The Luxury Market: Where Opulence Meets Opportunity

True luxury businesses with resilient UHNWI clientele are very rewarding for investors, but finding them in a market increasingly moving to fashion and premium models is not so easy.

I think many investors in the luxury sector are without realizing it, diluting their exposure to the luxury market and also missing an opportunity to raise the bar with a little known company operating in a luxury sector with rapidly growing demand and even tighter supply than Hermes’ artisanal workshops.

Hermes, Ferrari, and LVMH dominate luxury investing - and for good reason. Their businesses thrive despite political and economic uncertainty. They trade at hefty valuations, normal for this high margin luxury industry and the pricing power it commands.

True luxury businesses are relatively immune to economic downturns. Stated simply, the wealthy still enjoy their lifestyles when times are tough and are generally the last to run out of money. Those who struggle during economic downturns still aspire to luxury products. This is the key to both a growing customer base and to keep the existing clientele of luxury goods content with their choice.

Today I want to take a different approach to luxury investing that I don’t see talked about by many in the space. The question of the wider economy and if and when it will hit the luxury sector players is always a key topic. We also see talked about ad nauseam the same players over and over, none more so than LVMH.

LVMH has a number of true luxury brands including Dior and Louis Vuitton - brands that follow the true luxury business model described well by the various writings of Jean-Noël Kapferer including his more recent book ‘Kapferer on Luxury: How Luxury Brands Can Grow Yet Remain Rare’, well worth a read for anyone interested in the space.

But LVMH also has entry level 'luxury' or ‘masstige’ such as its Sephora beauty chain and more reasonably priced alcohol brands. These are in reality not luxury businesses, but premium brands. I look at it in a simple way, if the regular man on the street can walk into the store and without much hesitation buy the product with no discomfort, I don’t consider it luxury by it’s true definition. Yes lower price points do exist in the true luxury brands such as entry level Dior earrings, but they are a very small part of the offering, designed to onboard new aspirational clientele. Sephora is a different business model aimed at the masses.

The blurring of many luxury businesses into the realm of fashion or premium business models is real, as Kapferer explains well in his book.

The luxury sector in investment markets incorporates both true luxury players as well as fashion and premium businesses, in part because of name heritage and I imagine also due to a lack of investable options if one were to target true luxury only, instead of mass prestige.

Most of the constituents in the luxury indexes and ETF’s are a blend of some luxury, but fashion and premium businesses dominate the sector now. True luxury players in the public markets are few and far between.

According to Kapferer, the elements of the luxury business model are:

full control of the value chain;

full control of the retail experience;

highly selective distribution;

one-to-one relationship with clients at retail level;

high level of personalized services;

high level of craftsmanship;

exceptional level of quality;

no licences;

no super-sales, no promotions;

developing brand awareness well beyond the core target;

always increasing average prices;

strong involvement with arts;

beware of celebrities.

I doubt you’ll find many investable companies in the luxury space that fulfill all these criteria. I’ve only found three.

I’d argue in reality the only investable options for true luxury are Hermes (if we forgive them their skincare and makeup expansion), Ferrari (if we ignore their licensing division), and one other company that I’ll get to later in this piece.

Kering and LVMH have proved to be very resilient companies over the years, but are more susceptible to economic conditions and consumer discretion than other true luxury players due to their expansion into premium and fashion markets. This is not to say LVMH hasn’t done an excellent job with it’s capital allocation in recent decades, but keep in mind much of it’s growth comes from acquisitions of other luxury brands and expansion of offerings to larger audiences outside the luxury model. Nothing wrong with this, but be aware of it for what it is.

The true luxury players have performed better than LVMH and still command a significantly higher market valuation as such. Hermes who follow the luxury model better than any business I’ve seen, whose strictly limited supply handbags can run into the hundreds of thousands per item have a consistent PE in the low to mid 40s (and currently much higher). Ferrari who limits the amount of cars it produces each year and for certain models goes into the millions of dollars, generally commands a PE in the high 30’s (also currently much higher at 56). LVMH in comparison has a fairly consistent PE valuation in mid 20’s.

The market recognises and pays a premium for true luxury business models.

UHNWI’s

You can see when we talk about true luxury, while there will always be entry level items to onboard the aspirational class, generally we are talking about very expensive goods for the wealthy. A demographic who's clientele and therefore product has a consistent demand.

Even in downturns, UHNWIs continue to buy Ferraris, Hermes handbags, Cartier jewelry and keep an eye out for any new listings on Lake Como.

Simply put, UHNWIs are insulated from economic downturns and their demand for luxury goods maintains.

