Geopolitical Compass #8

Tin supply shock. Ukraine's tainted grain rejected. Chinese vs Western debt relief models.

Notable events in geopolitics and capital markets this week. Expand your perspective, gain context, and discover actionable insights.

Bitcoin

With each passing month, Russia grows a little more accepting of the inevitability of Bitcoin.

The Bank of Russia is working on a bill that will introduce an “experimental legal regime” for cryptocurrencies to be used exclusively in export-import deals, the head of the regulatory agency, Elvira Naiullina, said on Monday, according to Russian news agency TASS.

Nations that move first will have unprecedented advantage in the inevitable Bitcoin monetary system the world will move into, whether it be 3, 5 or 20 years away. Game theory plays a massive part of relations between states. Those that move last will be massively disadvantaged.

Gold Heist

The inherent problem with securing gold comes up again in Canada as around $20 million in gold is stolen at Pearson International Airport.

Chile

Resource nationalism continues to spread worldwide as Chile moves to nationalise it’s lithium industry.

The left-leaning government would not terminate current contracts, but hoped companies would be open to state participation before they expire, he said, without naming Albemarle and SQM, the world’s top two lithium producers. SQM’s contract is set to expire in 2030 and Albemarle’s in 2043.

“If a public-private company is created to exploit lithium in the Atacama salt flats, it will be controlled by the state through Codelco,” Mr Boric said.

Chinese vs Western Debt Relief

As we see increasing calls for debt relief to nations like Ghana, don’t fall for the propaganda articles extolling the virtues of the IMF and other Western lead blocks condemning China as not being open to debt relief.

There is a big difference between the type of debt relief views of China vs IMF, World Bank and other Western backed development banks. What is the sticking point? China is willing to take a haircut and resturcture debt including reneogtiating the principle amount that will be repaid. .

The IMF and World Bank NEVER negotiate on the principal amount owing, and any debt relief simply entails adjustment of repayment terms, or even further loans to INCREASE the debt obligation. IMF loans also come with many more strings attached including changing the entire nations production and industry - impositions also absent from China backed loans - which often lead to further decline such as seen in Sri Lanka and its inability to produce sufficient rice after decades of self sufficiency.

Sure, China may take control of a port it built if a nation defaults on a loan, while also then forgiving principle. The IMF will increase the debt owed by providing further loans, force the country to sell the port and use the funds to make interest payments, as well as force policy change and budgetary constraints, further crippling the nation which make repayment of the debt harder.

Just ask Greece, Argentina, most African nations and a plethora of other countries the IMF or World Bank have ‘assisted’ with never ending, revolving ‘restructured’ loans.

China wants to trade, the IMF (US) is just interested in keeping nations indebted, chained to the current system and enslaved to its agenda:

Local politicians usually opt for the easy way out and take on more debt to keep the wheels greased for their term in office. It take courageous leaders to stand up and say ‘enough,’ but more are starting to do so.

