Coal Isn't Going Away

As much as the climate changers and ESG crowd would like to convince themselves we don't need coal anymore, reality says otherwise.

Contrary to what ESG fanboys may want, the realities of the world mean that coal is not going away anytime soon. Let’s take a look at some figures.

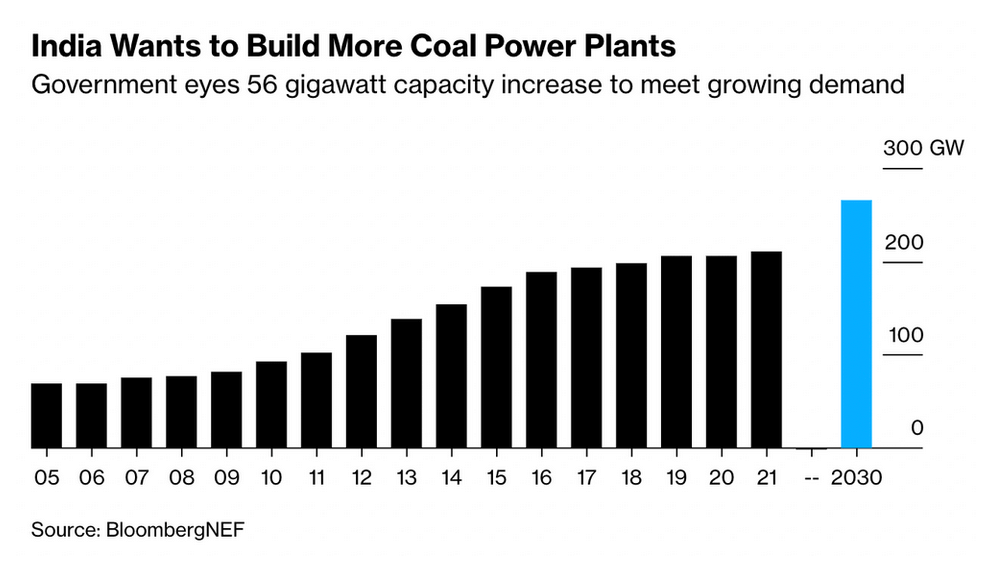

India projects an almost 50% increase in thermal coal use by the end of this decade - only eight years away.

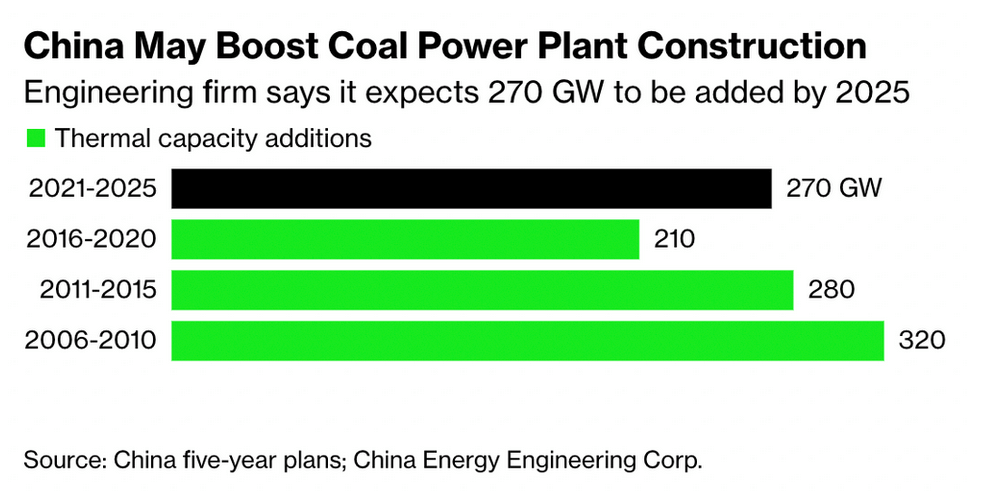

China continues building more coal power plants than any other country and is expected to add 270 GW of coal power capacity by 2025 - an even shorter period than India. Remember this is just new additions to an already huge coal power fleet.

Climate fanatics who are convinced the world is coming to an end in a few years (speaking of, has anyone head from Greta lately?) may ask why this is the case. There’s a fairly simple answer, coal power is still one of the most economical forms of power, particularly for developing nations with less funds, growing populations and less capacity for infrastructure investment.

Cleaner sources of power like natural gas need a much larger amount of infrastructure to go along with it. For a start the country needs to be blessed with natural gas resources of its own, or be on friendly terms with neighboring countries that do. In that case, pipeline infrastrucure needs to be developed. If there is no local gas, LNG terminals, conversion infrastructure and gas fired power plants need to be constructed.

With coal, you just need the power plant (quicker and cheaper to construct than other plants like natural gas and nuclear), and a railway (or road, but that’s less economical) to move the coal from the source or port to the power plant. Assuming the country has no domestic source, importation of coal is much less geopolitically frought than having problems with your gas supplier. Just get coal shipped from another country. Something particularly prescient in the current geopolitical climate.