How To Position

According to the Credit Suisse Global Wealth Report, there are currently 260,000 UHNWI's and the number is expected to grow to 385,000 by 2026.

So how can investors benefit from this growing demographic? It would seem logical that the luxury market will be an outsized beneficiary of this trend. Some obvious investment options would be;

Hermes; the French company established in 1924. A maker of luxury goods, in particular leather goods including very expensive handbags like the Kelly and Birkin.

LVMH; a luxury goods company that owns a plethora of brands in the space including Chanel, Louis Vuitton, Dom Perignon, hotels and many many more brands wealthy people love to be seen in or with every day.

Ferrari; the ultra luxury car in such demand you can be on a waiting list for years to get a new model.

Societe des Bains de Mer; an odd named French company which translates to the ‘Sea Bath Society’. Strange name, but you'll likely have heard of what it owns - it is the holding company of large amounts of Monegasque property including the Monte-Carlo Casino, multiple hotels and residential buildings in the small sovereign nation the wealthy flock to. For more insight on this fascinating company, see the detailed report my friend Swen Lorenz put out in 2019.

Bitcoin; only ever 21 million Bitcoin. What will happen to the price of Bitcoin when hundreds of thousands of decamillion and billionaires decide they need to preserve some of their wealth in Bitcoin? I’ve discussed this topic at length in my book. Suffice to say, Bitcoin is a veblen good.

A veblen good is a good for which demand increases as the price increases due to its exclusive nature and appeal as a status symbol.

All the companies above (and Bitcoin) offer us veblen goods. The higher the prices of these items rise, demand actually increases.

The names above will benefit from the luxury theme and the growing UHNWI population. Keep in mind during a larger downturn, some businesses will suffer more than others even in this space. Hence my preference for true luxury, not luxury mixed with fashion and premium models. That rules out the vast majority of companies lumped into the luxury market for me as mentioned earlier.

