The Hidden Parts Matter

While I think we can all agree that money and wealth are not the keys to happiness, it does provide you with optionality for your future to make it what you want.

For this reason it's sad that we are at a point in time where we are accelerating toward a cliff, and with each mile, you lose more of your money until the inevitable...

This week, the UK's new budget announcement provides an excellent opportunity to illustrate what happens behind the headlines. I have several friends in the UK, some of whom read this blog, so hopefully, it provides a little more context to the otherwise headline-grabbing news of corporate tax rates and energy assistance taglines.

Many people will say they don't care about money or wealth. This is disingenuous even if they don't realise it. At the end of the day, whether you have a lot or a little, it still matters what you can do with it. Your future lifestyle and choices depend on it, whether you're talking about how your retirement will look or how you'll celebrate your next birthday.

Since January 1st this year, the British Pound has slid 19% from USD 1.34 to USD 1.08. Or, if you prefer, in gold terms, down 11% from 0.00074 oz of gold to 0.00066. Why do I use the US dollar and gold as frames of reference? For better or worse, the USD is the world's most widely-used currency for trade and settlement and, therefore, what assets are ultimately valued in. The US is also the safest nation of the Western hemisphere when it comes to times of war – it’s the one country no one will ever be able to invade. Almost every currency in the world is currently dropping in value compared to the USD as people flood into its relative economic and military safety. Gold has had a similar function for thousands of years.

Some may say, “but who cares? I only use British pounds, Australian dollars or euros.” That’s fine until it’s not. Do you plan to ever take another holiday in Spain? Do you like to drink French wine? Are some of the products you purchase for yourself or loved ones – whether toys or new angling reels – manufactured abroad in places like China?

It all comes down to time frames. Yes, the British pound is dropping slower than countries already in a crisis state, but look at the above figures again. Since the start of this year, anything of value you hold in GBP - cash, term deposits, annuities, shares, property - has all dropped in the value of the world's most important currency (for now), the US dollar. Your house may still be worth the same GBP 500,000, but at the beginning of the year, it could get you 670,000 US dollars. Now it can only get you 540,000 US dollars. That is a massive hit in only nine months. Your house may even have gone up in value, giving you a warm and tingly feel-good, but it remains worth a lot less in USD.

Does it matter whether your currency is labelled GBP, LKR or VEF if it's depreciating at a rate of almost 20% this year, and we still have three months left of 2022?

Again some will protest that it doesn't matter to them; their expenses are in GBP, so who cares what the USD is doing? That may be ok if you don't plan on leaving the UK, for example, on holiday - or you'll have to find a destination where the local currency is performing even worse than the British pound. The euro comes to mind, but performing slightly better than an imploding EUSSR is hardly a claim to fame.

It's essential also to remember that we live in a globally connected world, with commodities priced in USD and closely linked supply chains, as seen by the current energy crisis and the impending food crisis.

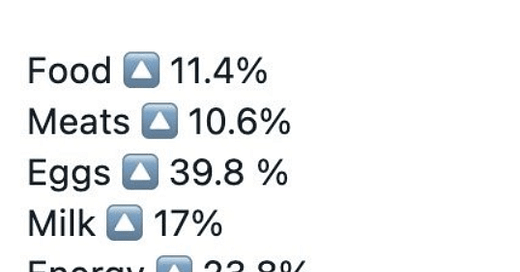

If you think the scenario outlined above doesn't get worse, strap yourself in. The 'strongest currency' I refer to - the USD - is also losing its value during this same time frame through inflation. The official rate is around 9% year-on-year, and the more realistic unofficial rate is closer to 18%, hidden through government fiddling with the figures (you can check the likely real inflation rate on Shadow Stats). It matters only if you want to buy things with your money, like food or energy.

So not only is your GBP getting you 20% less of the global currency and counting, but that US dollar's purchasing power is also dropping by a further 18%. Compounding the loss of your wealth to the extreme.

Now is the time to take your head out of the sand. Government can hide much evil simply because most people only look at their local currency. If you intend to have a prosperous future not reliant on government handouts (that may never come), you need to think NOW about how to protect your savings and wealth from further erosion at the hands of an inept government. The next government will be no better. In a collapsing system, the best one can do is rearrange the deck chairs on the Titanic; the inevitable will still happen.

Now is the time to save your future. Seriously consider where you hold your money and assets. Consider what currency your wealth is denominated in and what that could mean in the future. Seriously start to look at moving funds into investments that will appreciate over time in line or better than the inflation rate and degradation of the currencies. Yes, that is currencies plural - the US dollar is simply the best of a bad bunch.

Let's use a working example of an investment in a commodity like coal. Yes, everyone's favourite environmental boogey man - but the current situation illustrates just how important it is and will remain for decades to come. Are you wanting to safeguard some funds by investing in, say, a commodity coal producer? Well, your GBP will get you a lot less of that asset today than it did on January 1st.

At the start of the year, the GBP/AUD rate was 1.86; it is now 1.65. Whitehaven Coal, a thermal coal producer exporting to Japan, South Korea, India and others (all who aren't going off coal anytime soon) on January 1st, was trading at AUD 2.75. For 1,000 GBP, you could have bought 676 shares. If the share price had stayed the same today, you would only be able to buy 600 shares. That's a simple currency loss which is not good.

But Whitehaven is producing a commodity that has skyrocketed due to years of stupidity in global government policy and planning (not because of Russia, as they would have you believe); as such, its profits and therefore share price have skyrocketed. Its current share price is AUD 9.20 (still kicking off an expected dividend of around 7%, which is conservative).

Today your same GBP 1,000 will only buy you 180 shares of Whitehaven. This is a rare exception as an exceedingly well-performing asset. But its still a choice you could have made with your 1,000 pounds. Am I suggesting running out and buying coal assets? Not necessarily; every person must find assets and investments they are comfortable with. Though I think one could do worse than buying a bunch of commodities plays ahead of the incoming supercycle. This example illustrates the necessity for you to analyse where you store your wealth, both in choice of currency and selection of asset. At best, with no rise, you would have only bought 11% fewer shares, but the reality is that now you get less than a third of those same shares.

The AUD has also lost 9% against the USD this year, again illustrating why making conscious decisions about where to put your money is essential. Had you not touched shares but bought the right currency with your 1,000 GBP, you would have 20% more USD had you put it directly into that currency or only have lost 9% if you chose AUD. Maybe you need to then convert back to GBP for one reason or another? Great, you have 20% more than if you had done nothing. What you can and should do will depend on a variety of factors, unique to every individual. The point is that this is something you should be considering.

Some may proclaim this as all too hard. For some, it may be, but realistically, that will separate the average from the successful. Can you afford to keep sticking your head in the sand, trusting your government will sort it all out and everything will be okay? Ignoring the degradation of your local currency because it's hidden from plain sight. If you ignore it, realise that is an active choice, and the outcome will still happen regardless.

Perhaps now is the time to put some serious thought into your asset allocation.

Thank you for checking out Rambling Investor. Hit the like button and use the share button to share this across social media. Leave a comment below if the mood strikes you, and don’t forget to subscribe if you haven’t done so already.