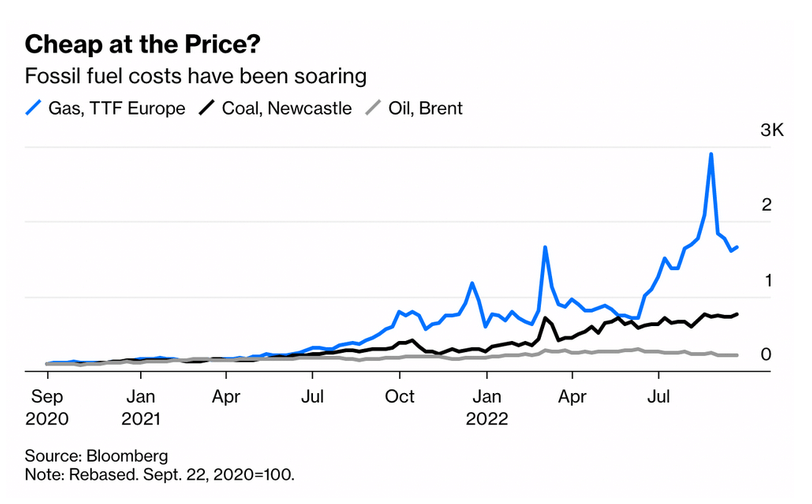

Coal also remains one of the cheapest forms of power compared to alternatives, and that’s with the recent spike in price. This is before the incoming oil price rise due to government disincentives for producers.

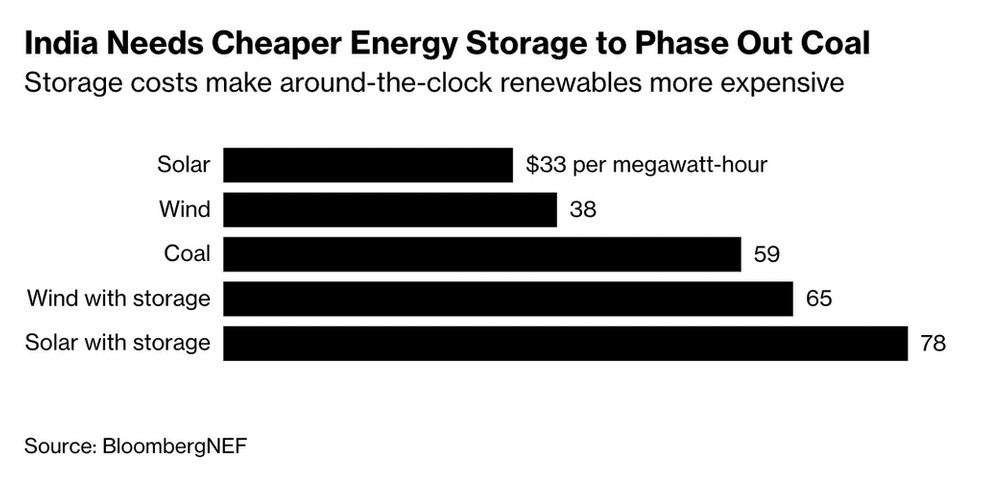

In addition to higher infrastructure costs, proponents of renewables conveniently or ignorantly leave out the cost of storage. This of course doesn't fit the narrative of western nations screeching ESG to these poorer nations.

Coal base load power can ratchet up or down as needed by peak demand. Renewables that in practice often only produce energy 50% of the time then need to store this power. The cost of all these battery material is already prohibitively expensive for developing nations and in the incoming commodity super cycle will only increase these costs as shortages in copper, cobalt, lithium and other commodities become apparent.

If all this weren’t enough to deal with, developing countries now have the wealthier nations of Europe simultaneously ramping back up their natural gas and coal use while at the same time having the audacity to lament developing nations' continued use of that same coal.

These same wealthier nations are also depriving developing nations of climate-friendlier LNG shipments as Pakistan has just found out the hard way as no traders tendered for their recent LNG contracts.

I get that when push comes to shove, its every nation for itself - but have the decency not to virtue signal bullshit while you do it. Perhaps Asian nations should sacrifice more for Europe and sit in the dark? Remember, Energy = Life.

So while demand and capacity construction continues to grow, and markets such as Europe 'temporarily' revert to coal use (sorry, no pretty chart for this one as they attempt to hide it), supply is severely constrained; ESG politics, virtue signalling, and financing cut off.

Big coal miners Glencore, New Hope, Whitehaven, Thungela and Peabody aren't encouraged to expand production and are admonished when they do. Priced as though they're going out of business next year at PEs & P/CF's less than 2 in some cases.

Coal's not going away anytime soon and is a vital base load energy source, especially for developing nations who cannot afford the vastly more expensive infrastructure and energy sources western nations can (for now).

The choice to virtue signal or accept reality and profit from it is yours.

Thank you for checking out Rambling Investor. Hit the like button and use the share button to share this across social media. Leave a comment below if the mood strikes you, and don’t forget to subscribe if you haven’t done so already.

Some interesting South Africa, India and Indonesia coal stocks have popped up and been talked about in emerging market fund commentaries I have written about. So not every fund/investor is into ESG ideology... Far more worrisome are the coming EU attempts to force ESG onto their Asian suppliers... https://emergingmarketskeptic.substack.com/p/emerging-markets-week-february-20-2023