Uncovering Asymmetry in Oil: Expressing a Bullish View for the Coming Supercycle

The coming energy supercycle presents investors with a massive opportunity. But how you position yourself will make the difference between average and super-sized returns.

Oil and energy, generally, is the most geopolitical investment in existence. It is critical to humans and industry in everything we do, and as a result there is always a scramble for nations to ensure the security of supply. For decades wars have been waged to ensure access to timely and sufficient sources of oil; Iran, Iraq, Syria, Libya, South America and on and on. Of course, that's never given as the reason; these wars are only ever fought to bring democracy to these nations of course. *cough*

Since oil greases the wheels of everything we do, it always takes a leading position in the economy and investment world. Endless talk and predictions abound about what energy prices will do in the future. Will OPEC+ do this or that? Can the US increase field production? How much demand will China bring?

Unless you've been living under a rock, you're probably aware that though oil and gas stocks may be at close to historical highs, they are still currently at relative depressed valuation based on historical norms. But what is the best way to express a bullish view on oil?

This write-up is not designed to educate you on energy markets nor convince you that oil is a good idea to invest in ahead of an upcoming energy supercycle. Understandably, investing in energy can be volatile - often by design to shake out the weak hands - and is not an area of investment interest for some.

But I want to provide a brief birds-eye-view of the current issues and then detail how and why I have positioned my portfolio exposure the way I have. Apologies in advance to any oil experts that come across this idea; this is a very generalist essay designed to be easy to read for those not immersed in the sector.

Why are energy stocks 'relatively' depressed?

I say relatively depressed because most oil and gas stocks have already had an excellent 18-24 months, although having come off their highs recently. Despite these significant run-ups, the stocks are still priced at their lowest valuations for years due to the runaway cash flow and profits generated by the sector, yet a disproportionately smaller increase in valuations.

Why are energy stocks at depressed valuations? The three basic headline points are:

Fears we're entering a global depression brought on my government ineptitude and central bank demolition.

China won't re-open after all or will have much lower demand when it does; this one should be dead by now, but what can I say? What seems obvious to those understanding geopolitics does not come so easily to those stuck in the weeds of forecasting and listening to the news cycle.

The world won't need oil for much longer, climate change matters above all, and renewables are our only future.

Are these reasons valid? In my opinion, no.

Supply vs Demand

Whether we are entering a depression or not is debatable but also, to a lesser extent, inconsequential when we have continued increasing demand from the developing world and an OPEC+ cartel happy to cut supply as needed to maintain reasonable price levels, not to mention a likely peak and coming fall in domestic onshore US production rates (Goehring & Rozencwajg provide excellent detailed analysis in this area).

This is before the West agitates us into a potential WWIII. War always sends oil higher. Saudi Arabia have made it clear which side they are on should increased conflict occur. They are growing closer to Russia and China by the day and even starting reproachment with Iran. What happens to the oil price as tensions escalate and how important is Saudi Arabia?

Take a look at this map of global shipping and the choke point that is the Middle East, and tell me it doesn’t matter:

If wider conflict were to break out, and Saudi Arabia, Iran or other Gulf States are forced to be more vocal about who’s side their on (Russia & China), there is little chance the combined West will be able to do much in the region other than espionage and subversive terrorist attacks (eg. Nordstream II) which is about all they’re good at these days.

In the eventuality of a wider oil crisis, the US with a drawn down Strategic Petroleum Reserve thanks to Dementia Joe’s vote buying will limp along on domestic supply, increase imports from Canada and possibly start to strong arm South America again to a lesser extent (but even South American nations are finding their voice), but that’s about it.

While it can’t admit it aloud, the United States days of adventuring and force projection in the Middle East are drawing to a close, and if it wants to keep its aircraft carriers out of the way of the hypersonic missiles that render them sitting ducks, they’ll quietly recognise that, or #FAFO.

During any wider crisis, the EU is screwed regardless.

China

China is re-opening after playing the same stupid Covid game all other governments played. While I believe China had different reasons to prolong their lockdowns, the fact is they are now finished, and every day China's energy demand will continue to pick up again.

I can vouch first hand from recent travels in Asia that visitors from China are still nowhere near previous levels. There is only one direction this is going - violently to the upside.

Whether it takes six, nine or twelve months - China’s oil demand is about to come roaring back.