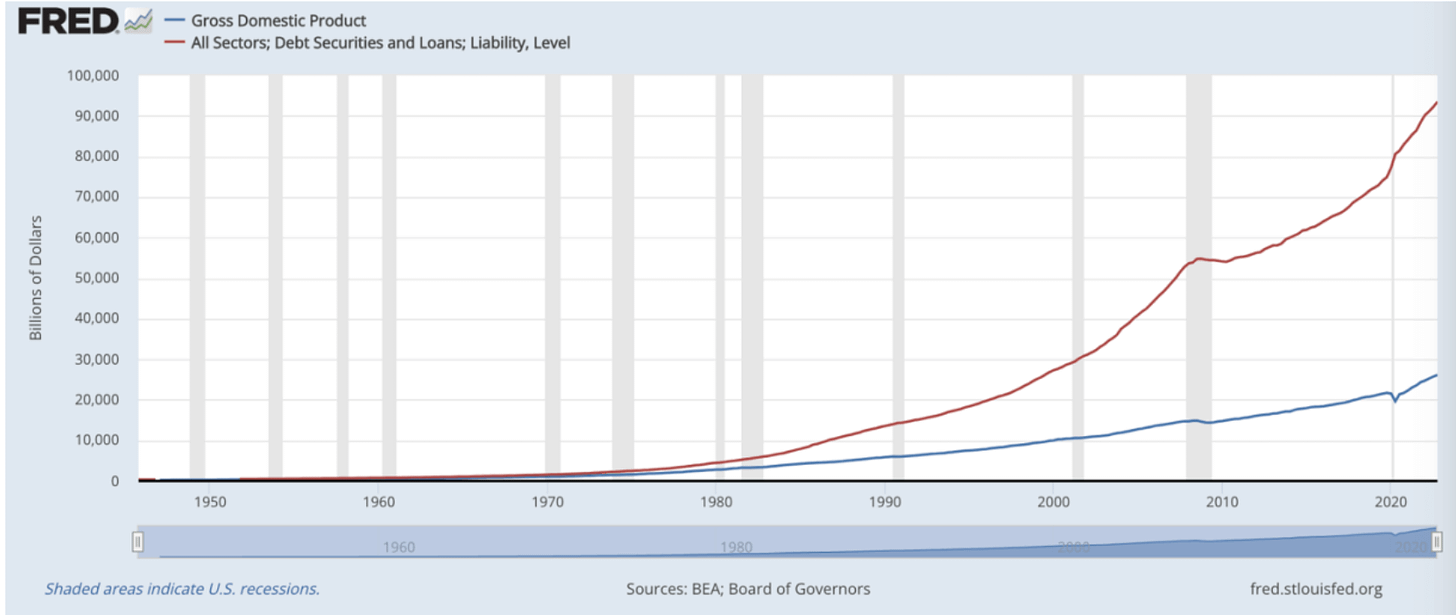

Debt vs GDP

Speaking of debt, how much longer before the wheels fall off? This is why governments worldwide are intent on releasing totally controllable CBDCs before the system breaks or hyperinflation takes hold.

We have long maintained that a system in which debt growth exceeds GDP growth sows the seeds of its own demise. GDP is the engine which produces earnings to pay interest on debt incurred. If debt grows at a faster rate than GDP eventually the interest cannot be paid and the value of the debt must adjust downward in nominal or real terms, or both. The is simple math and it is not up for debate.

France

Business transactions more than EUR 1,000 in cash are now illegal in France. This is called conditioning. The noose will continue to tighten. The limit will be lowered and soon a limit on person to person transactions will also be introduced. It’s only a matter of time.

This is why we Bitcoin.

Polarization

Where are you allocating your capital?