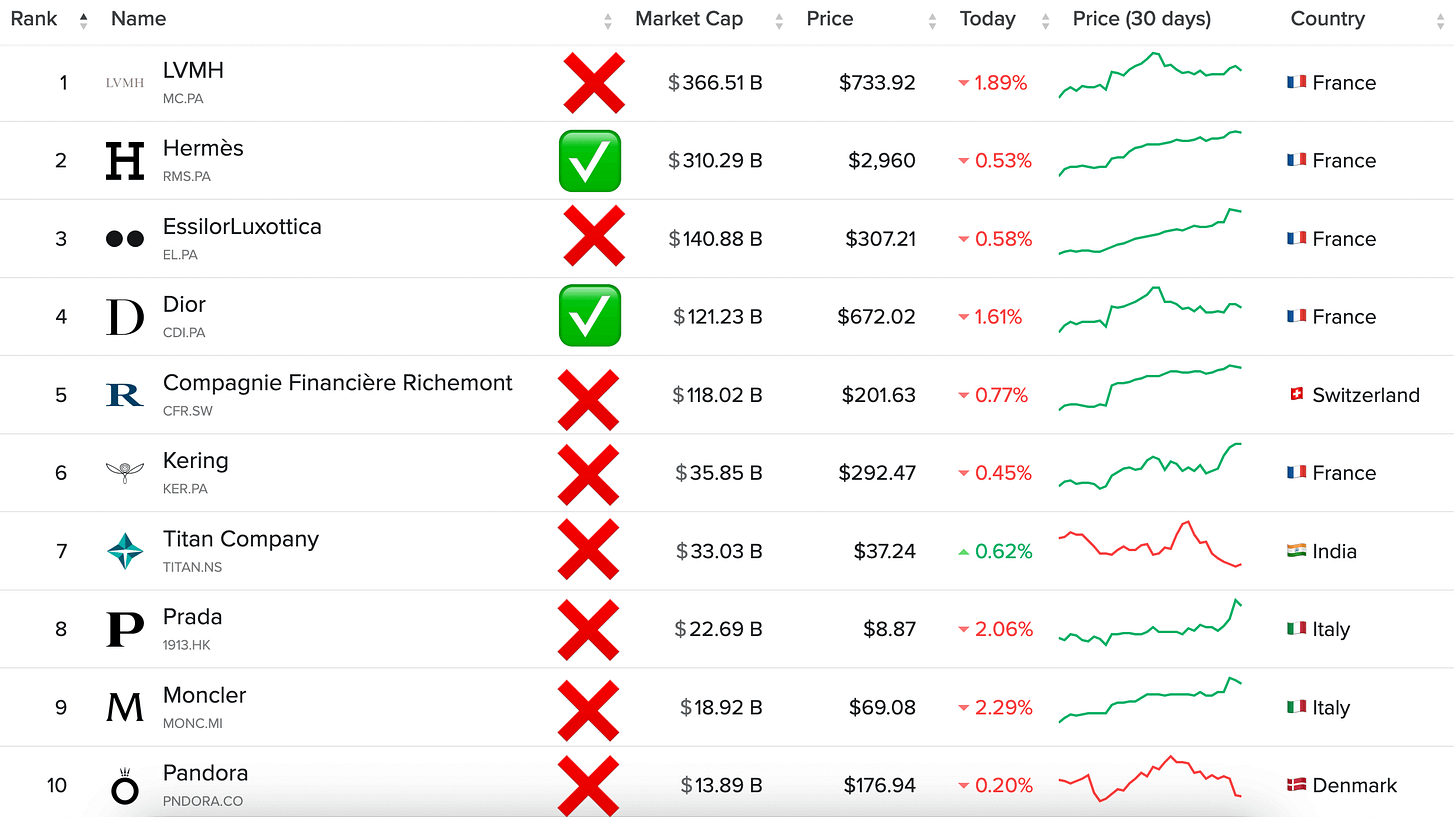

Let’s look at the Top 10 by market cap in the sector:

Investors in the luxury sector may consider this harsh. But when looking at true luxury, I think it’s a fair assessment. Bear in mind Dior is intertwined in ownership structure with LVMH, so not really an investable option.

I do like Hermes and Ferrari, and I sit eagerly on the sidelines waiting for their valuations to ease back somewhat. These companies will never trade at cheap multiples, but right now they are historically hefty.

So what about finding a pure luxury player targeting the UHNWI class without the luxurious valuation commanded by Hermes and Ferrari?

What is an even more exclusive purchase than a USD 388,000 Birkin handbag or standard new Ferrari model selling upward of USD 500,000?

I've read a lot on luxury in recent years and even in the current market with many investors writing on the subject, there is one industry that seldom comes up and one name in particular that rarely if ever comes up outside of the few that follow the company. Yet this business is in the ultra premium luxury, that even if they want to, very few can partake in due to a severe lack of supply.

Perhaps because it's a microcap listed on the Borsa Italiana in Italy it goes relatively unnoticed? Well I've noticed and the current valuation is extremely appealing considering it's product, growing margins and growth prospects. Against the checklist of the luxury business model above, it adheres to every facet better than almost all other luxury companies...

When we think of luxury, our minds usually go to beautiful jewellery, expensive cars, large mansions but there's also the obvious luxury play toy the wealthy love to enjoy. These beauties…

Wouldn’t you consider a USD 50, 100 or 200 million dollar luxury super yacht the ultimate luxury product and status symbol for the ultra wealthy? A product a very small group (but growing in number fast) of people can afford, and an even smaller number of suppliers can deliver.

Let Them Have Yachts

Luxury mega and gigayachts have been THE lifestyle item for the uber wealthy for decades (if not centuries depending on how you want to define it). But how do small investors take advantage of the increasing numbers of very wealthy individuals desiring their own yacht?

Cue the supply demand imbalance.

As mentioned earlier, the UHNWI class numbers are growing rapidly. By 2026, 385,000 UHNWIs will compete for fewer than 6,000 mega yachts and an additional 1,000 per year in production. Supply simply can’t keep up.

The number of megayachts that can be built by firms with storied reputations of quality craftsmanship in Europe are much less still. Remember that list of elements of luxury business above - there’s a reason that model works. The luxury business model is not just about the product, but about the brands history, reputation, the quality, the number of people that aspire to the name and so much more. The number of wealthy people who admire, respect and envy the beautiful knew yacht their friend has bought that was built on the Italian Riviera will trump a yacht built in Turkey or Asia every time.

Which Boats?

For luxury cantillion investing in the superyacht space, we aren't interested in I'm sure wonderful but 'lowly' USD 1-5 million yachts that any moderately successful investment banker or fund manager can buy. This is a market that will suffer a demand collapse during economic downturns and market turmoil.

The sweet spot we want to hit is the USD 50-100 million and above category. A class of ship whose owner is not cancelling his build order anytime soon short of some catastrophic collapse of his empire - and even then, there is another UHNWI ready to step up and takeover the build contract right behind him. Shipyard slots for this calibre of megayacht are not easy to get.