ESG

As the Western world falls deeper into a malice of debt, I imagine the constant distractions away from government failings that are climate, 82 genders and God knows what next month must be reminiscent of the 'bread and circus' during the gradual collapse of the Roman Empire.

Profit and sanity are being subjugated to climate and the Enterprise Surrender Ground Environmental Social Governance screed. But despite the fairy tales the virtue signallers would like you to believe, at the end of the day oil and energy boils down to reality. You can scream from the rooftops all day how we will no longer need oil, but reality and physics speak the truth; increasing demand continues, and it's not going away.

Bear in mind even at the lower side of these estimates, Western sources of oil are declining, with the only major new increases in production coming from the developing world. The US can continue to increase E&P spend to prolong their domestic fields declines and limp along. Again, the EU is screwed.

To think and especially invest otherwise is a fallacy you take on at your detriment as an investor. Governments who think and act like oil is not needed will endanger their citizens living standards and usher in further social and economic decline.

While the ESG and climate morons are doing their utmost to convince us wind and solar are cheaper, more reliable and are the future, the facts speak differently. Let’s take a quick look at Germany’s electricity prices over ten years which has some of the highest proportion of renewables in its grid.

Note that I’ve purposely selected a graph that shows the rise in electricity prices BEFORE the Covid scam and ‘Putin’s war’ which is blamed for all Western government incompetence these days.

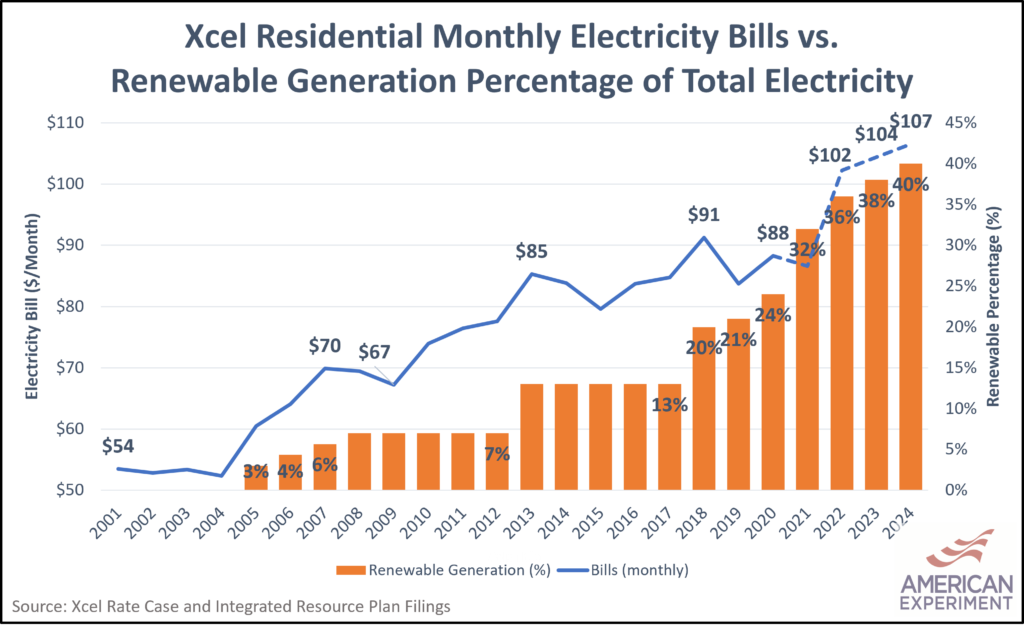

It’s not just Germany and Europe lest you still believe Russia is causing all this. Let’s take a look at the soaring cost of electricity in Minnesota USA where as the share of renewables continues increasing, and so does the resulting electricity price:

Last time I checked, Russia hadn’t invaded Minnesota in 2013, 2018, or 2021 when there were massive spikes in electricity prices across the state. Unsurprisingly, every time renewables increase their share of the grid, electricity prices skyrocket.

It’s simply a matter of time before the virtue signalers in these states and nations that can afford to do so realise the giant mistakes they are making converting their energy consumption and electricity grids into more fragile, inefficient and unreliable as well as expensive renewable energy sources.

As an aside, after all the failings to deliver on the promises of cheap energy, these renewables are also more wasteful than they ever admit to:

All this should lead those with common sense to understand that oil and gas are not going away anytime soon and the work of ESG’ers simply increases the price of energy for everyone.

