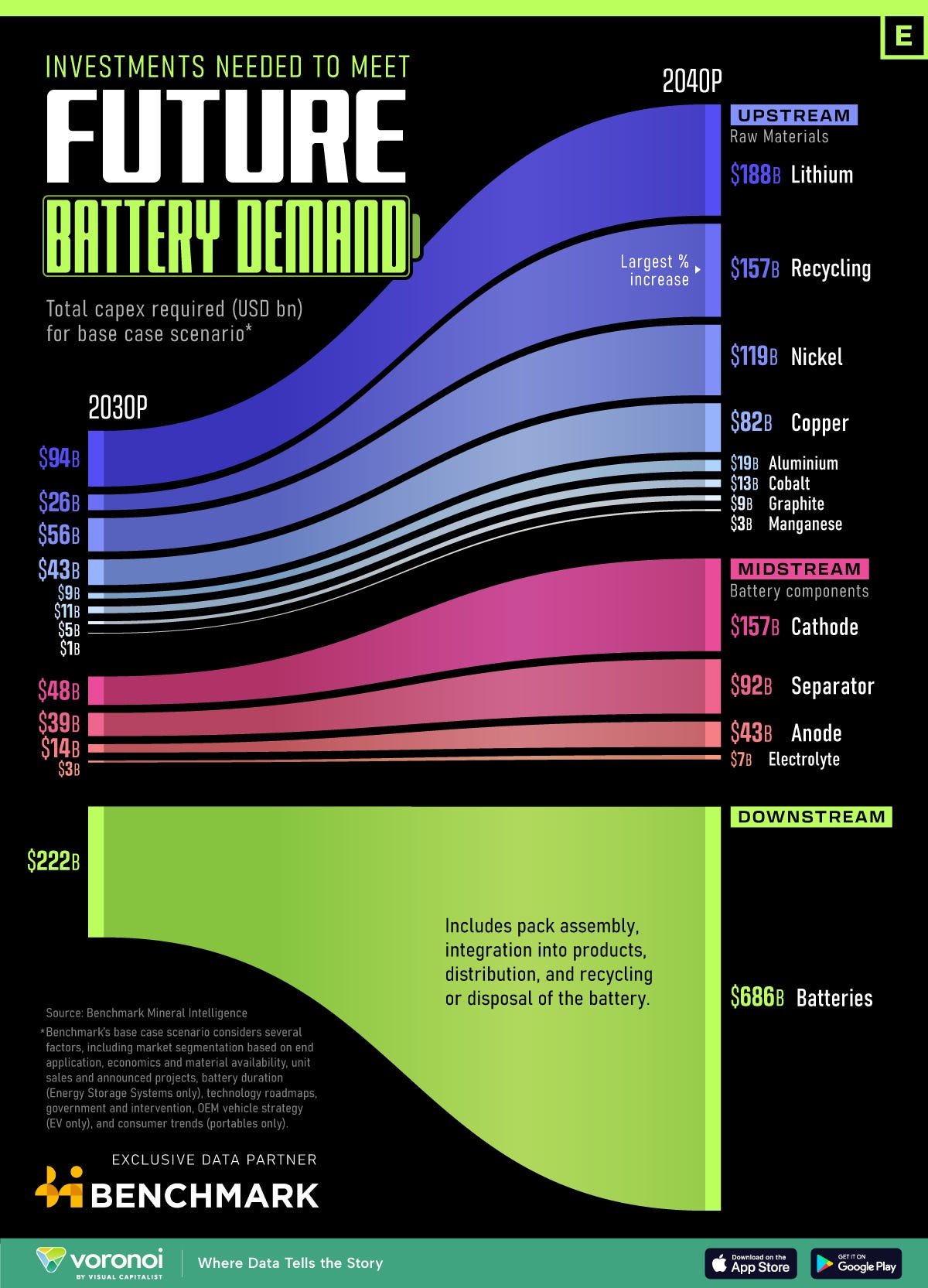

Future Battery Demand

While I think the battery/climate euphoria is overblown and reality will settle this down, man will always need to dig stuff out of the ground and build.

Who will supply the picks and shovels to facilitate this and other capex (in addition to all other commodity extraction)? In decades past, one of the main beneficiaries was Caterpillar (CAT) - the go to brand for decades to equip the extraction and construction markets. But Chinese companies like Sany Heavy (HK:0631) and Zoomlion (HK:1157) have been growing rapidly for years and expanding their market share, particularly in developing nations.

Market commentary relates that the equipment from China has become just as good, but at a substantially cheaper price point (hence gaining traction in BRICS and other developing nations).

With China equity markets being slammed due to fears of a downturn, is now an opportunity to wade into heavily sold down stocks like Sany Heavy (at a PE of less than half that of Caterpillar) that are expanding rapidly outside China?

US Debt

As US debt continues to mount with no end in sight, is the Tether stable coin the answer to the US Treasuries problems?

If you pair this strategy alongside a strategic bitcoin reserve as laid out in a bill presented by Cynthia Lummis earlier today you can imagine a scenario in which the federal government is able to bring more certainty to Treasury markets while simultaneously working on a solution to pay down the debt over the long-term via the strategic bitcoin stockpile.

A strategic Bitcoin reserve as envisioned by Senator Cynthia Lummis could conceivably also help manage if not eliminate the US debt problem completely in the decades ahead, if the US takes action soon.

The Treasury secretary would establish a "Bitcoin Purchase Program" of up to 200,000 BTC a year over a five-year period, for a total of 1 million, according to the draft. The bitcoin would be held for at least 20 years and could only be disposed of for the purpose of paying off federal debt. After that, no more than 10% of the assets could be sold during any two-year period.

Without concrete long-term action by the US government to fix the debt problem with Bitcoin, Tether simply replaces existing buyers of US treasuries that no longer have interest like China.

Would the US staking a claim in Bitcoin now and accumulating a meaningful amount of the limited supply of the world’s future money be looked back on in the centuries ahead as another Louisiana Purchase moment?