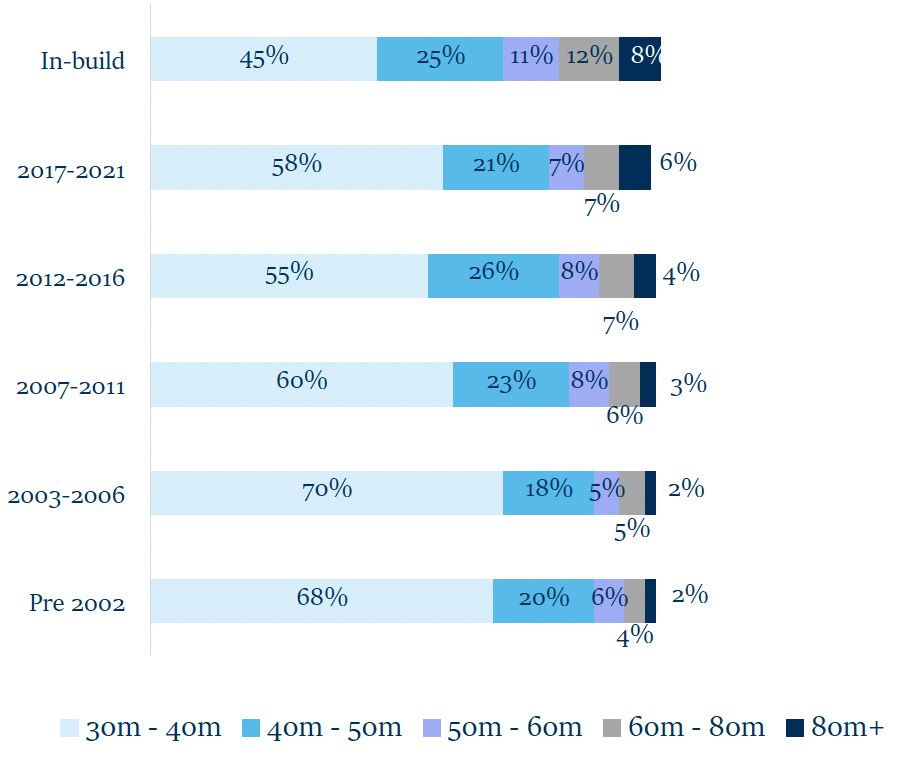

As shown by this table of the global yacht fleet by size, the trend continues to move toward larger yachts as worldwide wealth increases:

Supply of Birkin bags from Hermes is strictly limited each year, intentionally as well as due to the hand craftsmenship they entail from French aristan craftsmen. It is a similar story with Ferrari in the automobile industry. A strictly limited amount of cars are produced each year. In both Ferrari and Hermes, when it comes to their most exclusive products, it's not even a case of being in possession of the funds to afford some of their products - you must have a history with the company and be invited to purchase one of the strictly limited edition products. Demand ALWAYS outstrips supply.

The same supply constraint exists in megayachts. In this niche sector, we have come across arguably the most expensive and prestigious luxury investment there is save for realestate. The supply is even more limited than the famous Birken bag.

The demand for large yachts has increased considerably in the last twenty years: in 2002, in fact, the category of yachts over 50 meters only accounted for 12% of the fleet under construction: in 2022 this percentage reached approximately 31%.

This strong increase is due, on the one hand, to the rise in UHNWI, i.e. potential customers with spending power oriented towards large-sized yachts, and on the other to a growing new desire for exclusivity and comfort on the part of these wealthy individuals. In particular, after the pandemic, this category of customers felt the need to build real completely customised “travelling islands” for themselves and their families, where they can live life without restrictions and in total safety and privacy.

How to Position for Increasing Mega Yacht Demand

So how can we benefit from the UHNWI growth, the luxury status craved by them and the resultant continuing rise of the mega yacht?

There are a number of listed yacht manufacturers;

Beneteau

Ferretti

MarineMax

Malibu Boats

MasterCraft Boat Holdings

But most of these players whilst producing very enviable boats, are not catering to the UHNWI class we are attempting to capture. They’re also not pure luxury. Yes, a $1 million dollar yacht is fantastic, no doubt! But this is a much more fluctuating market that will see many customers fall off in times of crisis. SanLorenzo’s (discussed further below) recent FY 2024 results bear this out with only their superyacht segment growing at 17.6% YoY while their other divisions stagnated at 1.8% for standard yachts and 1% for their Bluegame division.

These yachts are also generally built standard as opposed to custom built, again not luxury.

We want to go after the uber wealthy clientele. Think oligarchs like Jeff Bezos, Bernard Arnault, Bill Gates, Stefan Quandt, Roman Abromovich, Carlos Slim, Mukesh Ambani and so on. REAL wealth. Those so wealthy that supply of the size and quality of the mega yachts they are after is quite limited by the amount of shipyards capable of building such floating luxury palaces. The demand for yachts of this size does not eb and flow with the rise and fall of the stockmarket, but only increases as more individuals enter this class.