How to position best for the non-death of oil?

Oil will be around for many decades to come - for the entire investment lives of you reading this article today, as well as your children. So assuming you agree and want to take advantage of extremely low historical valuations, how best to benefit?

The lazy answer is to buy an ETF like IEO or invest in the biggest and safest ExxonMobil (XOM), or copy Warren Buffet:

These options are valid and will do well in the energy supercycle, but asymmetry is also limited. Like anything worthwhile, you need to do the work and dig deeper (much like in oil extraction) to achieve better results than average.

There are many opportunities to profit on a much larger scale for those willing to take on additional risk and stomach higher volatility. For long-term players, volatility need not be the dirty word it is to short-term fund managers, deftly afraid of making their quarterly returns look bad.

For asymmetry, we can look to developing and frontier markets, exploration plays, small caps and even service providers in the sector. My holdings built up over the last six months consist of a basket of these players which I'll briefly outline below.

As you go through these investments, you’ll note I have avoided two key asset types that, although still remarkably cheap like the rest of the oil market, pose potential problems; Western nations and onshore fields.

I avoid assets in Western nations simply because they are proving more and more with each passing day they are no longer trustworthy for storing wealth or doing business in risk averse manner, yet they still carry the higher value multiples.

Governments across the West are introducing 'excess profit' taxes as well as pressuring their producers to throw money at the ESG Gods as Shell (SHEL) and BP PLC (BP) are forced to do in the EUSSR, already evidenced by their relatively lower returns in recent years compared to ExxonMobil and Chevron (CVX) - though I'm just as happy to avoid those majors as well.

For fun, I asked ChatGPT the question: what are the risks of emerging markets?

Here is its reply. Have a quick scan and tell me with a straight face this does not describe the current climate in the USA, Canada, Australia, the UK and the EUSSR?

Some of the key risks of emerging markets include:

Economic and Financial Risks: Emerging markets often face risks associated with macroeconomic instability, such as high inflation, currency volatility, and fiscal deficits. These factors can impact the overall economic health of the country and create uncertainties for investors.

Political and Regulatory Risks: Political instability, changes in government, and regulatory changes can create uncertainties and risks for businesses operating in emerging markets. This includes risks associated with changes in trade policies, tax regulations, and legal frameworks, which can impact business operations and profitability.

Operational Risks: Emerging markets may have underdeveloped infrastructure, inefficient supply chains, and other operational challenges that can impact the smooth functioning of businesses. This includes risks related to logistics, transportation, and communication, which can affect the cost and reliability of doing business.

Social and Cultural Risks: Emerging markets often have diverse social and cultural contexts, which can impact business operations. This includes risks related to social unrest, labor strikes, cultural differences, and local customs that may affect business practices and relationships.

Market Risks: Emerging markets can be subject to market volatility, including fluctuations in stock markets, bond markets, and commodity prices. This can impact the valuation of investments and the overall performance of portfolios.

Legal and Corruption Risks: Emerging markets may have weak legal systems and high levels of corruption, which can create risks for businesses in terms of contract enforcement, intellectual property protection, and fair competition. These risks can impact the operational and financial performance of businesses.

Environmental and Sustainability Risks: Emerging markets may face challenges related to environmental sustainability, including issues such as climate change, natural resource depletion, and pollution. These risks can impact the long-term sustainability of businesses and investment opportunities.

Can someone send me the names of the developed Western countries that aren’t currently experiencing most of these problems while they still look down their nose at ‘developing countries?’ I’d like to know!

Due to the nature of their decline and the increased hostility of leaders to their populations, I'd just as soon avoid assets in Western jurisdictions for the most part. In extreme circumstances, they are even confiscating assets (sorry, Russia, your money is ours now) or forced divestiture of previously purchased assets (sorry, China, your money's no good here).

Secondly, specific to oil - I also avoid ageing fields that will shortly decline output and increase extraction costs. That rules out onshore US fields of the Permian, Eagle Ford and the Bakken. The stocks here also look downright cheap and will do well in a supercycle, but I wouldn’t say I like the future potential as fields peak and decline shortly (again, refer to G&R excellent analysis on this). They lack the asymmetry I'm trying to assemble in my exposure basket. I'd rather be in plays with massive potential that simply need to drill and sort out the logistics.

So how have I positioned myself? Hint: very little Western exposure.