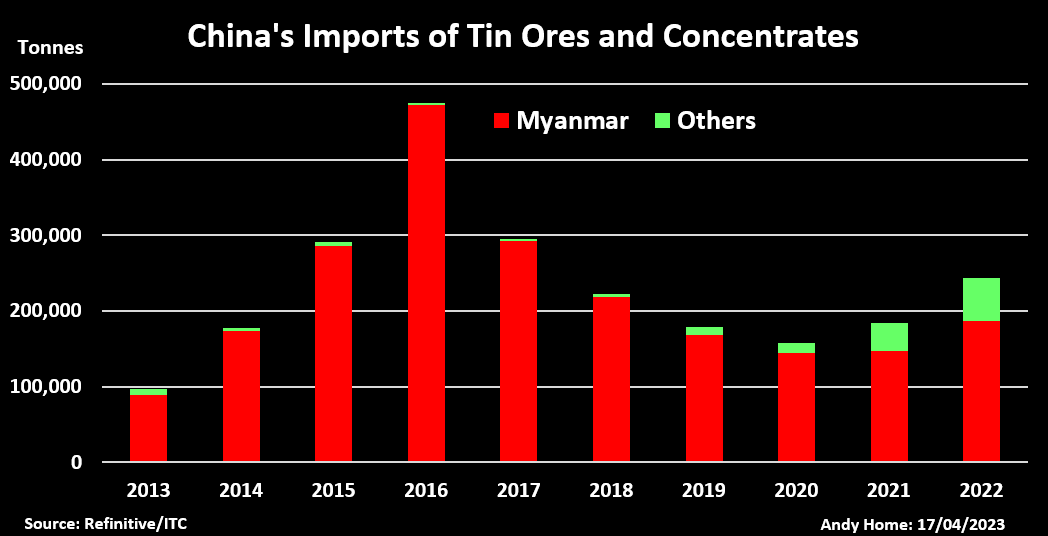

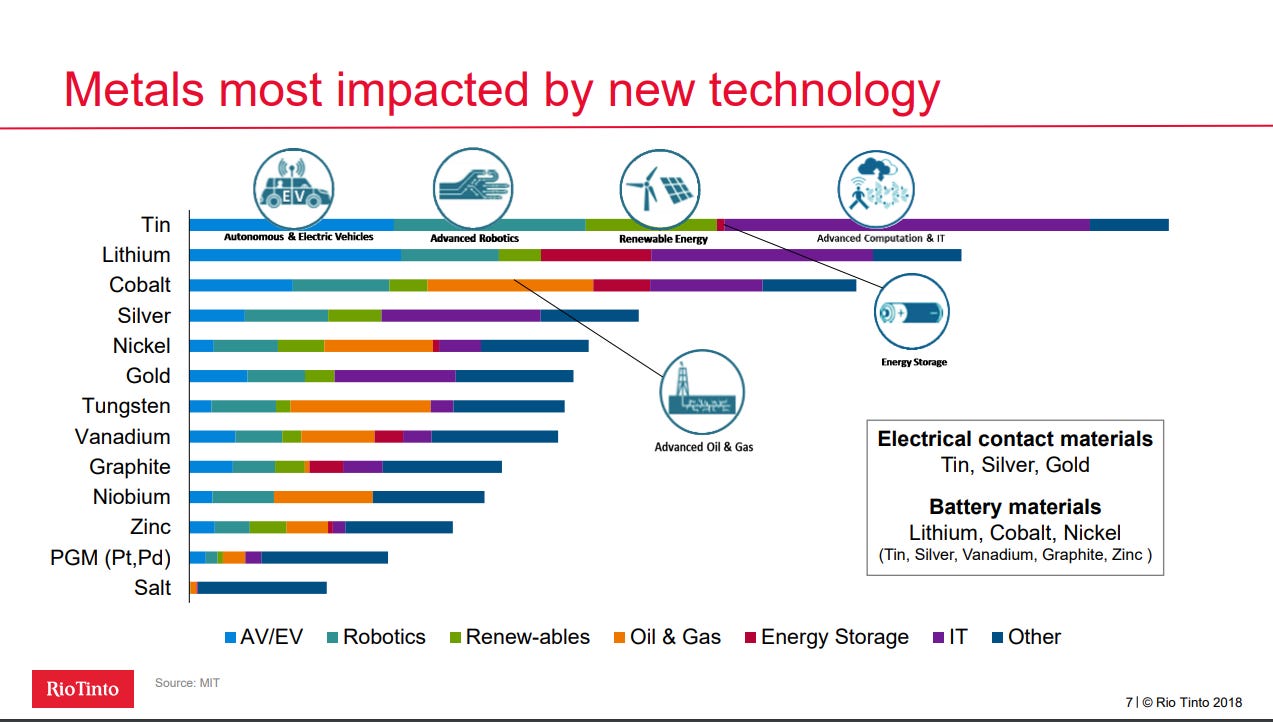

Tin Supply

China just lost 50% of it’s supply of tin.

The document released on 15th April 2023 by the Wa State Central Economic Planning Commission said, “in order to protect the remaining mineral resources in Wa State in a timely manner, all mining and excavation of mineral resources are suspended until mature mining conditions are in place”. The document has since been confirmed by a United Wa State Army information official, as reported by Reuters.

A critical metal already facing a shortage with only a handful of producers has just seen Myanmar - responsible for 10% of world volume - take the majority of its capacity offline. Virtually all Myanmar tin was shipped to refiners in China.

Where does China go to next if Myanmar tin is off the market? Strategic sources of the metal like the Mpama mine in the DRC (Alphamin, CA: AFM) and the Renison mine in Australia (Metals X, ASX: MLX) just became more important and will be large beneficiaries as the market price rises for one of the most critical technology metals.

Ukraine

Poland, Hungary, Slovakia and Bulgaria are banning the import of Ukrainian grain to protect local farmers from a flood of inferior imported grain with high chemical content.

But let’s read between the lines; mere months ago we were told that ‘evil Russia’ stopping the export of Ukrainian grain would cause a food crisis in developing countries like Somalia. So it was imperative Ukrainian grain be allowed to leave via ports.

Well which is it? Is Ukrainian grain feeding the third world, or flooding neighbouring markets with cheap, chemically laced grain? One by one each Ukrainian/Western narrative is sooner or later destroyed by the truth. But for the most part sheep only consume headlines and don’t bother with independent thought.

More importantly, it means fatigue of the Western manufactured war in Ukraine is starting to set in with support waning. Decisions like this and even reporting on it would not have been permitted in 2022 when ‘Slava Ukraini’ ruled all.

United States

Nothing to see here, just a Target store in San Fancisco that needs all merchandise to be locked up.

That’s it for this week, if you enjoyed this edition, please give it a like below!

Penang 's beaches weren't nothing special. Lots of high rises, not my cup of tea I like the vibe of KL, but would also live in outer suburbs. Malacca is ok for visit. We visited Borneo, but wouldn't live there. Kuching on Sarawak sounds cool but haven't visited.

Totally agree. My wife and I checked it out a couple of years ago as a place to live. We loved it, but wouldn't live in Penang. I would like to check out East Coast. As you say they speak English, 3 cultures foods, friendly people. We are checking out Vietnam in October.