The order backlog in particular of these yachts out to 2027 reminds me of the demand/supply dynamic of Hermes Birkin bags which also have a waiting list of customers reliant on the company's French based artisan workshops and the slow rate at which they can gradually increase production each year.

For this type of yacht market, the capacity is quite low, and only a handful of boat builders/shipyards have the capability to do so. Most of these companies are also private. But there are two overlooked companies who floated on the stock exchange in recent years and offer us access to this elite clientele.

The Players in Mega and Giga Yachts

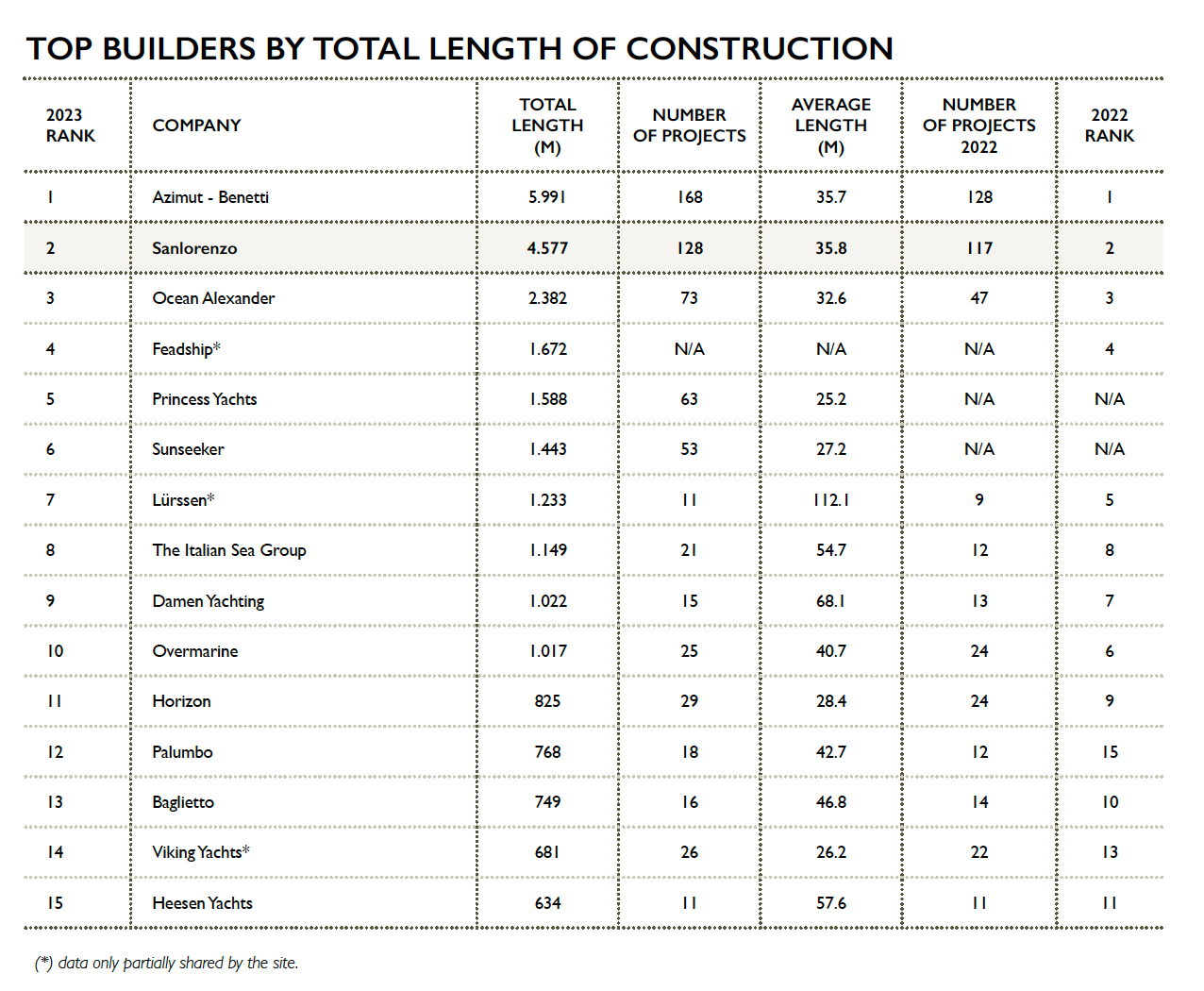

The list of boat builders in this ultimate luxury category is quite small. Here is a the 2023 list of the top builders by length of construction currently under build:

Can they create more shipyards to build more yachts? Yes they can, Turkey is expanding production already. But what cannot be built is the luxury element that takes a long time to build; a storied history with decades or even centuries of tradition, craftsmanship and pure luxury that comes with it.

