War Profiteering

Wherever you stand on the current war in Ukraine - or any other conflicts worldwide that aren't as trendy (Yemen eight years and counting…anybody...?), a continuing ratcheting up of conflict is clear.

Increased hostilities between nations, regional tensions, border disputes erupting and Government oppression of descent among its people as a result of policy ineptitude and a rising sense of entitlement and socialism. I said last year we have already entered WWIII in all but name. Hostilities abound.

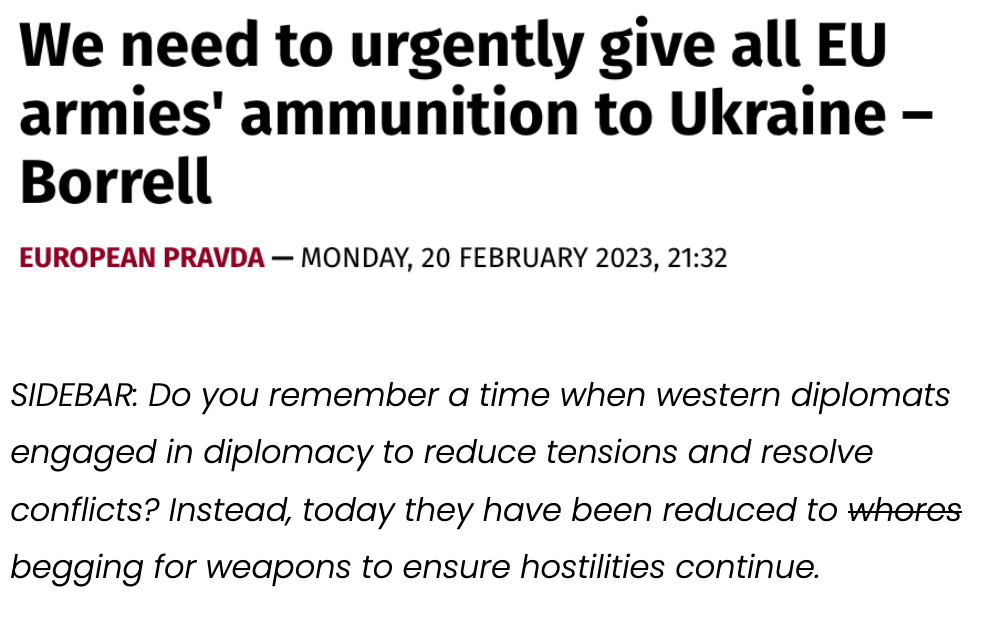

On one hand we have governments purposely ratcheting up tensions against other nations, while those same government’s at home attempt to oppress civil unrest directed at them - instead of at each other as they prefer. All this means we are seeing a lot of conflicts, rising violence and show of weapons. With the exception of open war situations, most of the guns are still for intimidation purposes. We can hope it remains that way, but I'm not so sure. That being said, either result whether for show or actual use makes no difference.

To ensure that police can continue to intimidate, soldiers are equipped for ever-more provoked hostilities, and domestic security agencies (or tax collectors) can illicit fear amongst those they profess to defend - I expect the number of small firearms and munitions sold worldwide to increase rapidly. Likely higher than the current projected CAGR of 2.75%.

In short, were going to see more guns, of all types, everywhere, on all sides. In 2019 demand for small firearms was approximately 1.09 billion units and is expected to rise to 1.26 billion units by the end of this year. The split is roughly 68% civilian, 32% military and law enforcement.

So assuming you have taken sufficient steps to insulate yourself and loved ones from this expected violence, you can ask yourself, is there a way to profit from the inevitable ratcheting of tensions in an increasingly turbulent decade where threat of violence is rising, not subsiding? Where Western governments are actively promoting, even provoking open conflicts?

Weapons Manufacturers

Weapons manufacturers are the obvious answer. But as always, how you express the view is of crucial importance.

Since the war in Ukraine started, stock prices of manufacturers of large-scale weapons like missiles and aircraft, such as Lockheed Martin (LMT), have performed well - up 24% over the last year. But being such a behemoth, it takes a much bigger battle than Ukraine to move the needle for this defence contractor. Not to upset LMT shareholders, but let's hope I'm wrong about WWIII, and it remains a case of more minor regional conflicts. Rheinmetall AG (DE: RHMG), the diversified German arms manufacturer closer to the conflict and more directly affected, is up 168% over the year, evidence as always that selecting the correct expression of your view is crucial.

But are there other ways to play this trend beyond the immediate impact of the current Ukraine war? I would wager that despite Rheinmetall likely benefitting for the coming years as NATO arms have been depleted inside the Ukraine incinerator, there is no doubt should the conflict cease next month, the shares will fall back down. The weapons they supply will likely take years to manufacture and register a sizeable impact in sales - if at all when spread over long enough time frames. Despite the shares more than doubling, sales are only up around 10% year-on-year.

What may have a better chance at asymmetry are small firearms manufacturers. Though not all infantries are kitted out like Arnold in Commando, defence departments issue an array of small arms weapons to soldiers.

Higher quantities of weapons needed that are quicker to manufacture, require fewer commodity inputs and can have cost increases passed on with relative ease mean small arms manufacturers will benefit in the years ahead. Also importantly, more military and civilian police personnel will need more weaponry and replacements for more extended periods than the replenished rocket and tank inventories once the open conflict in situations like Ukraine subsides. Let's face it; you don't need missiles to quell an unhappy population threatening to overthrow a government; you need small arms and plenty of them. Conversely, unhappy people often resort to small arms when things get bad enough during a societal collapse.

But there's a plethora of small arms and ammunition manufacturers worldwide in a highly competitive market. Well-known US companies may first jump to mind; Smith & Wesson (SWBI) - the most prominent US handgun manufacturer, or Sturm, Ruger & Company (RGR), the largest US firearms manufacturer.

The problem with US-listed small arms makers is the vast majority of their sales are domestic only and to civilian customers primarily. 97% of Smith & Wesson sales are to the US domestic market, with Sturm, Ruger & Co. close behind at 96% - with negligible government sales for both. These companies are pure plays on US hunting, gun sports and citizens arming themselves, not global military and security services armament. After a peak in 2020/2021, this market has declined, resulting in the poor performance of many listed players (SWBI, POWW, VSTO, and AOUT). This is another trend in and of itself that people invest in; the future self-destruction and potential oncoming civil war as the US empire collapses, with an unhappy populace increasingly arming itself. But that's a story for another day. That said, the civilian sales market seems to be bottoming out now and should return to steady growth in due course.

There are also more obscure players like Poongsan Corporation (KR: 103140), a South Korean ammunition manufacturer selling worldwide, including to China and the United States. But the ammunition business contributes less than 30% of total group revenues, so not a pure expression of the view. US ammunition manufacturer Ammo Inc (POWW) does not make it clear how much of their sales are derived from civilian vs military and law enforcement, but judging by their sales slump - it appears to be predominantly civilian and to US domestic market only.

Many of the players in the industry are government-owned or private companies, such Italian manufacturer Fabbrica d'Armi Pietro Beretta or Austrian manufacturer Glock Gesellschaft, the hands-down favourite with US police forces.

The key to positioning yourself for the trend of rising global tensions and an increase in military and police armament is to find a manufacturer geared toward supplying both the civilian market and police, security and military industries. One such player catering to these markets and one I've long admired the work of and wanted to invest in is Axon Enterprises (AXON) - the maker of Tasers and Axon body cameras. I've never 'pulled the trigger' on this one due to the perpetual eye-watering valuation it commands. It continues to mock me with its relentless rise regardless.