The uber wealthy will always choose first to go with the impeccable reputation and quality product of Italian, French and Dutch shipmakers well before they’ll build a yacht from a three year old Turkish shipyard. This is where the luxury theory of marketing takes hold; pricing power, reputation, history, craftsmanship honed over decades, aspirational brands and prestige. Can a Hermes bag be produced in China? In theory, but its value is derived around the fact that all bags are still produced in small French workshops by artisans who have undergone years of training.

Almost all of the builders in the table above are private, with the exception of two Italian players.

Sanlorenzo

Founded in 1958, Sanlorenzo has four shipyards on the Italian Riviera and produces yachts ranging in size from 13 to 73 meters.

Sanlorenzo is a profitable yacht producer with annual revenue of EUR 866 million and an order backlog of EUR 1.1 billion. It benefits from rising UHNWI numbers and increasing margins but focuses more on smaller, standardized yachts.

The Italian Sea Group

We now hit the real UHNWI market sweet spot with The Italian Sea Group (TISG), a parent company with a stable of luxury yacht brands targeting different markets. If Sanlorenzo is the LVMH of luxury superyachts, then TISG is the Hermes.

TISG was established in 2009 by founder and majority shareholder Giovanni Constantino when he acquired the Tecnomar brand. The company went on to acquire other boat builders including in 2021 the acquisition of Pinchotti, one of the oldest Italian ship builders still operating today that can trace its origins back to 1575.

TISG also owns Perini Navi, and is targeting collaboration with other Italian luxury brands to bring special projects to the luxury yacht market including the Tecnomar for Lamborghini 63, and the recent collaboration to build superyachts with Giorgi Armani (who also holds a 5% stake in TISG).

Admiral is the elite superyacht brand of the group. All Admiral megayachts are custom made from beginning to end with the wealthy designing their dream boat, to their taste and specifications from scratch. Each vessel can take 2-3 years from planning to completion, with ability for owners to make modifications to plans along the way. TISG is currently among the top six shipyards in terms of average vessel length in 2021, 2022 and 2023 and is the only one that is investable by the public. These yachts are much larger on average than Sanlorenzo who's average build length is 35.8 meters vs TISG average of 54.7 meters. Yachts over 50 meters represent over 85% of TISG's order book and the the company will actively target the 100 meter and above market in the future.

In 2021, TISG’s purchase of Perini Navi and Pichiotti - the latter out of bankruptcy were a boon for the company. While these brands have large appeal in the luxury yacht segment, the acquisitions came with world class construction yard facilities and space, as well as experienced craftsman, in many cases coming from families that have worked for these businesses for generations.

This is allowing TISG to ramp up its operations and subsequent sales for the future. The group also has its own shipyard in Turkey where it manufacturers the hulls before being shipped to Italy for fit-out and construction of the rest of the yacht. This allows the Italian yards to focus on the highly customised and value added section of the business and provides the additional yard space dearly needed in an industry with immense demand for its product. Since 2018, TISG has spent EUR 68 million expanding production capacity in its shipyards including facilities capable of handling yachts up to 140 meters.

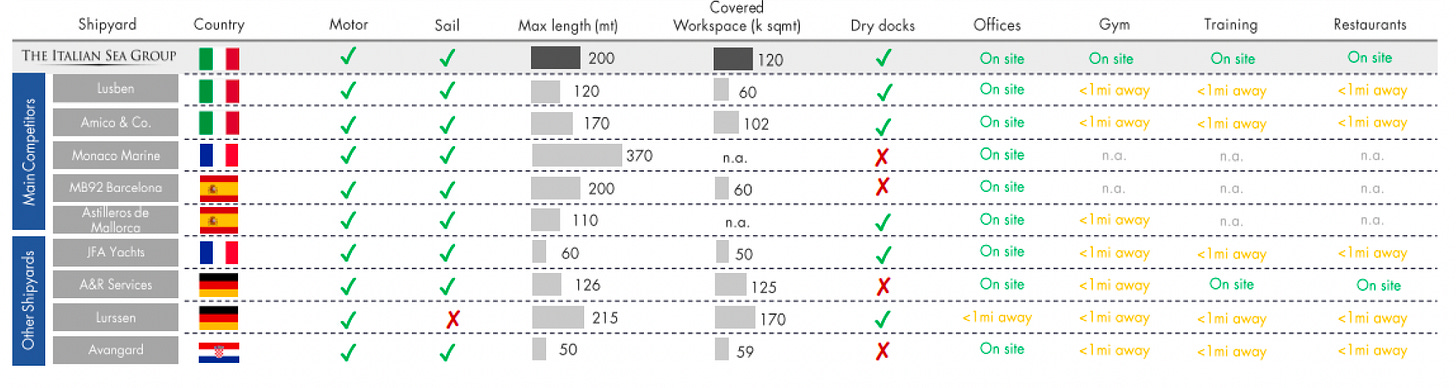

TISG also has its NCA Refit division which solely caters to refitting older super yachts. As we have seen, shipyard capacity for new builds (supply) is limited, so refit is becoming an increasingly important business for customers who still demand the latest and best of everything.

The NCA Refit division are specialists in redesign and refit of existing luxury vessels - including those not built by them originally - to exacting standards. Their updated facility in La Spezia specially caters for crews awaiting upgrades to vessels by providing facilities including accommodation, dining and recreation facilities. For this reason, it is often favoured by crews to bring the business to TISG.

You can see the scale and appeal of the NCA Refit division on the following graphic:

The refit division is also growing rapidly with a 2017-21 CAGR of 16% and a niche with high barriers to entry as it:

Requires the right technical experience, significant investments in production capacity and equipment and a reputation built over time towards shipowners and crews.

TISG has also been following the luxury playlist similar to Hermes by acquiring local Italian suppliers to ensure its supply chain is controlled and to gain access to the talented artisans whose families have been in the shipbuilding industries for decades, even centuries.

When we look back at the checklist of a luxury company, we see TISG fits all the criteria perfectly:

full control of the value chain; ✅ yachts built from scratch by local Italian artisans and existing supply chain being bought out or in close cooperation.

full control of the retail experience; ✅ TISG has a show room in Marina di Carrara and works closely with clients and their agents through the entire build.

highly selective distribution; ✅ the price tag pretty much takes care of this.

one-to-one relationship with clients at retail level; ✅ as above, it’s a very personal and close working relationship with clients over years to arrive at the finishes product.

high level of personalized services; ✅ product is fully designed by the client (or highly customisable for entry level brand like Tecnomar).

high level of craftsmanship; ✅ centuries of shipbuilding experience by management and Italian craftsmen.

exceptional level of quality; ✅ Admiral and TISG’s other brands have storied reputations in the industry.

no licences; I won’t give them a perfect score here, technically while not licensing as such, they have collaborations with Laborghini in the Tecnomar division and also a partnership with Giorgio Armani. This is more so to incorporate the luxury design and reputation of these two brands.

no super-sales, no promotions; ✅ demand outstrips supply so there’s no need for sales and supply chain inflation can be passed directly to the client.

developing brand awareness well beyond the core target; ✅ this leads back to the point above, developing more awareness through partnership with other luxury brands that it doesn’t compete with, but actually add to it’s prestige and awareness.

always increasing average prices; ✅ margins are rising and inflation in costs is passed on. I think there is a lot of room to increase margins in the future through further economies of scale, growing demand and adhering to the luxury strategy of always increasing prices to ensure they remain aspirational.

strong involvement with arts; ✅ spend ten minutes going through TISG's literature and presentations and you’ll see art and culture is a heavy focus and inspiration in everything they do.

beware of celebrities; ✅ the company is not chasing the latest fads or celebrities. It chooses wisely who it works with, Giorgi Armani being a name synonomous for decades in the luxury world.

I would argue that TISG adheres to the luxury business model just as well as Hermes and Ferrari and better than all the other listed players. Perhaps compare how your favourite luxury investment stacks up against each of the criteria above.

I’m purposely not delving deep into the financials of the company as this investment thesis is designed to find a true luxury company, and TISG being so young in it’s corporate life (though not its consituent parts which have storied history), it doesn’t make sense to compare it to the margins currently exhibited by Hermes and Ferrari. For that reason we also have a much lower entry valuation.

With TISG, I am buying the potential it holds to grow into the luxury margins I believe will come with the its business plan, heritage and dedication to luxury.

What Can Go Wrong?

Due to the nature of the product, the mega yachts that TISG builds are not subject to usual economic ups and downs. Arguably it has a more resilient demand than expensive jewellery that could easily be delayed by a few months or a year in tougher times. A client is not going to stop his build half way through, in fact if he were to he’d lose his slot and likely the yacht.

What if the client half way through building his superyacht goes bankrupt?

The business model of TISG is resilient - the company takes progress payments along the construction process once pre-agreed points are met. Importantly, every single order on the books of TISG has been commissioned by a purchaser. The company does not hold any stock of yachts, and only begins production of a new vessel once a deposit has been paid. The progressive payments through the construction project also ensure the company does not take on material financial risk of a customer going bust or changing their mind. In rare circumstances where a customer backs out, TISG finds another buyer willing to takeover the ownership and finish its construction - remember supply of these vessel categories is very limited.

If TISG were to veer away from the luxury model, it would negate my thesis. But the company seems dedicated to ensuring it follows the rules of luxury. It’s product is the ultimate in luxury, it is keeping production local and it is not trying to expand too quickly. Assuming this continues and it keeps reasonable debt levels, I see little risk of any material adverse event.

Growth

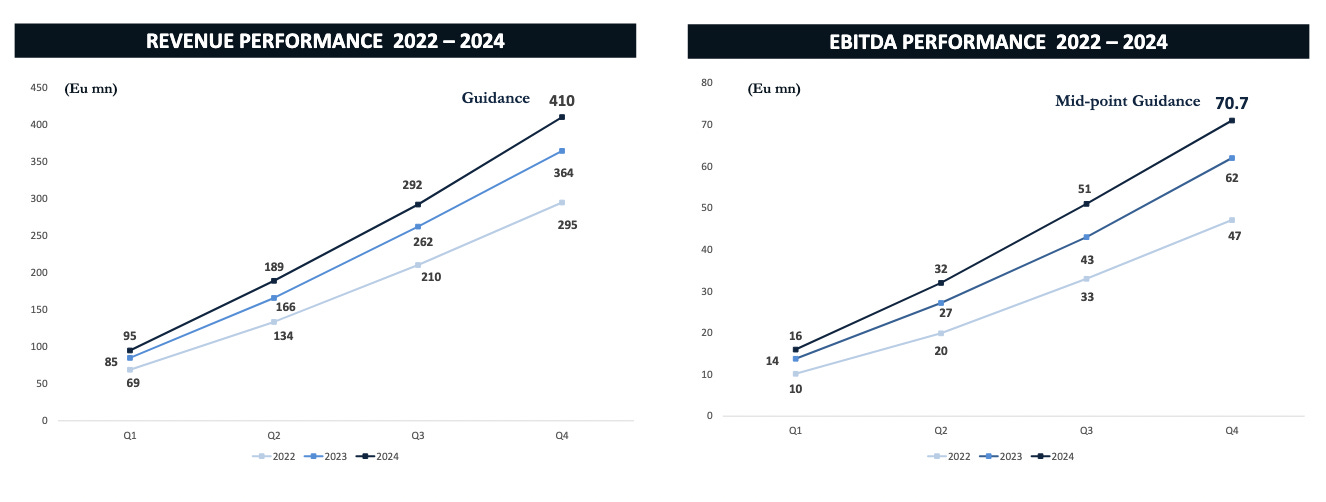

TISG’s growth has been impressive. It has experienced a 45% CAGR since 2018 with the help of acquisitions, and importantly it's margins are consistently expanding, EBITDA margins rising from 9.1% in 2018 to 16.4% in H1 2023. The company is targeting the 17-17.5% range in 2024.

TISG is expanding it’s facilities and it’s order book is growing each quarter. It currently stands at EUR 1.24 billion - around three years at current revenue run rate.

While not yet the lofty heights of the margins secured by Hermes, the business is heading in the right direction and with a a clientele base at such an elite level of wealth - passing on inflation in costs is not an issue for the superyacht builders. A true reflection of the luxury nature of the business.

It is also recording very respectable return on equity around 30% and return on invested capital of 18%.

Summary

True luxury is not easy to find in today’s investment markets. Many of the companies investors view as luxury are moving away from the model, branching into fashion or premium markets which bring vulnerability into their business models and makes them more subject to adverse economic conditions, not to mention loss of identity and execution risk as they stray from their original model in the search for growth.

Like Hermes and Ferrari, TISG adheres to the pure luxury model, making it an attractive long-term opportunity.

Not only are we arguably looking at a product with a just-as-high supply demand ratio as Hermes Birkin bags, but we are paying a much lower valuation for the privilege for an industry that is still relatively new to public markets and still in the early stages of margin expansion.

Growth in demand for super yachts - in particular mega and giga yachts - is growing as its addressable market of wealthy individuals does the same.

TISG with a forward PE ratio around 9 and PEG of 0.5 is valued many multiples lower than the other two pure luxury players Hermes and Ferrari with FWD PE’s in the mid-high 50’s and PEG’s of 4-6. Yet it has just as much if not more resilient demand for its product, with years of forward orders and I would argue plenty of room to move margins up in the coming years as both demand and reputation continue to build.

TISG offers a rare opportunity: a luxury business unaffected by economic turbulence, trading at an attractive valuation. We may be seeing the early beginnings of a future luxury market darling.